When most people think about the hardest jobs in the world, they don't usually think about debt collectors and credit controllers. These roles are often overlooked but can be some of the most difficult.

The reason for this is that debt collectors and credit controllers have to deal with a lot of negativity on a daily basis. They are constantly dealing with customers who are angry and frustrated because they haven't been able to pay their bills.

This can be really tough on the psyche, and it's no wonder that these professionals often find it hard to cope with their job.

In this article, we'll be looking at some of the reasons why debt collections and receivables management is one of the hardest jobs in the world and what you can do to make it easier for yourself.

If you're currently struggling with your job in this field, then this article is definitely for you. Let's take a look at some of the reasons why debt collections and receivables management is one of the hardest jobs in the world.

Debtors are usually going through a rough time

Just because people are in debt doesn't mean they’re maliciously withholding money from you. In most cases, debtors are going through a tough time in their life, and they're struggling to make ends meet.

Unfortunately, the job of the debt collector is to try and get as much money from the debtor as possible - regardless of their personal circumstances. This can often be a very difficult thing to do, especially if you sympathise with the person's situation.

Most people are empathetic to the struggles of others, and this can often make the job of debt collection very difficult. It's hard to constantly chase people for money, especially when you know that they're struggling to make ends meet.

Asking for money is awkward

No one actually likes asking for money - it's just not something that people enjoy doing. And yet, debt collectors have to do this on a daily basis. It can be extremely awkward asking people for money, especially if you know that they're struggling financially.

Another difficult thing about debt collections is that you constantly get rejected. People are often reluctant to pay their debts, and they can be quite forceful in their refusal. This can be extremely frustrating, and it's easy to start feeling like you're not making any progress.

No one likes to be rejected, but debt collectors have to deal with it on a regular basis. If a debtor is not willing to cooperate or make payments, there is very little that a collector can do. It can be frustrating and disheartening to constantly be told no, but collectors have to keep trying.

Debtors might have mental health issues

Feeling like you've ruined someone's day, or added to their stress, is never fun. And yet, debt collectors have to deal with this on a regular basis. It can be difficult to remain professional and calm in the face of someone's anger or distress.

Of course, not all debtors are angry or aggressive. Some simply don't have the money to pay their debts, and others may be going through a tough time in their life. It can be difficult to remain impartial when you know that someone is struggling, but collectors have to remember that they're just doing their job.

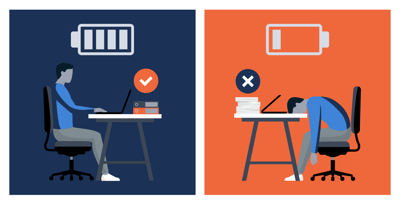

It's a high-pressure job

As a credit controller, securing the funds that are owed to your company is essential. This means that there is a lot of pressure to perform well. If you don't meet your targets, it can have a negative impact on your career.

Your success might be what the future of the company hinges on

In many cases, the future of a company rests on its ability to collect payments from its debtors. This means that the pressure is on for collectors to perform well. If they don't, it could mean financial ruin for the company.

It's also a high-pressure job because of the nature of the work. You're constantly chasing people for money, and often dealing with difficult situations. This can be stressful and can take its toll on your mental health.

It can be a thankless job

Credit control is a thankless job because you're constantly chasing people for money. This can be frustrating, and you may not always feel appreciated. It's also a job that often goes unnoticed, as it's not usually considered to be glamorous or exciting.

Recognition, both internally and externally, can be hard to come by

Despite the importance of credit control and debt collection, it's a job that is often overlooked. This can be frustrating, as you may not feel appreciated or valued. It can be difficult to get recognition for your work, both internally from your company and externally from clients and customers.

You have to be detail-oriented

The job requires a lot of attention to detail. You need to be able to keep track of many different things at once, including invoices, payments, deadlines, and customer information. This can be challenging, as it's easy to make mistakes or miss something important.

Making mistakes as a credit controller can be costly for the company, as it can lead to late payments, interest charges, or even bad debt. As a result, you need to be very careful and organised in your work.

You have to be both customer-driven and numbers-driven

Insisting someone pay you the money your company is owed while still maintaining a positive working relationship is a fine line to tread. You need to be firm but fair, and always keep the company's best interests in mind.

This can be a difficult balance to strike, and it's one of the things that makes debt collections and receivables management such a challenging job. It's also why it's so important to have a good team supporting you.

What can you do, as a credit controller, to make your job easier?

As a credit controller, there are a few things you can do to make your job easier.

Have a solid credit policy

Make sure you have a good understanding of the company's credit policy. This will help you to know how far you can push when it comes to collections.

An effective internal and external communication of the credit policy will help to avoid misunderstandings later on as well as provide a good foundation for future negotiations.

Monitor your customer's credit risk

Keep an eye on your customer's credit risk. This will help you to know when to take action and how much pressure to put on them. If you know your customers' situation, you will be in a better position to negotiate, and you can offer them alternatives to help them pay their debt.

Be persistent but not pushy

Customers who are behind on their payments will often try to avoid contact with debt collectors. It is important to be persistent but not pushy. Pushing too hard will only make the situation worse and may result in the customer being less likely to pay.

Develop strong relationships with your customers

Getting to know your customers can be helpful in a number of ways.

First, it gives you a better understanding of their business and their ability to pay. This can help you to make more informed decisions about when to pursue collections action.

Second, it can make the collections process itself more efficient and effective.

Finally, it can help to build goodwill and mutual respect between the company and its customers.

Stay on top of your invoicing

Effective, error-free invoicing is essential to the receivables management process. Your invoices must be accurate, complete, and timely in order to avoid delays in payments.

Additionally, you should make sure that your invoicing system is integrated with your collections system so that you can track payments and easily follow up on late or missing payments.

This will help to ensure that customers are being billed correctly, and it will also help you to spot any red flags that may indicate a problem with a customer's ability to pay.

A vital part of any business

Debt collections and receivables management is one of the hardest jobs in the world. It's often a thankless job, but it's an important one. Without effective debt collections, businesses would struggle to stay afloat, making it one of the most vital jobs in the business world.