Start your risk-free trial

Start your free trial today and experience the power of automation software for accounts receivables management.

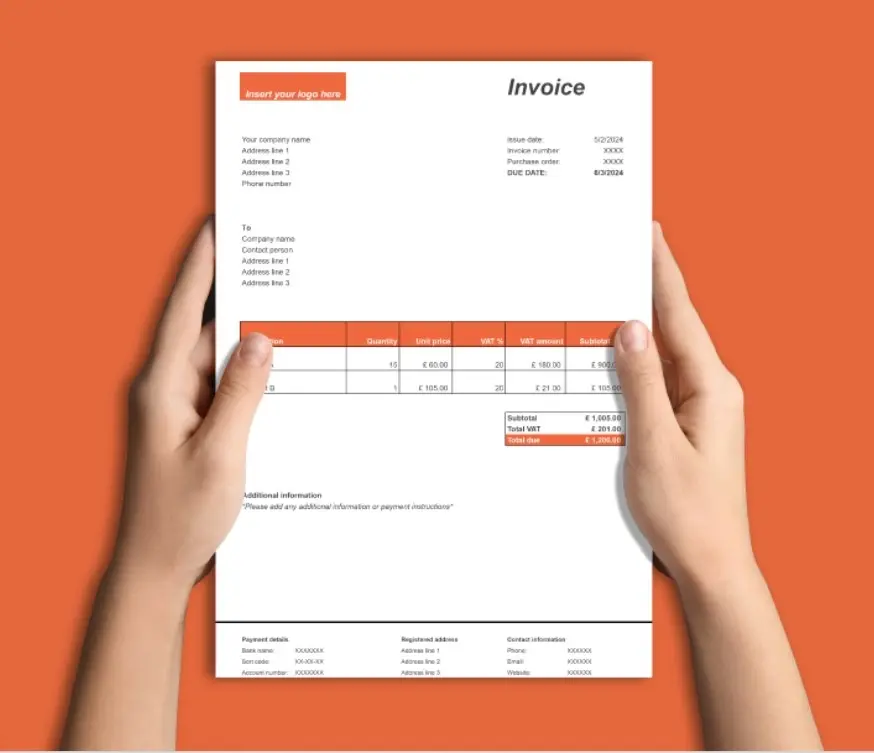

Struggling to create invoices that ensure prompt payment? Chaser offers a solution with its customizable invoice template library. Chaser editable templates save you valuable time and enhance AR organization by providing easily downloadable templates in any format. You can access editable templates tailored to your specific needs and in compliance with major regional standards.

Chaser provides a comprehensive library of customizable invoice templates easily downloaded into PDF, Excel, and Word to meet the diverse needs of today's businesses. These templates are specifically designed for a range of sectors, including retail, the service industry, dental, HVAC, and manufacturing, incorporating industry best practices and relevant fields.

By using Chaser library, businesses can simplify their accounts receivable processes, improve efficiency, and accelerate payment cycles. Chaser customizable invoice template library empowers businesses to revolutionize their Accounts Receivable (AR) management.

By leveraging our diverse collection of professionally designed templates, companies can streamline and simplify intricate AR processes, leading to substantial gains in operational efficiency and a reduction in invoice mistakes. This enhanced efficiency directly contributes to a significant acceleration of payment cycles, ensuring a healthier and more predictable cash flow.

Once you've downloaded a Chaser invoice template, customizing it to reflect your brand is straightforward. Here are the key steps to personalize your invoice:

Creating effective invoices is crucial for ensuring timely payments and maintaining a professional business image. Here are some best practices:

|

Element |

Description |

|---|---|

|

Invoice number |

Unique identifier for tracking. |

|

Date of issue |

Date the invoice was created. |

|

Customer details |

Name, address, and contact information. |

|

Your business details |

Name, address, and contact information. |

|

Description of goods/services |

Detailed list of items or services provided, including quantity and price. |

|

Total amount due |

Sum of all items/services, including taxes and discounts. |

|

Payment terms |

Instructions for payment, due date, and any late fees. |

Include clear and concise payment instructions on the invoice. This helps avoid confusion and speeds up the payment process.

List all acceptable payment methods:

"Payment can be made via bank transfer to the following account:

Account Name: [Your Business Name]

Account Number: [Account Number]

Sort Code: [Sort Code]

SWIFT Code: [SWIFT Code]

Alternatively, you can pay online using this link: [Payment Link]"

Start your free trial today and experience the power of automation software for accounts receivables management.

While the generic best practices above create a firm foundation to make your invoices more accurate and effective, there are certain industry-specific best practices that will help ensure you get paid faster:

The HVAC industry’s focus on providing installation of equipment means there are some extra sections that are beneficial to add to your invoice, including:

Since the laundry businesses are responsible for the condition of their customer items, having service descriptions, condition notes, and even images appended to the invoices is solid best practice.

In addition to the general invoicing best practices, dental practices should include the following details for efficient and accurate billing:

Establish clear payment due dates. It is common to set payment terms like "Net 30," meaning payment is due 30 days after the invoice date.

State any penalties for late payments. This can be a fixed fee or a percentage of the total amount. Clearly communicate the late fee policy on the invoice to avoid disputes.

"Payment is due within 30 days of the invoice date. A late fee of 5% will be charged for payments received after the due date."

Consistent branding reinforces your company's identity and professionalism. It helps clients recognize and remember your business.

The first step in ensuring timely payment is the prompt and efficient delivery of the invoice. Businesses have the option to send invoices via email or traditional mail.

While traditional mail may be suitable in some cases, email is generally preferred for its speed, convenience, and cost-effectiveness. Sending invoices via email allows for instant delivery and can often include clickable payment links, streamlining the payment process for the client.

After sending the initial invoice, consistent follow-up is essential. Manual follow-ups, however, can be time-consuming and prone to errors. This is where Chaser comes in. Chaser is designed to automate the process of sending payment reminders.

Once an invoice is sent, Chaser can be configured to automatically send email and SMS reminders at preset intervals. This ensures that payment deadlines are clearly communicated and helps to reduce the risk of late payments, thus improving cash flow and reducing the time spent on manual follow-ups.

Chaser can significantly optimize the accounts receivable process by automating these vital communication tasks.

By utilizing Chaser's customizable invoice template library, businesses can significantly enhance their Accounts Receivable processes. These free templates, available in multiple formats and tailored for various industries, save time and ensure compliance with regional standards.

Ready to streamline your invoicing process and improve your cash flow? Download Chaser's free customizable invoice templates today and start implementing these best practices. Once you've sent your invoices, Chaser can further assist with automating your payment chasing and credit control, ensuring you get paid on time, every time.

Download your industry-specific templates and let Chaser automate payment reminders — no more chasing invoices manually