Topic: Credit control & accounts receivables

Charging late payment fees: Guide to legality and client communication

Late payments are a common problem for businesses. You've finished your work, but now you're waiting for...

.webp)

Accounts receivable aging report: Complete guide (+ free template)

You've done the work and sent the invoice, but your bank account doesn't reflect it. The key to controlling...

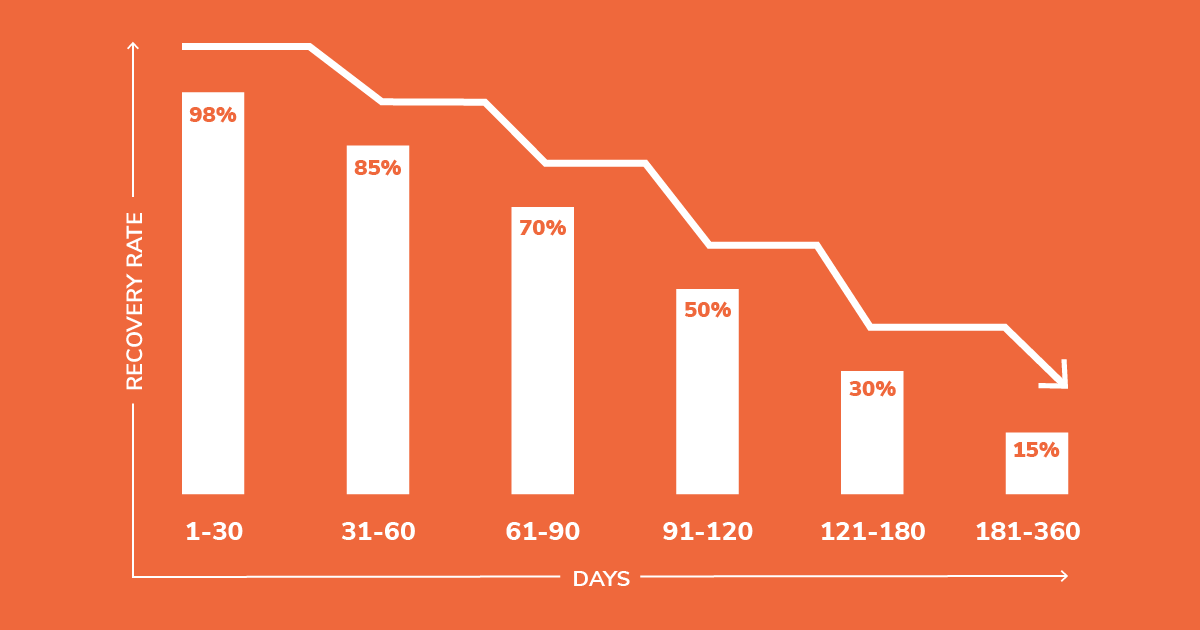

When to send unpaid invoices to collections (and why timing matters)

Every finance team has faced the same challenge: an invoice that lingers unpaid long after its due date. At...

Late payments still hold SMEs back: Truth behind the UK PM’s warning

A short post on X (formerly Twitter) has recently shone a spotlight on a challenge small businesses across...

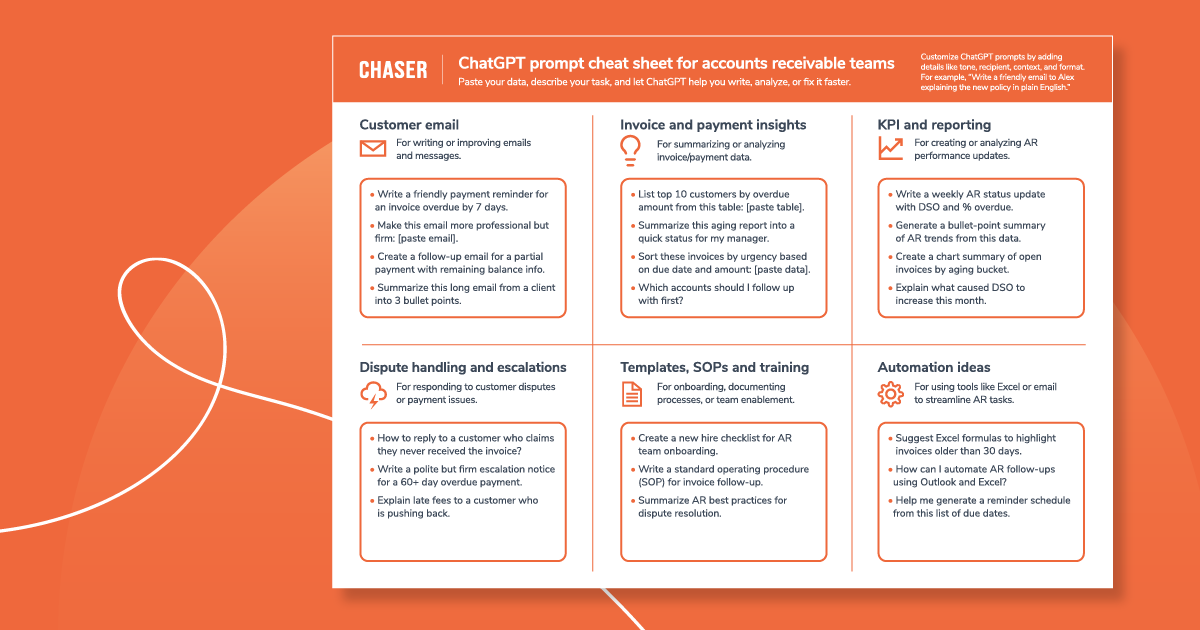

ChatGPT prompt cheat sheet for accounts receivable teams

Late payments are not just a cash flow problem — they derail forecasting, create bottlenecks, and increase...

_%20What%20it%20is%20and%20how%20it%20works%5D%20Outline.png)

Accounts receivable conversion (ARC): How does it work?

Imagine Sarah, owner of a growing online boutique, drowning in a sea of paper checks. Each week, she spent...

%5D%20Outline.png)

How to write a past due invoice email (with templates & examples)

The persistent struggle with overdue payments is a common pain point for businesses of all sizes. You've...

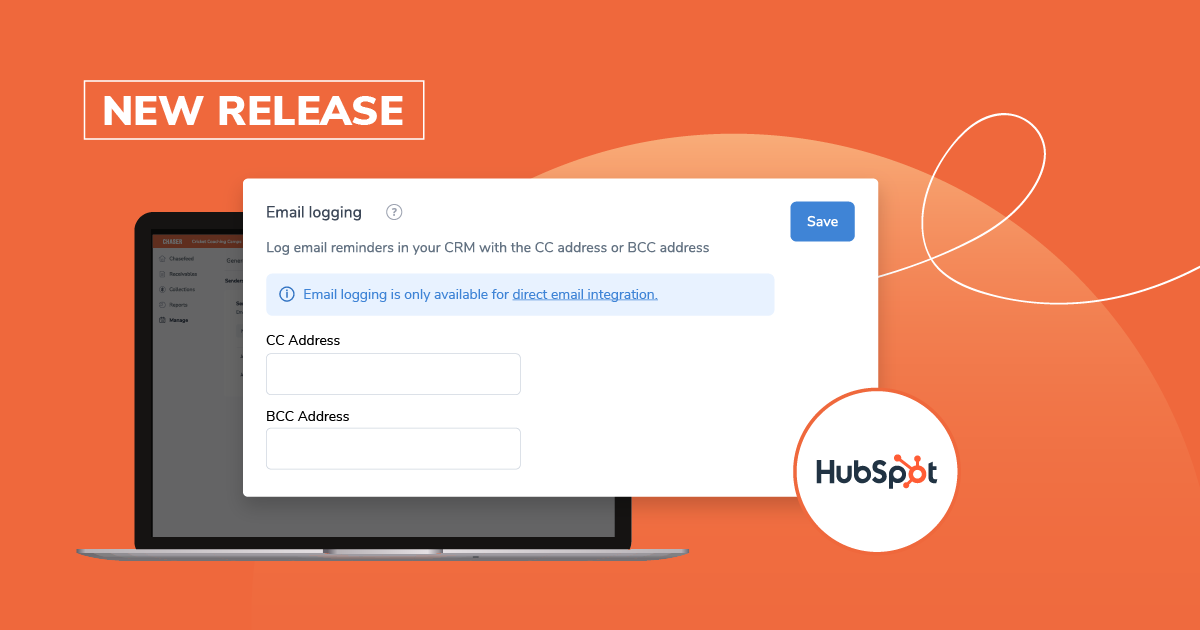

Track receivables conversations in HubSpot automatically using Chaser

Keeping a complete record of your customer communications is essential in accounts receivable—especially when...

Accounts receivable subsidiary ledger: What is it and how to use it?

Have you ever found yourself in this situation: your customer wants to extend their line of credit with you,...

.png)

Free accounts receivable templates (Excel & Google Sheets)

Managing accounts receivable can be a time-consuming task, but it doesn't have to be. To simplify your...

What are uncollectible accounts & how to account for bad debt

Uncollectible accounts, also known as bad debt, represent the portion of accounts receivable that a business...

Why people don't use automated accounts receivable

Accounts receivable (AR) automation offers a more efficient and cost-effective way to manage cash flow,...