As a small or medium business (SME), implementing a strong receivables process is one of the most important things you can do to survive an economic downturn. This process should be made up of a cloud accounting system, invoice chasing automation, and a debt recovery process. This will allow you to streamline your invoicing process, have greater visibility on cash flow, and protect yourself from having to write off overdue invoices as bad debt.

By doing so, you can improve your cash flow at a vital time. You may have had to furlough or lay-off staff and your debtors may be withholding payment as they themselves are struggling. Automating as much as you can, and using a digital debt recovery service can be the difference between the success or failure of your business now but also impact the future growth of your business when the economy picks up. .

What is Digital Debt Collection?

Good question. Digital debt collection uses a data-driven approach to deliver better results, for a lower cost to collect. It empowers the debtor to self-manage payments and resolves their debts. Data is used to form deep insights into the payment options and channels to ensure customers are contacted at the right time, with the right message, and through the right channel.

As a natural extension to credit control, Chaser provides SMEs with Chaser Collections, a digital debt recovery service available within the Chaser app. You can escalate an overdue invoice in just a few clicks. The Chaser Collections team have Chaser’s automation tools at our disposal, ensuring we get the majority of overdue debts paid without legal escalation. This means we’re able to charge less than traditional agencies. You also have complete peace of mind that you’re kept up to date with what's happening, with all contact logged within your Chaser account. But that’s not all.

With years of experience in providing a personalised, human approach to credit control, our Chaser Collections team ensures that your customer relationships are not damaged throughout the collections process. This will not only help you get paid, but also preserve the relationships you’ve taken time, money and effort building in the first place.

How to bulletproof your receivables process

Step 1 - Switch to a cloud accounting software

Think of this as the foundation of your process. You need to get this right in order for the rest of it to work correctly. Using a cloud accounting system like Xero, QuickBooks Online, or Sage Business Cloud Accounting removes the vast majority of manual administrative work from your invoicing process. This in turn prevents errors, or simply forgetting to send the invoice! Check out our webinar on how to transition to a cloud accounting system in uncertain times here.

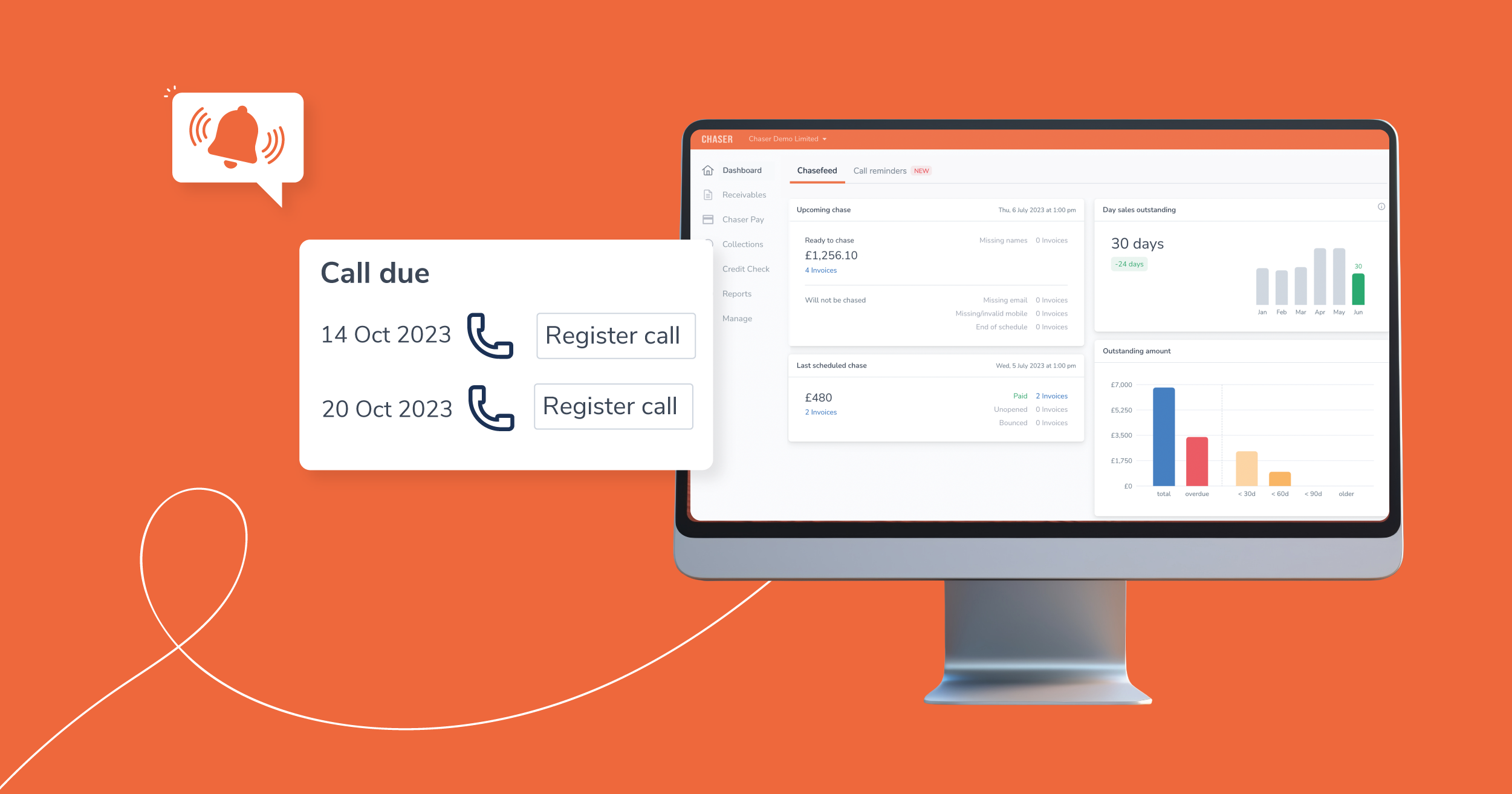

Step 2 - Use an automated invoice chasing tool

In an ideal world, you would issue an invoice and your customer would pay it as soon as it becomes due. However, this rarely happens. In reality, once you’ve issued an invoice you’ll need to remind your customers to pay it.

Chaser integrates with your cloud accounting software and pulls through all the information needed to automatically chase customers with overdue invoices, or remind them that an invoice is about to become overdue. Each business is different, which is why your Chaser account is completely customisable. You know your customers are being chased how and when suits you. We know how important customer relationships and repeat business are to SMEs, so all emails they receive will look and feel as if you have hand typed them.

Don’t take our word for it. One of our accounting partners helped their client get paid £36,000 worth of invoices in just two weeks! Read more here.

Step 3 - Get a debt recovery process in place

Implementing Chaser within your business will get up to 80% of your invoices paid. However for that small portion of customers who are more stubborn, you need a plan in place. Deciding how you want to deal with these overdue invoices as and when they happen piles stress and worry onto your plate. You need to have a default position, from which you can deviate if necessary. And that position should not be to write it off as bad debt.

Enter Chaser Collections, a considerate debt recovery service. Chaser Collections is a service available from within your Chaser account, and involves escalating overdue invoices to the Chaser team! It’s the first-of-its-kind to combine data, technology and in-house collections experts with years of experience in empathetic, personalised invoice chasing.

What we do:

- Personalise messages specific to the customer

- Optimise when to reach out;

- Choose the right channel; and

- Offer the best payment arrangements that works for everyone

- Act as a mediator, enabling you to maintain positive relationships with your customers

This unique combination leads to superior debt recovery rates, ensures a better customer experience and helps resolve even the most difficult collections problems. Chaser Collections allows you to remove the guesswork, stress, and workload from your collections process.

If you'd like to discuss how Chaser Collections could help your business get paid the money you're owed, book a call with a member of our team below!