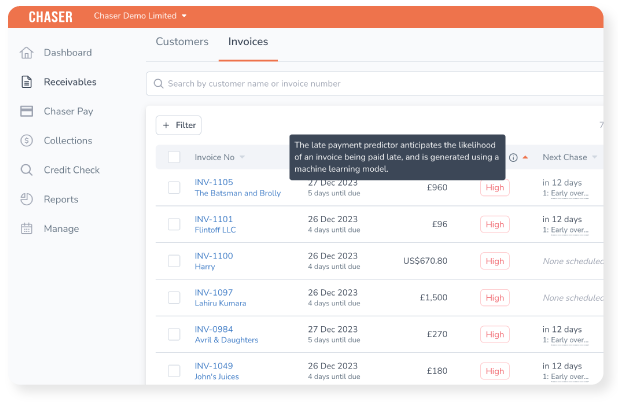

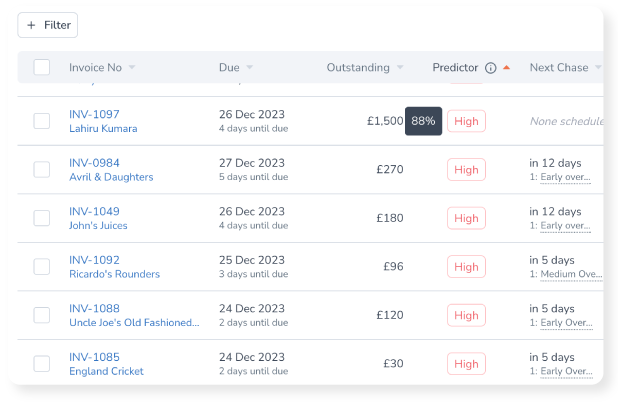

Prioritize your collection efforts

Gain a competitive edge by strategically allocating your collection resources. By pinpointing invoices at risk of late payment, your business can streamline resource allocation, directing efforts towards incentivizing high-risk customers to make timely payments. This targeted approach ensures that valuable resources are not evenly distributed among all invoices, allowing your team to focus on where it matters most