Discounted cash flow (DCF) is a valuation method used to estimate a company's or investment's intrinsic value by discounting its future cash flows back to the present day.

If that sounds complicated, don't worry. In this article, we'll be breaking down precisely what DCF means, its use cases, how to calculate it, and what you can use the results for.

So, if you'd like to know the value of an asset or company, read on to find out how to calculate it using DCF.

What is discounted cash flow?

Discounted cash flow is a technique used to estimate a company or asset by discounting future cash flows to the present day. In simpler terms, this valuation technique uses a combination of expected future cash flow and a fixed discount rate to estimate a company, investment or asset's fair market value (FMV).

The discount rate used can be either the Weighted Average Cost of Capital (WACC) or another customised rate that takes into account the riskiness of future cash flows.

For example, if a company operates in an industry with high uncertainty and volatility, a higher discount rate would be used to take this into account.

In short, if you are an investor looking to determine the value of an asset or company, discounted cash flow is a relatively simple and accurate way to do so.

Why is discounted cash flow necessary?

There are a number of reasons why DCF is considered to be a vital tool for owners and investors alike, including:

- It's an industry standard for estimating the fair value of an investment - If you're looking to buy or sell an asset, being able to calculate its fair market accurately is essential. Using DCF, you can get a quick and reliable estimate of an asset's worth.

- It helps with financial forecasting - DCF allows investors to predict future cash flows and their potential profitability accurately. This means that you can make more informed decisions regarding which investments are worth pursuing further.

- It considers the time value of money - TMV (Time value of money) is a concept that states that the present value of money is more than its future value. In other words, a dollar today will be worth more in the future due to inflation, interest rates and other factors. DCF takes this into account when estimating an asset's true worth.

- It allows investors to compare investments - By using DCF, investors are able to assess the potential return on their investment better when comparing two different assets.

- It allows you to accurately forecast the value of a company asset - By considering future cash flows and anticipating potential risks, DCF can be used to forecast the value of an asset. This is especially useful when evaluating assets with long-term growth potential, as you can effectively estimate the return on investment (ROI).

These are just some of the potential uses for DCF. As you can see, it is a great tool to use when assessing the financial worth of an investment or asset that allows you to make better-informed decisions.

How is DCF used by business owners?

So far, we've mainly discussed how DCF is used in an investment sense, but it has plenty of applications in a business setting, including:

- Forecasting revenue - DCF can be used to forecast a company's future revenue. Business owners can make more accurate predictions and plans by considering the expected cash flows.

- Forecasting expenses - As with predicting revenues, DCF can also be used to forecast a company's expenses in the future. This helps business owners budget their resources more effectively and anticipate any potential financial challenges.

- Setting prices - By looking at the expected cash flows associated with a product or service, businesses can set optimal selling prices considering market trends and demand.

- The timing of cash flow - DCF can be used to plan the timing of a company's cash flow. This includes when payments will be received and when bills need to be paid, allowing business owners to manage their cash flow better.

- Account valuation - As mentioned before, DCF can be used to calculate the fair market value of a company or asset. These assets can also include accounts receivable and other intangible assets, allowing owners to get a better understanding of their company's financial situation

Discounted cash flow is a handy tool that helps investors and business owners alike get a clearer picture of their financial situation and make more informed decisions. Cash flow forecasting is a critical part of financial planning, and DCF provides a simple and effective way to do so.

How do you calculate discounted cash flow?

Calculating DCF is a somewhat complicated process, but it can be done relatively quickly with some basic knowledge of finance principles.

DCF is both a progressive and cumulative process, meaning that the process of calculating a DCF is done in steps, with each step contributing to the next. To help you understand the process, we've broken it down into a few simple steps:

Step one: calculate your free cash flow (FCF)

The first step in calculating DCF is to calculate your FCF. Free cash flow is the amount of cash that is left after all expenses, taxes, and capital expenditures (CAPEX) are paid. This will give you an idea of how much money you have to invest after all necessary payments have been made.

You can use the following formula to calculate your FCF:

FCF = cash flow from operations + interest expense – tax shield on interest expense – capital expenditures (CAPEX)

Your FCF forms the basis of the DCF calculation, as it estimates future cash flow.

Step two: Choose your discount rate

Before calculating your discounted cash flow, you must decide what discount rate to use. The discount rate is the percentage of interest used to calculate a present-day value for a future cash flow.

The most commonly used discount rate is the weighted average of capital (WACC). WACC considers both debt and equity financing so that it can be seen as a more accurate indicator of your expected return on investment.

You can calculate WACC using the following formula:

WACC = (Debt/Capital x Cost of Debt) + (Equity/Capital x Cost of Equity)

You may also choose to use a specific rate that is more relevant to your business. For example, if you know that your business is more likely to take on debt financing than equity financing, you may opt for a higher discount rate.

Step three: Determine your terminal value

Since it is impossible to forecast cash flow over the entire life of a business, you must estimate a terminal value to represent the company's estimated future cash flows. This terminal value can then be discounted back to a present-day number to generate your total DCF.

The most commonly used method for calculating the terminal value is the Gordon Growth Model:

Terminal Value (TV) = FCFn x (1+g)/(WACC – g)

Where:

FCFn = Free cash flow in the “nth” period

g = The expected growth rate of FCF after the “nth” period

WACC = Weighted average cost of capital

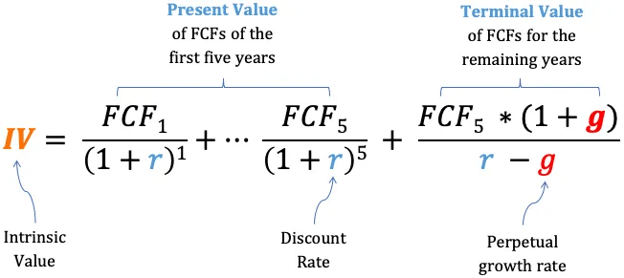

Step four: Calculate your discounted cash flow

Once you have calculated both your FCF and terminal value and chosen discount rate, you can use the following formula to calculate your DCF:

Image credit: getmoneyrich.com

Example of DCF in action

Now that we've covered the (admittedly pretty intimidating) maths required to calculate DCF, let's look at an example of how this process can be applied to real-life examples.

A company is looking at the potential long-term profitability of a particular project. The project is slated to last five years and will need an upfront investment of $11 million.

The company in question has a WACC of 5% and will use that as its discount.

The estimated cash flow and discounted cash flow of the project are as follows:

|

Year |

Cash Flow |

Discounted Cash Flow (nearest $) |

|---|---|---|

|

1 |

$1 million |

$952,381 |

|

2 |

$1 million |

$907,029 |

|

3 |

$4 million |

$3,455,350 |

|

4 |

$4 million |

$3,290,810 |

|

5 |

$6 million |

$4,701,157 |

When added together, the total projected discounted cash flow comes to $13,306,727.

Once the initial investment of $11 million is dedicated, the company is left with a potential profit of $2,306,727. The last figure is known as a net present value (NVP)

Is DCF the same as NPV?

No. While both techniques allow businesses to calculate the future value of a project, they are calculated differently. Whereas DCF calculations involve discounting future cash flows, NPV subtracts the initial investment from the total DCF.

NPV is often used to determine whether a project or investment is worth pursuing in the long term. If the NPV is negative, it suggests that the project will not generate sufficient returns to cover its costs. Conversely, if the NPV is positive, it indicates that the project will generate returns and should be pursued.

DCF can be used to calculate the NPV, but it is also helpful in its own right. It can provide insight into the future cash flows of a project and offer more detailed information than traditional NPV analysis.

Using DCF as part of credit control

In addition to the uses outlined, DCF can also be used to help inform a company's credit control decisions. Once the discount rate and cash flows for a particular customer have been calculated, credit controllers can assess whether or not it is worth extending credit to them.

In order to calculate a customer's creditworthiness, a company can compare the discounted cash flow to a figure known as an 'allowable loss'. The allowable loss is the maximum amount of money a business is willing to lose on any given transaction.

Having this kind of data to hand and other financial data can also help credit controllers make more informed decisions about whether they should grant a customer payment terms and how long those should be.

Chaser's comprehensive suite of analysis and debtor management tools can help you make more informed decisions about customer credit. To find out more, contact the Chaser team today or start your no-obligation 14-day free trial.

.jpg?width=1200&height=630&name=CM-202303-Blog%20cash%20flow_0000_Layer%20Comp%201%20(1).jpg)

.jpg?width=400&height=225&name=sample%20image%20remit%20payment%201200x6305px%20(1).jpg)

.png?width=400&height=225&name=June%206%20-%20Free%20cash%20flow%20formula_%20Definition%20and%20calculation%20(an%20SMB%20guide).png)