Topic: Debt collections

%20-%20Collection%20effectiveness%20index_%20optimize%20your%20debt%20recovery%20(1).webp)

Collection effectiveness index: How to calculate your debt recovery

Your board wants clearer cash forecasting. Your lender wants fewer surprises. Your aged-debtors report looks...

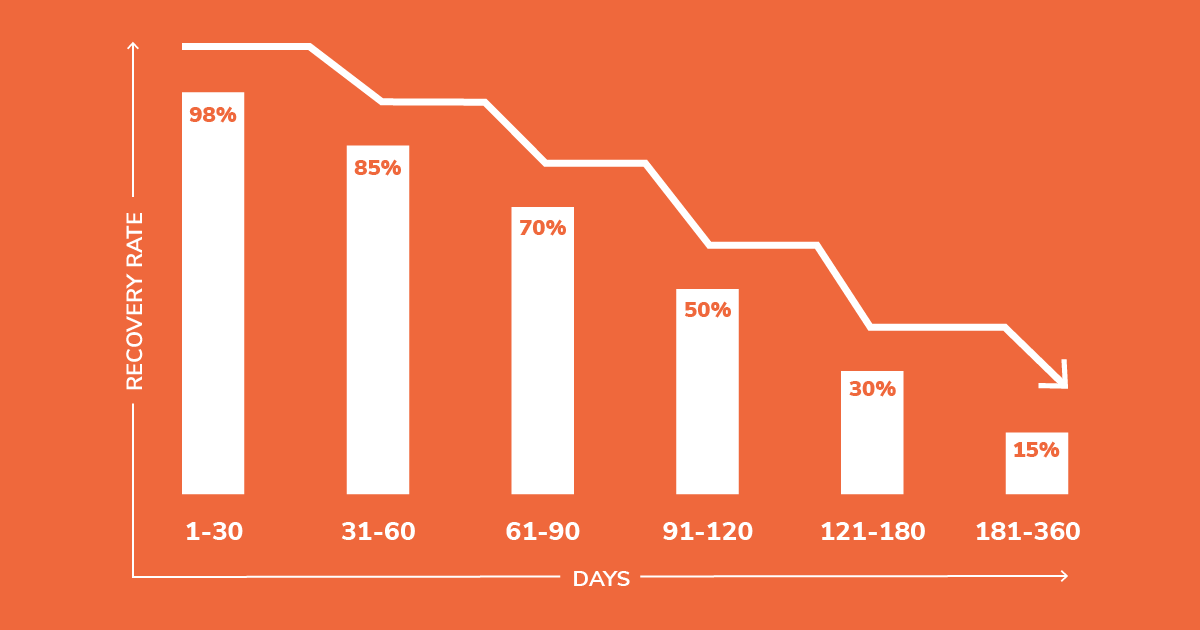

When to send unpaid invoices to collections (and why timing matters)

Every finance team has faced the same challenge: an invoice that lingers unpaid long after its due date. At...

Balance sheet forecasting: How to forecast your key line items

Are you making critical business decisions, like whether to hire a new employee or buy new equipment, based...

What is debt collection and how does it work?

Most UK businesses lose £15,000 GBP+ annually to unpaid invoices, and the majority don't have a systematic...

Can a debt collector take you to court after 7 years?

When it comes to managing personal finances, few things can be as stressful and daunting as dealing with old...

What happens if you lose a debt collection lawsuit?

Facing a debt collection lawsuit is a stressful experience. Many individuals find themselves in this...

How much do debt collectors pay for debt?

In the complex world of finance, debt collection is a significant aspect that affects individuals and...

What happens when a debt is sold to a collection agency?

When unforeseen circumstances lead to financial struggles, managing debt can become a daunting challenge....

What happens if you don't show up to court for debt collection?

In today's world, being in debt is all too common, and navigating the legal system can be overwhelming....

What is a write off & how companies use it

Navigating the world of finance can often feel like entering a complex maze of terminologies. One such term...

How often do debt collectors take you to court in the UK

Navigating the maze of debt collection can be a daunting experience, especially when faced with the prospect...

%20definition%20and%20rules%20(1).png)

Fair debt collection practices act (FDCPA): definition and rules

The Fair Debt Collection Practices Act (FDCPA) are the federal collection agency laws that protects consumers...