Late payments are becoming a bigger and bigger problem for businesses today. In 2021, 58% of SMEs reported they are typically paid late (Barclays). More recent research in 2022 found 87% of SMEs are usually paid late (The 2022 late payments report). This suggests late payments are growing and becoming increasingly common over time. In addition, a rise in interest rates and cost of living is making it harder for businesses to cover their costs and pay bills on time.

However, research shows that by providing a greater range of payment options to cater to customers’ needs, your business can improve its chances of receiving payment sooner (Yonyx), and reduce late payments.

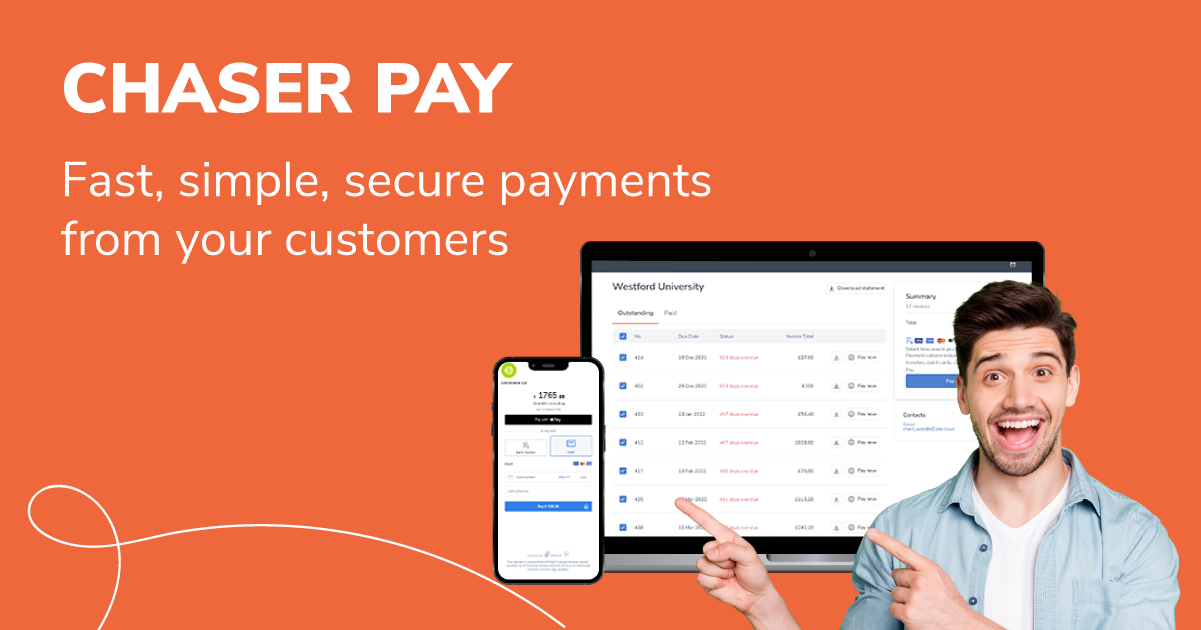

That's why Chaser is launching Chaser Pay. Chaser Pay is seamlessly integrated within Chaser's accounts receivable software, making it simple, secure, and efficient for businesses of all sizes to process payments. Chaser Pay provides businesses' customers with a range of fast and secure payment options to pay invoices, so they can encourage faster invoice payments and reduce their time spent on payment admin.

Businesses can now provide customers with a range of fast and secure payment options to pay invoices and cut their time on payment admin, by using Chaser pay

Faster payments with Chaser pay

Chaser Pay simplifies the payment process and provides a seamless experience for users, enabling them to focus on getting their invoices paid and reducing their days sales outstanding.

Businesses can now reduce late payments by receiving payments instantly with instant bank transfers (open banking), or within 1 to 3 days for card payments. By giving customers a range of payment options to suit their needs in one place, businesses can encourage faster invoice payments and reduce their time spent on payment admin.

With Chaser Pay, businesses can let customers pay with instant bank transfer and confirm payment directly from their online bank account, pay with Apple Pay and use FaceID or TouchID to confirm invoice payments, or use traditional debit and credit card payments including Visa, Mastercard, and Amex.

Chase. Collect. Confirm

Chaser pay provides businesses with a range of benefits to help chase, collect, and confirm payments. These features include:

- Request customer payments: All customers have a unique payment link and portal where they can pay invoices.

- Send reminders to customers: Automatically attach your payment link to email and SMS payment requests.

- Customers can make instant payments: Let customers pay using instant bank transfer and confirm payment directly from their online bank account.

- Let customers pay with Apple Pay: Customers can use Apple Pay FaceID and TouchID to quickly confirm invoice payments.

- Accept payments by debit and credit card: Offer customers familiar ways to pay, including Visa, Mastercard, and Amex.

- Manage payments in one place: View all collected payments in your Chaser Pay dashboard.

Seamless integration

Chaser Pay is seamlessly integrated with the Chaser accounts receivables software. This means every customer of the business using Chaser has a unique payment link and payment portal where they can pay and view all invoices, which can be automatically linked within SMS and email payment reminders. This gives customers the freedom to pay invoices instantly from their PC or mobile phone when a payment reminder is received, via the payment method of their choice.

All paid invoices are summarised on your Chaser Pay dashboard, so you always stay up to date on what has been paid, and when. This reduces the time you need to spend on payment admin and eliminates manual tasks associated with receiving payments from customers. See more info on the Chaser Pay fact sheet.

Secure payments

Protecting your financial data is central to Chaser pay's technology. All necessary compliance and data security requirements are taken care of to ensure your payments and transactions are safe, so you can focus on growing your business with peace of mind. With secure customer payment links, financial information is never shared, ensuring maximum security and minimum worry.

How to use Chaser pay

You can use Chaser Pay if you use either Xero or Quickbooks online and funds will be received into a UK bank account.

To start using Chaser Pay in your account take the following steps:

- Navigate to the manage section in your account.

- Create your Chaser Pay account.

- Read and accept the terms and conditions, then you’re ready to accept payments.

For more information on how to start using Chaser Pay, view the help centre article here.

.jpeg?width=50&height=50&name=g_JvnNFg%20(1).jpeg)