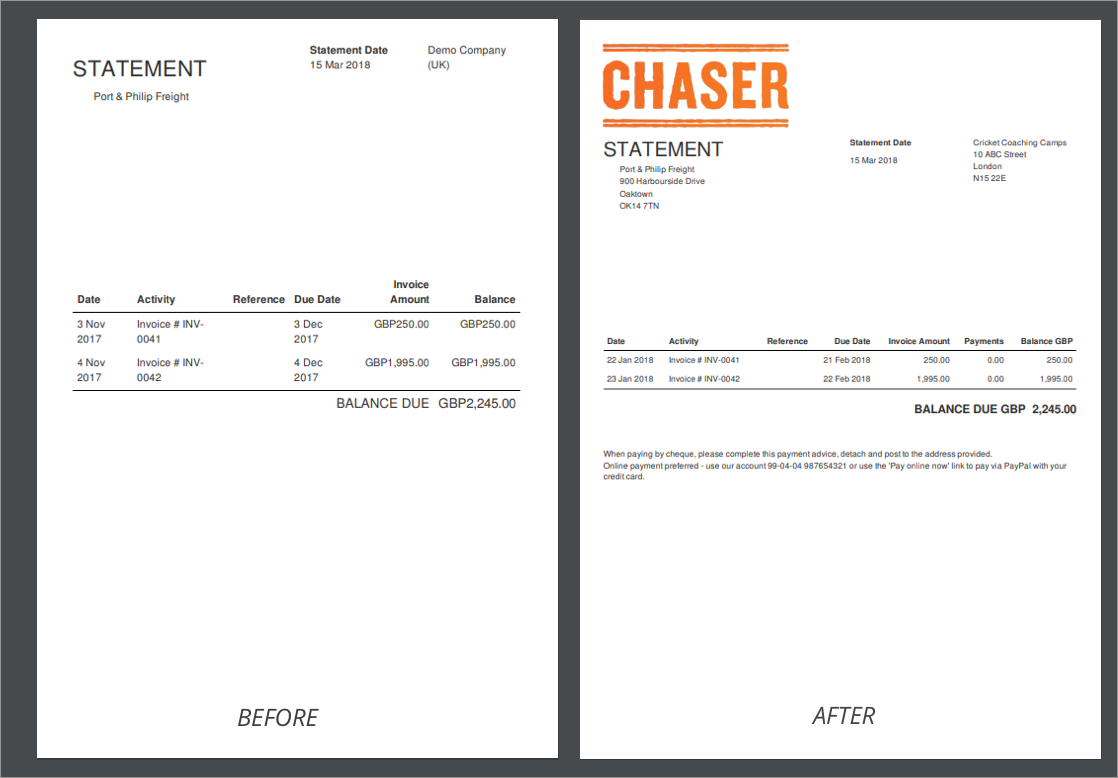

Customer statements are a fantastic complement to your automatic chasing. They ensure customers are acutely aware of their overall account balance and have up-to-date payment advice. Unfortunately, some accounting systems do not allow for direct access to these statements for chasing purposes. As a result, statements within Chaser have historically been plain, non-branded summaries.

We’re thrilled to announce that customer statements within Chaser have now been completely overhauled. You can now attach professional, easy-to-digest, branded PDF statements to your chasers, containing all the necessary information to get you paid.

What’s new?

Customer statements summarise all outstanding invoices, payments, and credit notes for a customer’s account. They can be automatically attached to your email chasers as a PDF - simply navigate to your templates within Chaser's settings.

We’ve completely rebuilt customer statements within Chaser, introducing a cleaner layout, new fonts, and a table format. This ensures new statements are now easy to interpret for customers and look professional, without being over-complicated.

Custom payment advice and contact information can now be added through settings, meaning your customers will never be in a position where they don’t understand payment options, or how to best contact you. Additionally, the ability to now brand your statement with a company logo removes any confusion that could arise through a lack of consistent branding.

Removing barriers to payment

Minimising any barriers to payment is the foundation to successful credit control. Customers often rely upon "reasonable" excuses to delay payment, such as not having clear records of outstanding balances or not understanding payment options. Removing as many barriers as possible places your customer in a position where they can’t justify delaying payment, and must face the reality that they are denying you payment for no good reason.

This will heavily influence their decision to settle your invoices first when it comes to completing the payment run. Attaching customer statements to chasers significantly reduces barriers to payment through providing up-to-date, clear information.

A common reason customers will delay payment is that they do not have a clear record of outstanding balances. Manually sending out statements from your accounting system wastes your valuable time and is prone to being forgotten. Attaching a Chaser statement to your automatic email chasers ensures customers always have an up-to-date, digestible summary of their outstanding account. This reduces your cognitive load and increases your likelihood of being paid.

Providing clear payment terms and advice is also a key step in removing barriers to payment. Chaser’s new statements provide the ability to enter custom payment information, so your customers are always aware of their payment options. You can also input additional contact information, so your customers know how to get in touch when reviewing the statement.

Whilst customer statements are great for removing barriers to getting paid, it is also imperative that customers don’t dismiss the information being provided. Maintaining common branding across company documents is necessary to conveying their legitimacy. By including your logo on customer statements within Chaser, your statements are instantly recognisable as valid and professional.

Happy chasing!

We're excited to continue removing barriers to help you get paid faster. If you have any feedback or suggestions, please do reach out at ben.king@chaserhq.com. I’d love to hear from you!

Blog header image modified from an image thanks to: Samuel Zeller