The 2022 late payments report

The challenge of late payments

Late payments are a problem impacting businesses globally. The World Bank predicts that late payments cost the global economy over $40 billion every year.

For small and medium businesses, these late payments can seriously impact business growth. Previous research indicates that 89% of business leaders believe late payments are stopping their business from growing (QuickBooks). Not only do late payments restrict growth by placing a strain on a business's cash flow, but in the case of small businesses, they frequently lead to business failures. In the UK alone, 50,000 small businesses face bankruptcy every year due to late payments (FSB).

The challenges faced by businesses in response to late payments are only heightened by challenging economic conditions. During the COVID-19 pandemic and ensuing recession, 40% of businesses saw worsening late payments (Barclays) and corporate insolvencies doubled (RSM). With the current threat of a global recession, it is more important than ever for small and medium businesses to take stock of the late payment challenges they are facing and adopt practical solutions to reduce them.

This research was conducted to understand the current severity of late payments, how they can be reduced, and what methods businesses have implemented to deal with them.

The scope of the research conducted covered accountants and finance professionals operating globally. Accounting and finance professionals from over 400 businesses worldwide responded to the survey.

Key findings

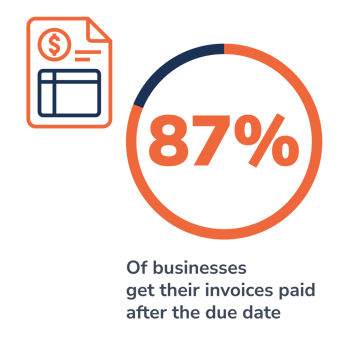

Previous research from Xero and Paypal in 2019 found that 48% of invoices issued by small businesses are paid late. However, in this research piece, surveying small, medium, and enterprise-sized businesses, 87% of businesses reported that their invoices get paid after the due date.

-

Almost 9 in every 10 businesses are typically paid late

-

50% of businesses spend more than four hours per week on accounts receivables tasks

-

Over a quarter of businesses admit to struggling to keep on top of their accounts receivables tasks every month

-

Businesses that follow up with 90% or more of their invoices are the most likely to get paid within a week of their invoice due date

-

Larger businesses generally wait the longest for payment from customers

-

Accounts receivables software users are 3 times more likely to get an invoice paid before the due date than non-software users

-

Email is the most commonly used method for following up on late payments, used by 93.8% of businesses

-

Using a combination of text and email reminders increases a business’ chance of getting paid within a week of the invoice due date by 56%

Implications

Based on this research it is clear late payments are still a significant challenge for businesses. Compared to previous research, findings indicate that late payments may now be more prevalent than ever before.

However, findings show that taking a proactive approach to accounts receivables management, staying on top of credit management tasks, and effectively following up with customers can reduce late payments. Late payments have effectively been reduced in businesses using less traditional payment follow-up methods such as SMS texts and Whatsapp. Additionally, businesses using software to support their accounts receivables management have effectively reduced late payments.

The late payment problem

Businesses around the world are facing a late payment crisis. The World Bank predicts that late payments cost the global economy over $40 billion every year.

Overdue invoices pose a huge problem for small and mid-sized businesses' growth. 89% of business leaders believe late payments are preventing their business’ growth (QuickBooks) due to the strain they place on cash flow.

Not only does this impact business growth, but for smaller businesses, late payments often lead to business failure. In the UK alone, for example, 50,000 small businesses have no choice but to close down each year due to late payments (FSB). Furthermore, late payments place a significant time cost on businesses, wasting a predicted 56.4 million hours per year (QuickBooks).

Healthy cash flow is essential to sustaining business growth during times of macroeconomic difficulty. As seen in the fall-out from the COVID-19 pandemic and ensuing recession, 40% of small and medium businesses reported worsening late payments (Barclays) and corporate insolvencies doubled (RSM).

With the looming threat of a global recession, small and medium businesses are again at risk of worsening late payments and more insolvencies.

This research was conducted on businesses around the globe to understand the current climate of late payments, how they can be reduced, and what methods and accounts receivable practices businesses have implemented to deal with them.

The research aims to gather insights into

- Company demographics that pose the highest risk factors for late payments. Such as business size and industry

- The time cost associated with late payments and how businesses can reduce them

- Accounts receivables processes employed by businesses that reduce late payments

- How effectively businesses are managing their accounts receivables workload, and what impact this has on late payments

- What channels of customer communications around late payments are most effective for improving payment times

The severity of late payments

In a dream world, all invoices businesses issue to their customers would get paid on time, preferably before the due date. Unfortunately, as the vast majority of businesses know, this is usually not the case. Late payments are becoming more prevalent in a time where getting paid promptly has never been more critical. Research from the CPA shows that since the global pandemic started in 2020 there’s been a 209% increase in late payments. The findings from this survey support this, also demonstrating the prevalence of late payments across businesses globally. These findings also look into characteristics that can make a business prone to later payments, such as industry, business size, and location.

Payment date

Almost 9 in every 10 businesses report that their average invoice will be paid after the due date

Just 13% of respondents reported getting paid on time, or before their invoice due date.

Payment date breakdown

Late payments are prevalent, 87% of businesses report that their invoices are typically paid after the due date

35% of invoices are paid more than 30 days after the invoice due date.

Payment date by business size

The larger a business grows, the later they are likely to get paid

Whilst previous research indicates that small businesses are most impacted by late payments in terms of the resulting cash flow strains and resource costs, results in this survey indicate that larger businesses wait the longest to get paid on average.

On average, larger businesses (500+ employees) get paid 15 to 30 days after the invoice due date, whereas smaller businesses (1-500 employees) get paid 1 to 2 weeks after.

Facing the most late payments

Waiting the longest for payment

Paid the fastest

Payment dates around the world

Businesses in Italy and the Netherlands wait the longest for invoices to get paid, typically 31-45 days after the due date

China, New Zealand, United Kingdom, Pakistan, and South Africa-based businesses are paid the fastest, typically 'less than a week after the due date'

Note: Italy, China, Pakistan, South Africa, Andorra, Netherlands, Ireland, France, and Kenya had small response sample sizes, so please interpret data with caution, results may not be representative

* Drag to scroll on the globe

Payment dates for software users

Accounts receivables (AR) software users are three times more likely to get an invoice paid before the due date than non-AR software users

Although late payments are an issue faced by businesses across the globe, results indicated that those currently using an accounts receivables software had increased their likelihood of getting paid before the invoice due date.

By proactively managing the accounts receivables process, for example, by reminding customers before an invoice due date with polite persistent reminders, AR software users were able to effectively increase the number of payments they receive before the due date.

The time cost of late payments

The cost of being paid late is not restricted to just the monies owed. It also encompasses the cost that businesses incur while chasing those outstanding invoices. Businesses waste hundreds of hours each year chasing unpaid and overdue invoices. For instance, businesses in the United Kingdom waste 56.4 million hours each year chasing money owed to them (Quickbooks). The results from this survey support previous findings and demonstrate that the time cost of following up with late-paying customers is greater than what many businesses might believe.

Time spent

Over half of businesses spend more than 4 hours per week on accounts receivables tasks

53.4% of businesses report spending 4 or more hours managing accounts receivables tasks every week. For small businesses and sole traders, the opportunity cost of these hours every week can be huge.

This can mean time away from sales activities, making crucial new hires, forecasting, or even raising investments.

Spends the least time

Spends the most time

The accounts receivables workload

Managing receivables tasks

Over a quarter of businesses admit to struggling to keep on top of their accounts receivables tasks every month

Computer software, Retail, Accounting and Construction are among the industries most likely to struggle to keep on top of AR tasks

Not following up on payments

What is the impact of not staying on top of accounts receivables tasks?

Businesses that follow up with 70% or fewer of their invoices are more likely to receive payments 31-45 days after their invoice due date

Businesses that follow up with 90% or more of their invoices are the most likely to get paid within a week of their invoice due date

Results highlight the importance of businesses keeping on top of their AR tasks and following up with a high proportion of their debtor book in a given month. Trends indicate that the more invoices a business follows up with, the earlier their average payment date is

This has implications in particular for businesses in the Computer software, Retail, Accounting and Construction industries, as those who are the least likely to stay on top of AR tasks

Processes and methods in accounts receivables

Each business has its own accounts receivable process and ways of following up with late-paying customers. Some businesses only offer their customers bank transfers as a payment option, while other businesses may give their customers the option to pay via credit card, open banking, or buy now pay later options. Similarly, some businesses prefer to text or WhatsApp their customers regarding an outstanding balance, while others use email as their main form of communication. However, this study indicates that there are methods and processes that are more effective than others, which businesses should consider implementing to reduce late payments.

Follow up methods

How are businesses following up on late payments?

Email is the most commonly used method for following up on late payments, used by 93.8% of businesses surveyed

Phone calls were the second most common method, used by over 60% of respondents

Fewer than a quarter of respondents reported using either SMS, post, WhatsApp, or ‘other’ methods

Follow up methods breakdown

Using a combination of SMS and email reminders increases a business’ chance of getting paid within a week of the invoice due date by 56%

Whilst traditional methods of emails and phone calls were the most popular for following up on late payments, results indicate that businesses supplementing these traditional methods with SMS or WhatsApp messages get paid sooner

100% of businesses using with SMS and email payment reminders reported that they get paid within 2 weeks of the invoice due date

Collection methods

Bank transfer is the most common method for collecting payment, used by 60% of businesses surveyed

Direct debit (16.2%) and Card Payments (14.6%) were the next most common methods for collecting payments after bank transfers

Despite the additional safety features, faster speeds and lower costs of open banking, adoption of open banking as the typical payment collection method for businesses is low. Only 2.5% of businesses reported using open banking or instant payments as their most common payment method. Adoption may be low as open banking is still a relatively new technique in the world of invoice payments, and could be yet to be adopted by many businesses answering the survey.

Based on the findings of this research, it is clear late payments remain a significant challenge for businesses in 2022. In fact, when compared with previous late payments research, the present research suggests that in the current economic climate, late payments are more prevalent than ever before.

In a 2019 study by Xero and Paypal into small business late payments, they found that 48% of all invoices issued are paid late. Barclays reports that in the UK, 58% of small and medium businesses are paid late, based on findings from 2021. However, the present research conducted by Chaser found that 87% of businesses are paid after their invoice due date. Therefore this research suggests that late payments may be more prevalent than before. This poses the question of whether late payments are becoming worse over time.

Recommendations

Despite the challenges businesses are facing with late payments, this research has identified methods used by businesses that are effectively reducing their late payments. The following recommendations are based on these findings:

1. Follow up with all invoices every month

Results show businesses that follow up with 90% or more of their invoices each month are the most likely to be paid within a week of the invoice due date. By having an efficient debtor tracking system in

place, keeping visibility over what is outstanding every month, and following up on all (or most) of these invoices each month, businesses can ensure they are paid on time - or within a week of their due date.

2. Send payment reminders through multiple channels

Although email payment reminders are the most commonly used method, results indicate that by supplementing email with SMS payment reminders businesses can increase their chance of getting paid before or within a week of their invoice due date by 56%. All respondents at businesses that send payment reminders via text as well as email reported that they are typically paid within two weeks of the invoice due date. This is in contrast to businesses using only email, who waited up to 60 days after the invoice due date for payment.

3. Support your accounts receivables process with technology

Businesses in the survey that used accounts receivables software to support their credit management process were three times more likely to get an invoice paid before the due date, compared to businesses not using accounts receivables software.

There are a variety of tools and systems available to help businesses with debtor tracking, payment reminder automation, payment collection, and debt recovery.

Automation and technology can allow businesses to reduce time spent on the manual, repetitive work involved in managing the accounts receivables process and following up on late payments.

As explored, taking a proactive approach to receivables management and following up on 90% or more of payments each month helps businesses receive payments faster. By implementing technology in the receivables process to automate manual tasks, businesses can stay on top of their receivables workload with minimal time input, and receive payments sooner.

This research follows a survey conducted by Chaser Technologies Limited's marketing team, which occurred from May 2022 to July 2022.

The sample frame was obtained from an internal database of more than 26,000 accounting and finance professionals. External databases were also used to gather survey responses including the ACCA, Financial Director, and Xero User Magazine. 411 survey responses were gathered from these sources. Of these, 240 survey respondents were identified for further analysis, following an intensive data-cleaning exercise to remove any incomplete and fictitious responses.

The sample includes accounting and finance professionals who work primarily in the UK, Australia, USA, Canada, and New Zealand, with very few responses in other countries worldwide. The finance professionals surveyed can be from any industry in a company of any size.

The above sample indicates an overall margin of error of around 6% in our survey sample, at a 95% confidence level (z-score of 1.96).

The survey was conducted via Survey Monkey, which formatted the questionnaire for respondents and collected the responses data. This platform also collected survey interaction data used in the data hygiene process.

The survey consisted of several scaled-numeric, single, and multiple-choice questions, designed to obtain insight into late payments and accounts receivables. The survey asked respondents about their key demographics, such as industry, geographical location, and company size. The survey also covered respondent behaviours, namely, their time spent on - and ability to manage accounts receivable tasks, along with their methods for following up on late payments. Finally, attitudinal questions were asked to gain insight into how the respondents view the topic of late payments.

The data was loaded, cleaned, and analysed using R. R was used to explore significant trends between questions. The Plotly library was used to visualise data and support useful insights from the analysis. These insights and visualisations form the basis for this report.

World Bank SME finance: Development news, research, Data (2021) World Bank. Available at: https://www.worldbank.org/en/topic/smefinance (Accessed: November 2, 2022).

New Quickbooks research reveals the impact of late payments on mid-sized businesses (2021) Article. Available at: https://quickbooks.intuit.com/r/midsize-business/midsize-payments-research/ (Accessed: November 2, 2022).

UK small businesses waste 56.4m hours a year chasing late payments (2019) Article. Available at: https://quickbooks.intuit.com/uk/press/smbs-chase-late-payments/

Time to Act: The economic impact of poor payment practice, FSB (2016).

Three in five UK businesses are owed money from late payments, fuelling stress and cash flow problems (2022) Barclays. Available at: https://home.barclays/news/press-releases/2022/01/three-in-five-uk-businesses-are-owed-money-from-late-payments--f/ (Accessed: November 2, 2022).

Corporate insolvencies to double in 2021, targeted action is needed warns RSM (2020) RSM UK. Available at: https://www.rsmuk.com/news/corporate-insolvencies-to-double-in-2021-targeted-action-is-needed-warns-rsm (Accessed: November 2, 2022).

State of late payments - do beautiful business | Xero us (2019) Xero. Available at: https://www.xero.com/content/dam/xero/pdf/state-of-late-payments/State-of-late-payments_report_2019.pdf (Accessed: November 2, 2022).