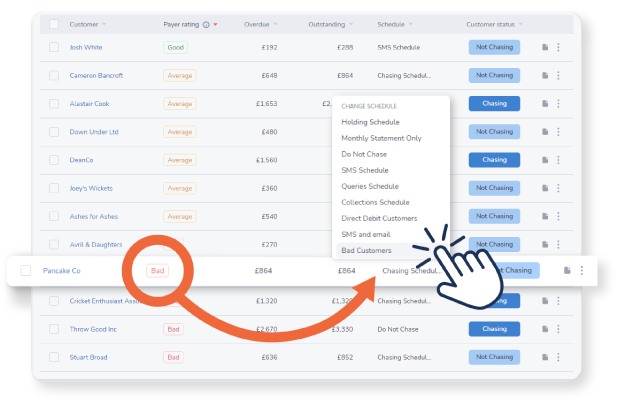

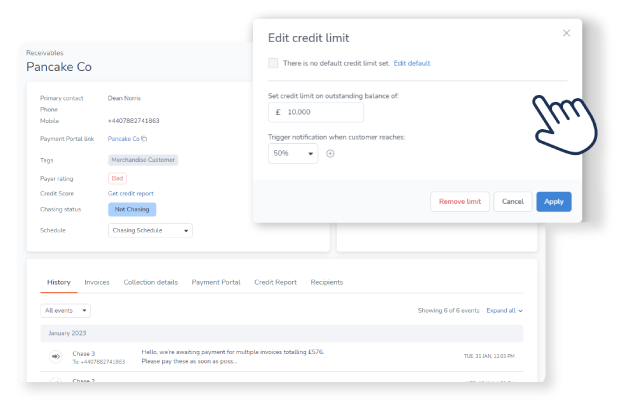

Prioritize effectively

Find out which customers are most likely to pay you late, and who you should follow up with first. Instantly identify problem accounts without the need for additional reports or tools, and gain clear insights into your payer's behavior before adjusting their credit limits or using debt collection.