Make it personal

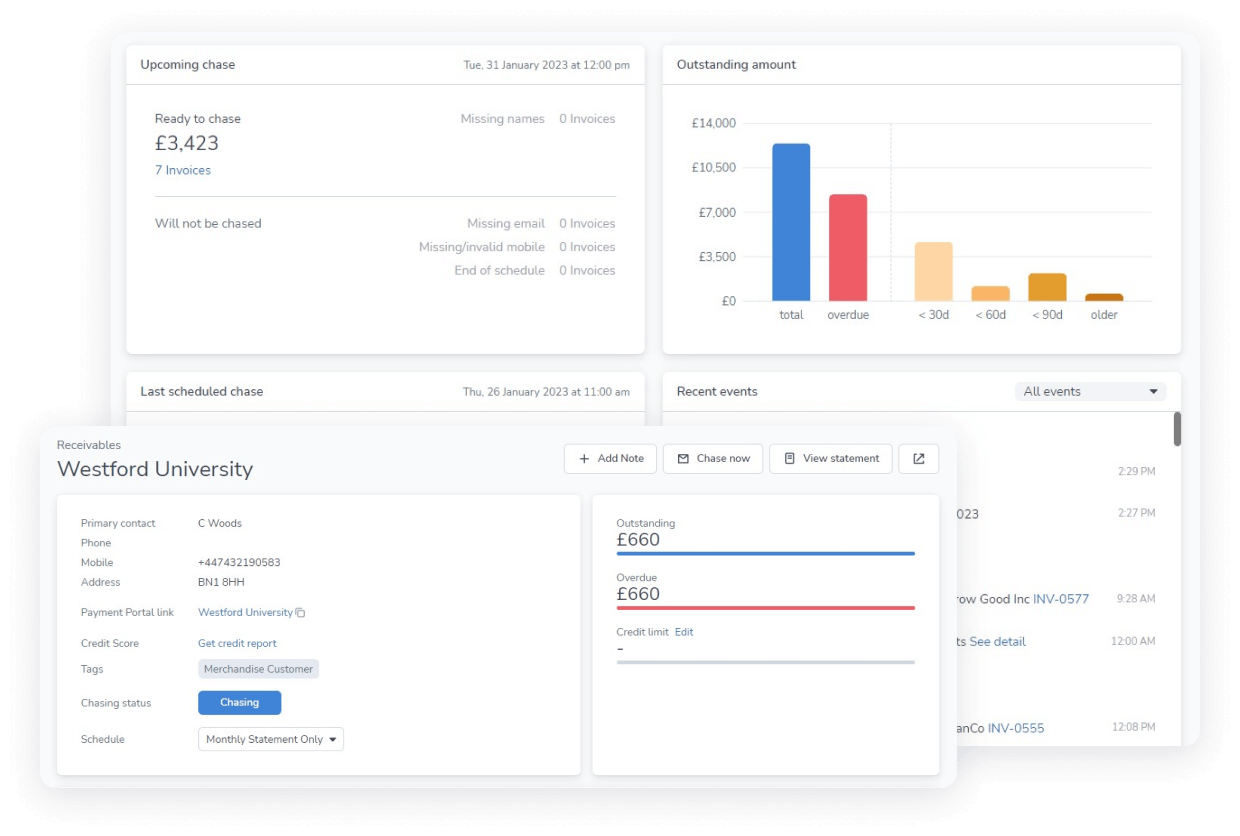

Your time is valuable - don't waste it writing payment reminders

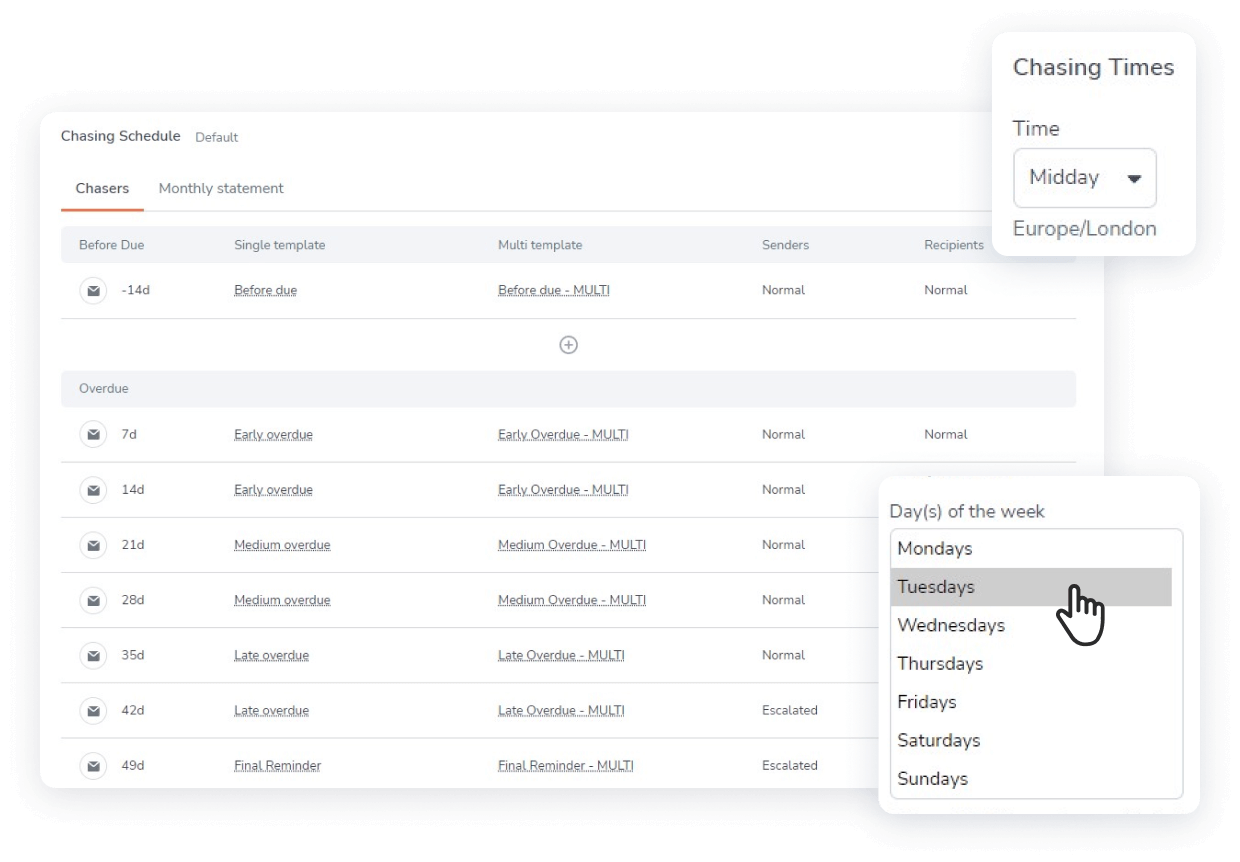

Automate your payment reminders in a personalized, human way so that you can dedicate your attention to your core business activities and growth.

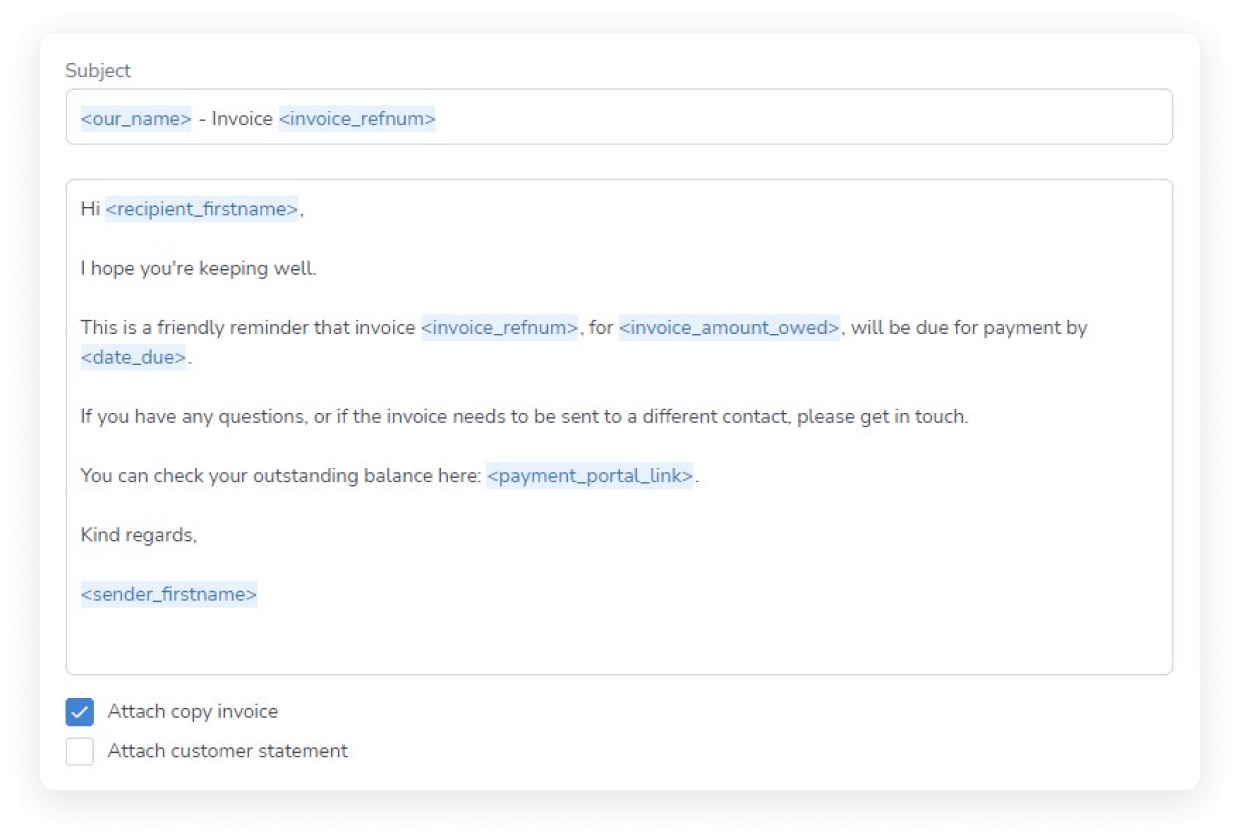

Use customizable templates and workflows to automate your credit control process while still reflecting your brand's unique voice.

Whenever your customers receive an invoice reminder email, it will appear that it is directly from you, so they'll always know who to contact.

After payments are received, an automated thank you message is automatically sent, so you can continue to enhance your customer relationships.

Easily attach invoices and customer statements to speed up payments.