Topic: Credit control & accounts receivables (18)

How to avoid difficult conversations with clients on overdue invoices

The impact of late payments on UK businesses is staggering.

Effective (and friendly) ways to handle invoice and payment disputes

Implementing effective credit control procedures is difficult enough as it is for most small and medium...

Credit control and debt collection policy template for businesses (free template included)

Late payment of invoices is one of the major issues businesses in the UK have to overcome. Despite the...

Summary of the UK Law on Late Payment of Commercial Debt

If you have an unpaid invoice for goods or services, you are, by law, entitled to claim interest on...

Why Microsoft Dynamics 365 Business Central users should use Chaser

Combining the functionality of Microsoft Dynamics 365 Business Central with Chaser’s proven ability to...

What are payment terms? What, why, and how | Chaser

Establishing clear payment terms is one of the easiest steps on the road to getting paid on time and getting...

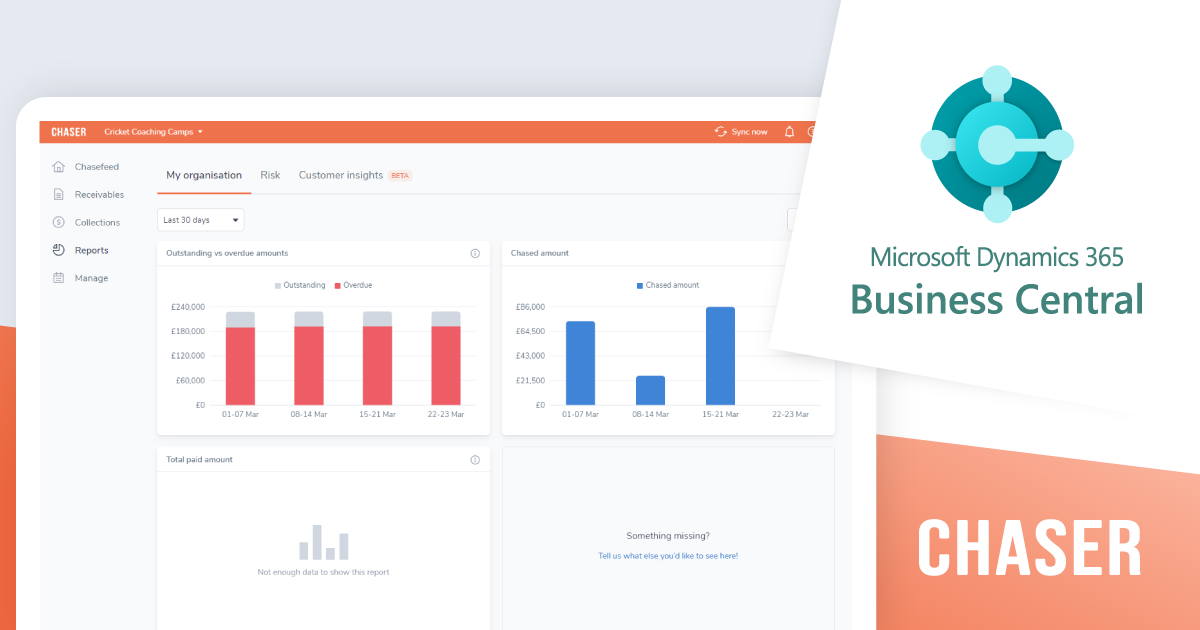

Faster invoice payments for Business Central users with Chaser

Microsoft Dynamics 365 Business Central users can now benefit from faster invoice payments with the leading...

Automate and personalise your accounts receivable process with Chaser

Consistency is hugely important when it comes to effective business communications.

How to deal with late payments without the cringe factor

No one likes dealing with late payments. In a perfect world, you’d provide the goods and services that your...

Top 10 signs it's time to outsource your credit control

Outsourcing business processes is a step many companies take to get effective control over a range of...

The importance of credit management at your business | Chaser

Do you struggle with hours of manual follow-ups and late payments? Do you find yourself in a feast or famine...

Accounts receivable automation benefits: 6 reasons to automate

Do you struggle to find the time to chase customers for your payment? Are you slogging away entering data...