Taking payment by direct debit has many benefits for small and medium businesses (SMEs).

Many businesses believe that direct debit payments will give them reasonable certainty around payment collection, which makes their internal forecasting easier and allows clients to smooth out the payment of their services evenly throughout the year.

However, direct debit can sometimes fail. This can occur for many reasons, including from invalid bank details and bank accounts being closed, to not enough money in the payer’s account, card details not being up to date due to them having expired, been lost, or stolen.

These issues can be overcome by using Chaser alongside direct debit. This creates a powerful combination that enables businesses to leverage the efficiencies of direct debit while also having a backup process in place for when it fails.

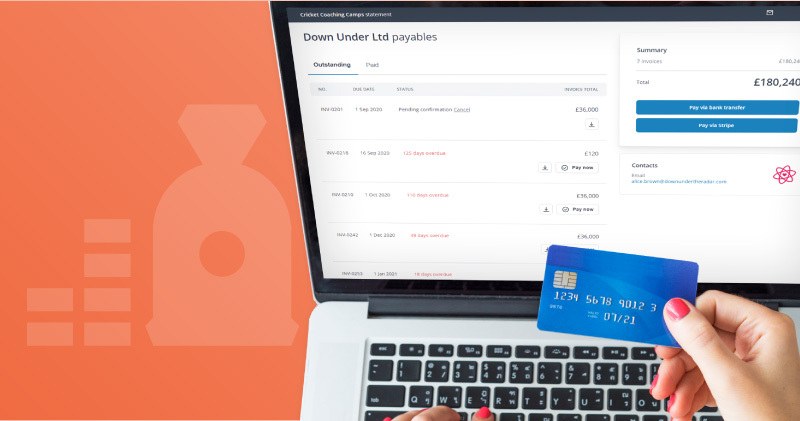

With the aim to help SMEs get paid faster, combined with our effort to resolve the late payment problem, Chaser has now released direct debit payment options within its application - so SMEs can cater to more of their customers' payment needs and increase their chance of receiving timely and predictable payments.

SMEs can get predictable payments from customers with direct debit options in the Payment Portal

What is direct debit?

Direct debit is an instruction from your customer to their bank that authorises you to collect payments from their account on agreed dates. You get this permission by receiving a completed direct debit mandate form from your customer. This is traditionally done in paper form but it can also be done online, which is how it works with the Chaser application.

Why use direct debit in Chaser?

Direct debit is one of the best ways for businesses to get paid. It helps overcome the issue of late payments by making it easy to collect funds once customers authorise its use. Payments are then automatically collected without clients needing to approve and consent each time. Unfortunately, used alone, they can still result in late payment problems for businesses, as there are instances where direct debit can fail.

Here are reasons why direct debit and receivables automation is a strong combination to help with late payments in your business:

1. Get paid faster and reduce debts

Businesses can now cater to more of their customers' payment needs and increase your chance of receiving timely and predictable payments by offering an additional payment option in they customers' payment portal. From customers to suppliers, all businesses have their preferred way of paying and by adding this additional option, they can provide more varied payment options, making them more likely to receive payments on time.

2. Save time

Businesses will spend less time on admin and debt collection phone calls as payments are collected automatically on the dates they have agreed with their customer in their direct debit mandate.

3. Cover all bases with Chaser

When direct debit isn't suitable for their customer, their payment fails, or their banking details change, they can follow up with the SMS and email payment reminders within the Chaser application. This ensures they have the best chance of receiving payments upfront, whilst covering all bases if their customer agreement changes or payments don't go through.

Get predictable customer payments with direct debit today

It's time to take action to reduce late payments and improve cash flow in the most efficient and friendly way possible for SMEs across the globe. By implementing direct debit options into their payment portal, businesses will increase their chances of getting paid on time and minimise late payments.

Users can see a full run-through of how to set up direct debit, here: help centre article.

.jpeg)