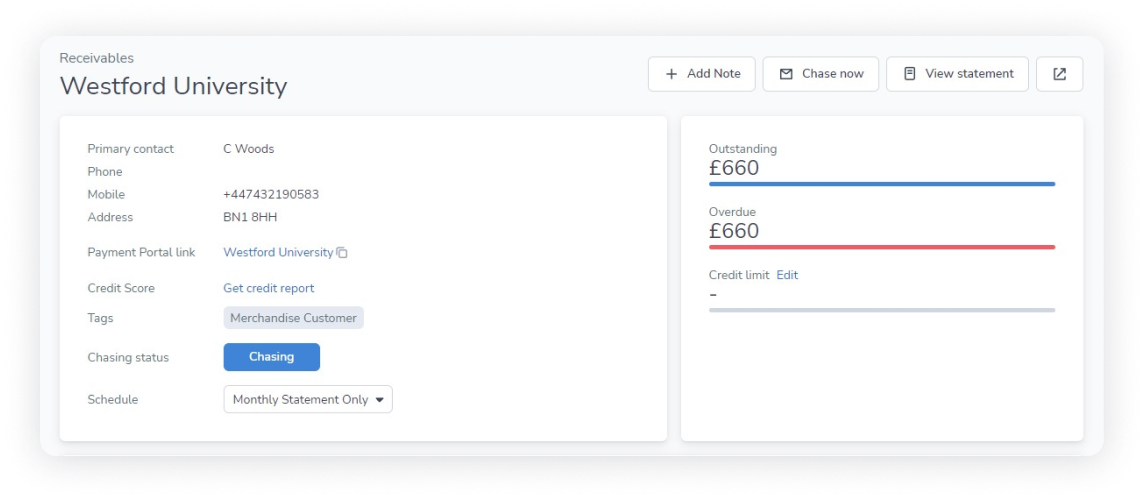

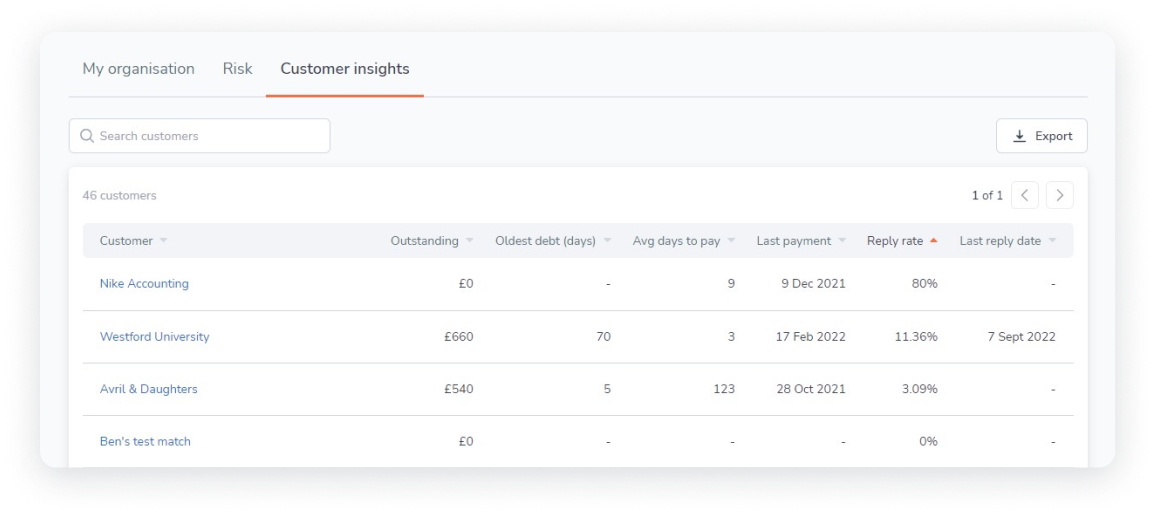

Credit risk monitoring and alerts

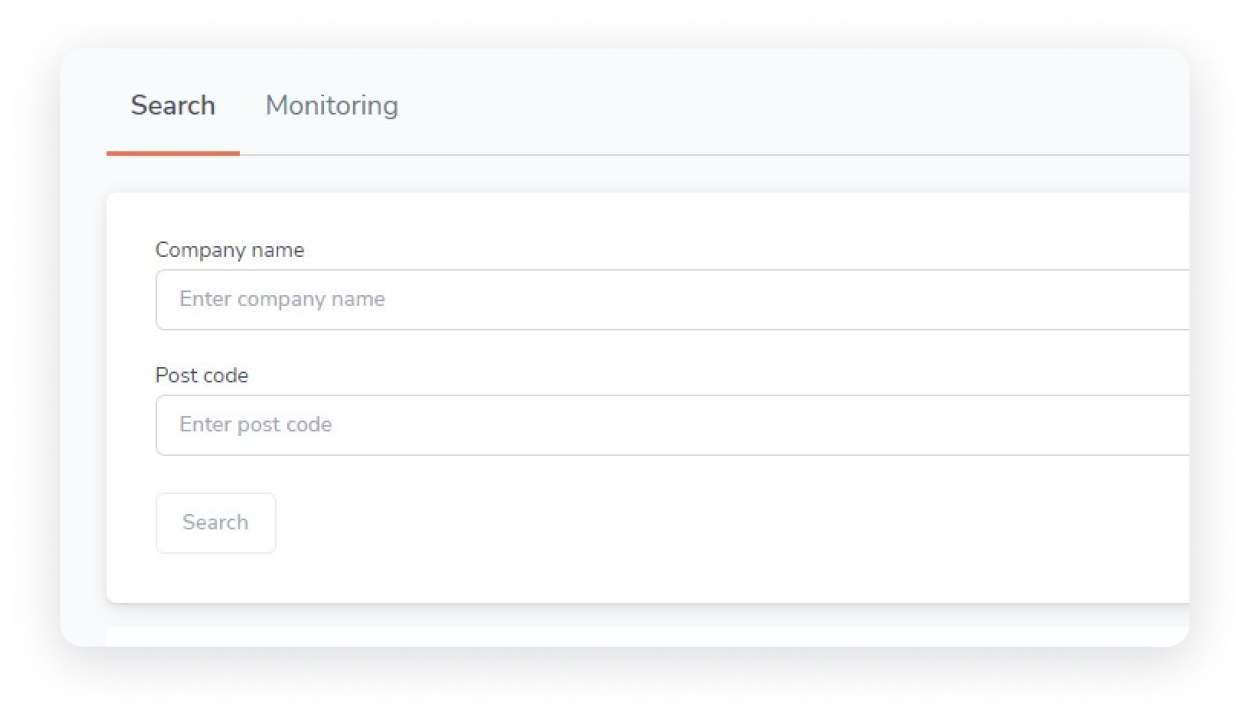

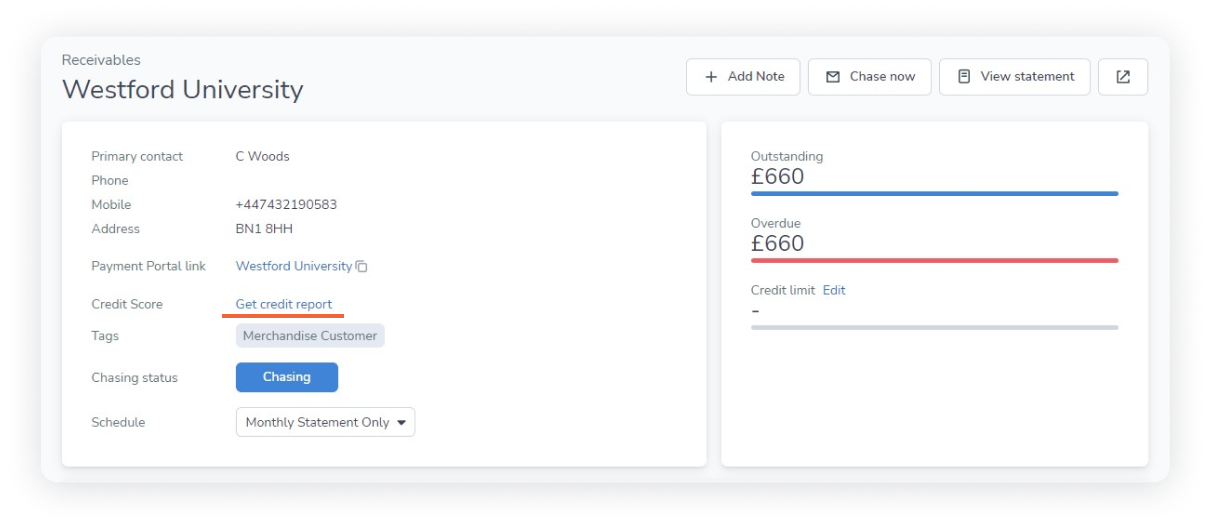

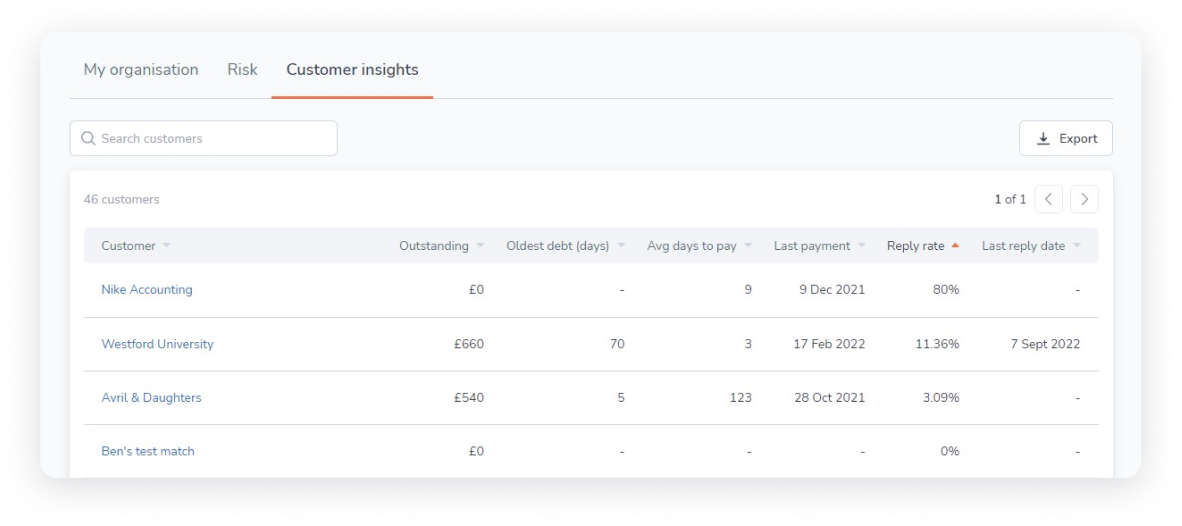

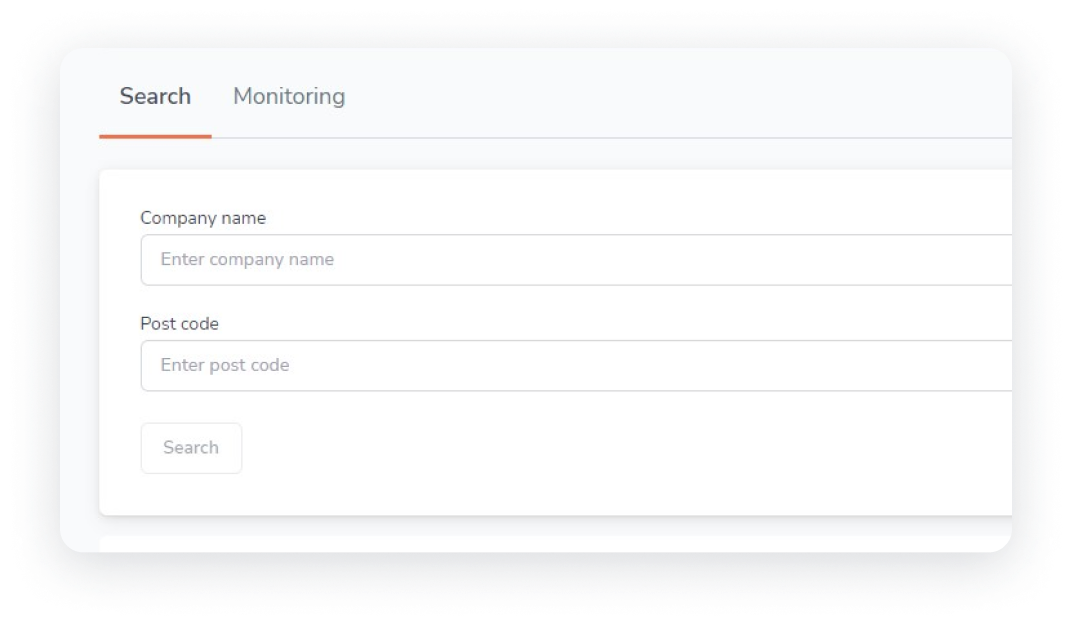

Assess the creditworthiness of potential customers before extending credit, and monitor and manage every customer's credit risk with alerts. Reduce the risk of extending credit to customers who have a history of defaulting on payments, and help prevent bad debt losses.