Save time chasing your debtors

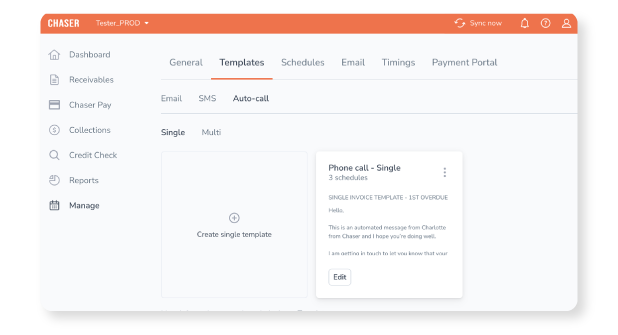

Save time and get paid faster by automating the chasing of invoice payments via phone call. Create text-to-speech templates in Chaser and send call reminders according to automated schedules, on the times and days that you choose.