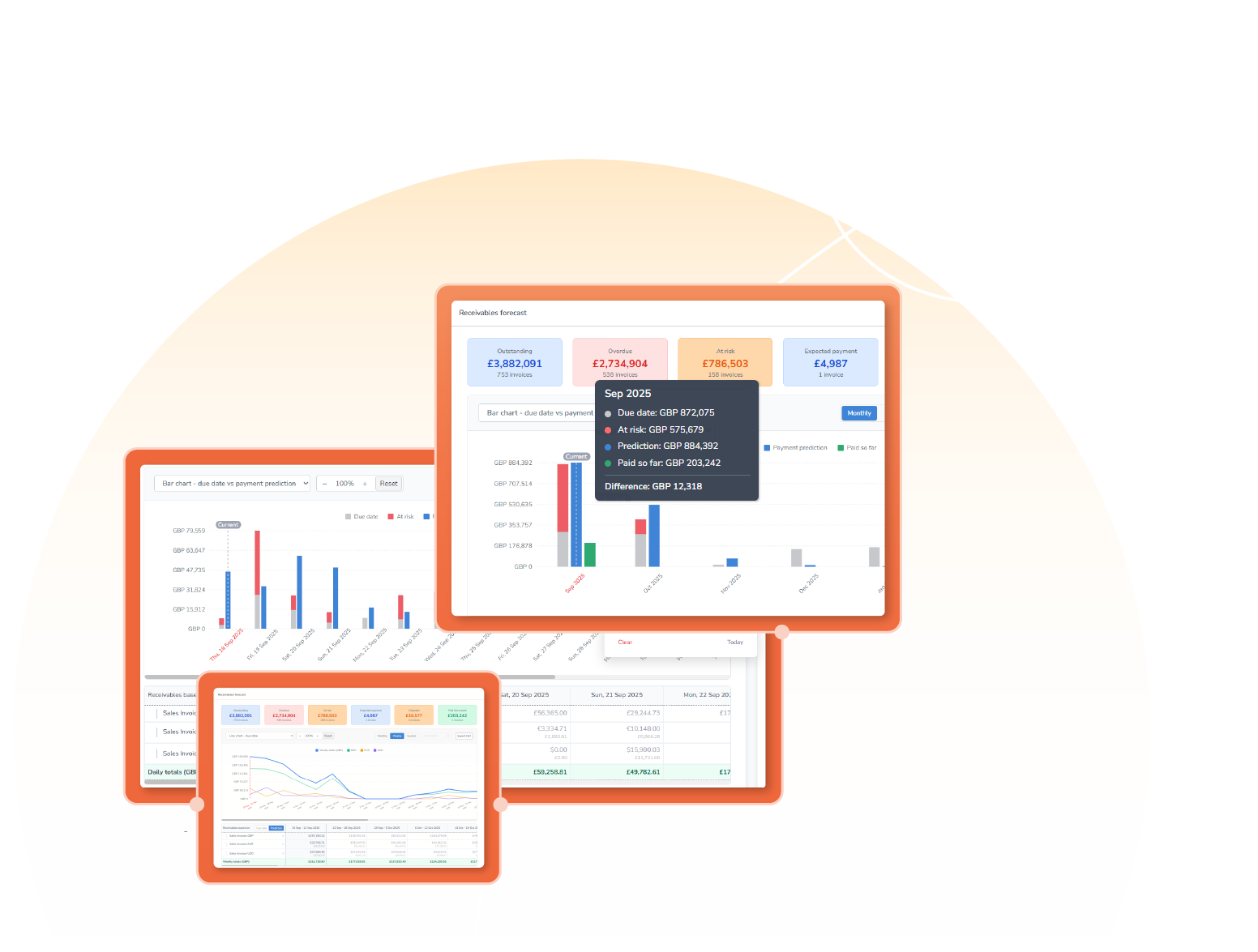

Improve financial planning

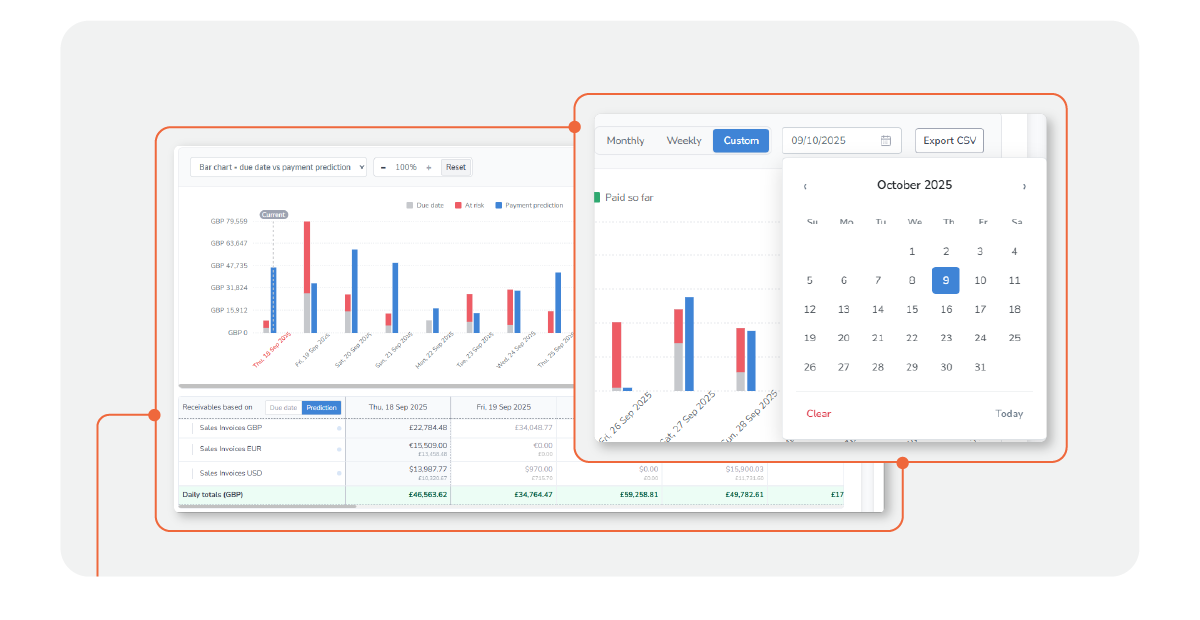

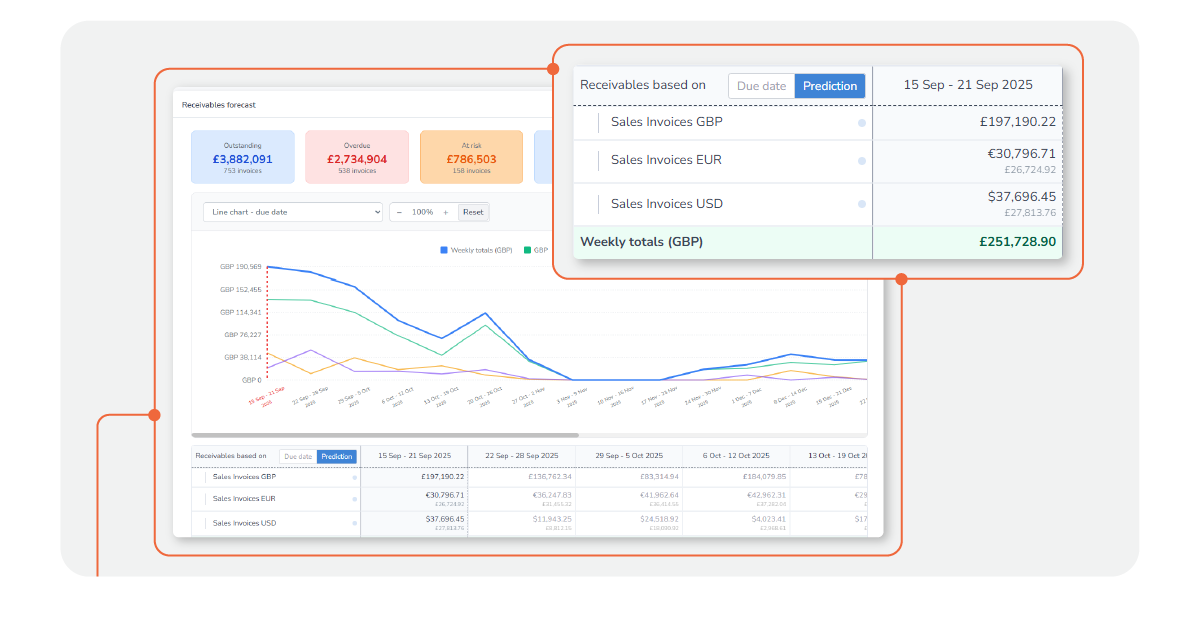

Create accurate forecasts for weekly, monthly, or custom periods. Plan budgets and resources with confidence, knowing exactly what income to expect.

Get your accounts receivable health checklist to protect your cash flow

Forecast your incoming payments with real-time receivables data, so you can plan with confidence, prioritize the right accounts, and protect cash flow

Create accurate forecasts for weekly, monthly, or custom periods. Plan budgets and resources with confidence, knowing exactly what income to expect.

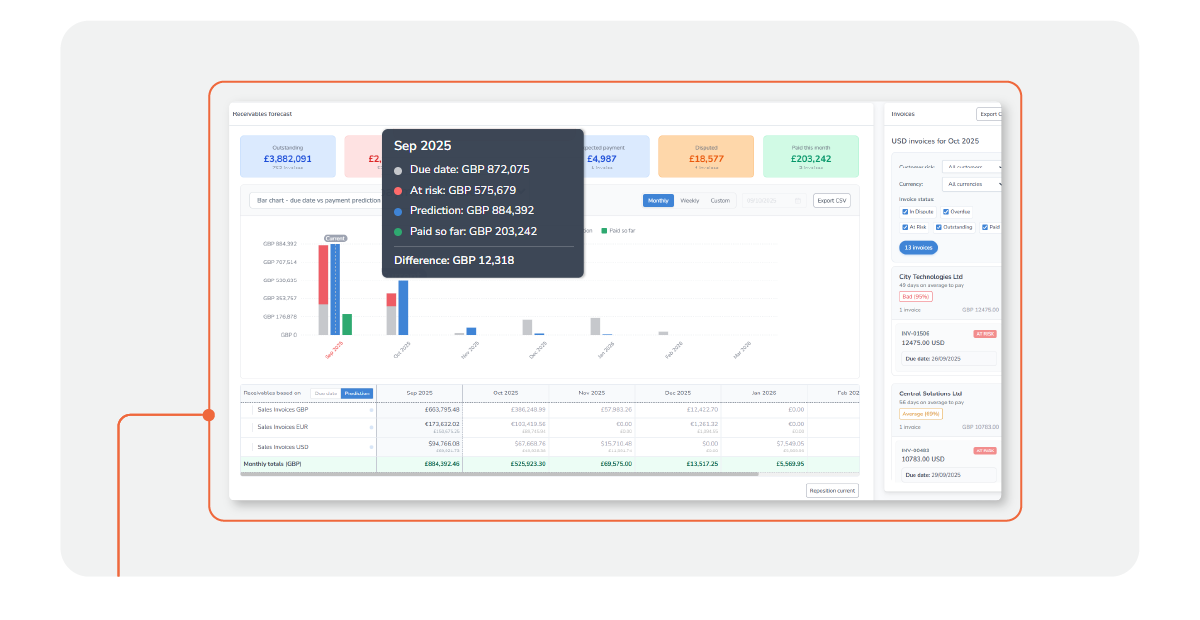

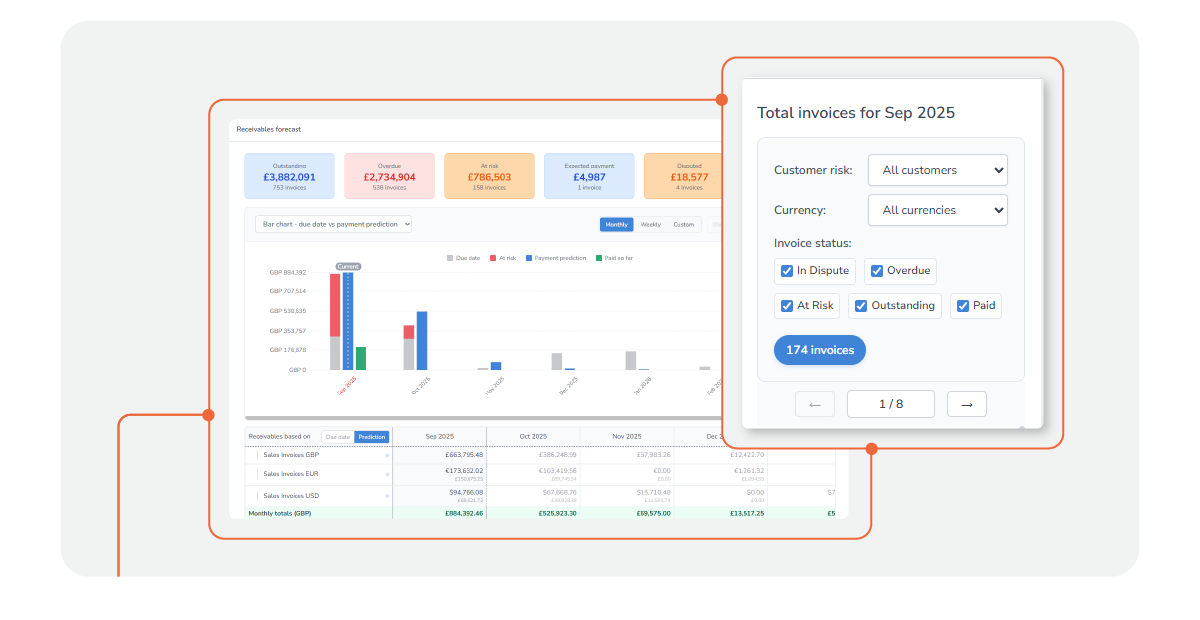

See when invoices are likely to be paid with due date vs. payment prediction views. Anticipate shortfalls before they happen and avoid surprises.

Forecast receivables across different entities and geographies. Use currency filters to get clarity over global income in the format that matters to you.

Tailor your forecast to your business. Include or exclude disputed, overdue, or paid invoices, and set up forecasts that align with your internal workflows.

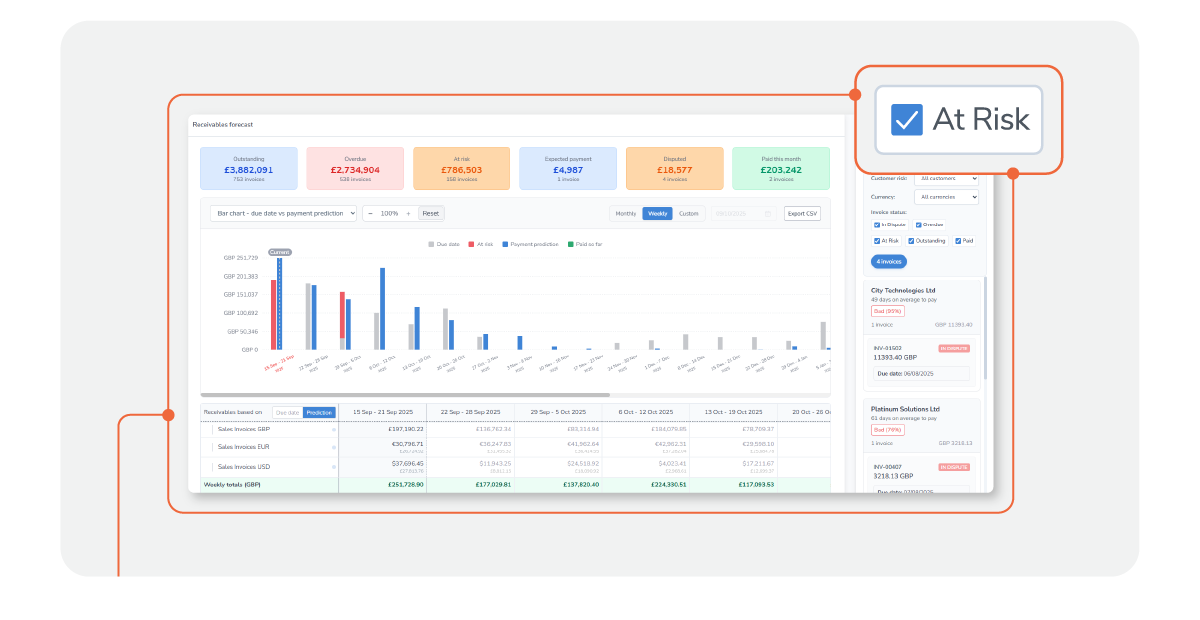

Quickly identify which invoices are most at risk of late payment, so you can direct your team’s effort to where it will have the most impact.

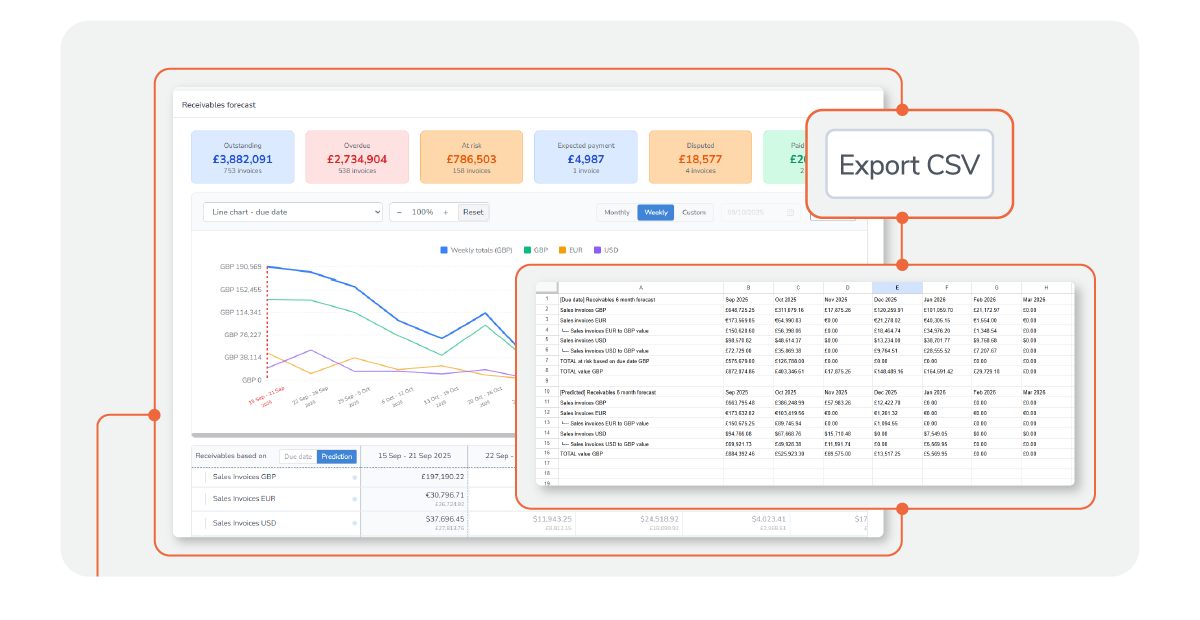

Export forecast data as a CSV to share in reports, analyze trends, or feed into wider business planning. Eliminate spreadsheets and save valuable time.

Receivables forecasting gives finance teams a clear, forward-looking view of expected payments. Instead of relying on static reports or gut feel, you can instantly see when income is likely to arrive, where risks exist, and how your receivables pipeline will impact cash flow in the weeks and months ahead.

Built directly on Chaser’s receivables data and your connected accounting system, forecasts update in real time and account for overdue invoices, disputes, expected payment dates, and installment plans. That means you’re always working from the most accurate and up-to-date information, without the need for manual spreadsheets or duplicated effort.

With clearer insight into future cash inflows, your team can plan budgets and resources more effectively, prioritize at-risk accounts to protect revenue, and share accurate forecasts with leadership and stakeholders. Receivables forecasting saves time, reduces uncertainty, and helps businesses of every size take control of their cash flow with confidence.

Over 10,000 users worldwide rely on Chaser to get paid faster, protect their cash flow and maintain good customer relationships.

Stuart Hurst

Head Of Cloud Accounting, UHY“A very easy to use app, that's very clever at chasing debts. We've seen an improvement to debtor days almost immediately. ..the customer service and support Chaser offer is superb, can't praise them highly enough".

Sharon Pocock

Md & Principal Accountant, Kinder Pocock“This is such a good add-on. I truly believe that Chaser emails are sent with a little bit of magic. Even though I regularly used to send statements from Xero, the Chaser emails have had a far greater response, clients apologising for not paying sooner! It has definitely improved credit control, and the ‘thank you’ email when clients have paid is a lovely touch.”

Emma Fox

Founder & Md, Fresh Financials"Chaser has really changed the space. Several other apps have appeared in the market since Chaser - even Xero has its own invoice reminders. For us, though, Chaser is the one with the features we need. And at a great price, and with a great team supporting it, why would we ever change?"

Stuart Hurst

Head Of Cloud Accounting, UHY“A very easy to use app, that's very clever at chasing debts. We've seen an improvement to debtor days almost immediately. ..the customer service and support Chaser offer is superb, can't praise them highly enough".

Sharon Pocock

Md & Principal Accountant, Kinder Pocock“This is such a good add-on. I truly believe that Chaser emails are sent with a little bit of magic. Even though I regularly used to send statements from Xero, the Chaser emails have had a far greater response, clients apologising for not paying sooner! It has definitely improved credit control, and the ‘thank you’ email when clients have paid is a lovely touch.”

Emma Fox

Founder & Md, Fresh Financials"Chaser has really changed the space. Several other apps have appeared in the market since Chaser - even Xero has its own invoice reminders. For us, though, Chaser is the one with the features we need. And at a great price, and with a great team supporting it, why would we ever change?"

Start your free trial today and experience the power of automation software for accounts receivables management.