As 2025 comes to a close, it is a moment to reflect on a year shaped by steady progress, practical innovation, and meaningful collaboration across the finance community. The past 12 months have reinforced the importance of building technology that supports real operational needs, enables better decision-making, and helps finance teams manage receivables with greater confidence.

Throughout the year, Chaser remained focused on creating tools and services that bring clarity, consistency, and structure to accounts receivable. This review looks back on the impact businesses achieved using Chaser in 2025, the evolution of the platform, and the culture that continues to define how Chaser operates as a global organization.

Key achievements: Supporting finance teams in 2025

During 2025, Chaser continued evolving from a reminder focused tool into a more comprehensive receivables platform. Finance teams faced increasing invoice volumes, higher expectations around forecasting accuracy, and greater pressure to protect cash flow without damaging customer relationships.

The work completed throughout the year focused on helping teams move away from reactive processes and toward more proactive, structured receivables management. Improvements in forecasting, credit visibility, and automation supported finance teams in responding earlier to risk and planning with greater certainty.

Product development and service expansion were shaped by close collaboration with customers. Decisions were guided by how finance teams operate in practice, ensuring that new capabilities delivered measurable value in real world environments.

Chaser’s impact in 2025: A year in numbers

The clearest indication of progress is how businesses used Chaser throughout the year. In 2025, the platform supported finance teams at scale across a wide range of industries.

During the year, businesses processed 16.4 million invoices through Chaser, reflecting growing adoption and increased reliance on structured systems to manage receivables as organizations scaled.

Payment performance continued to improve. More than 4.9 million invoices were paid before their due date, supporting healthier cash flow cycles and contributing to an average DSO of 26 days. Earlier payment reduced uncertainty and enabled more confident short term and long term planning.

Communication remained central to effective receivables management. Across 2025, businesses sent nearly 20 million reminder emails and 3.4 million thank you emails through Chaser. This consistent communication helped maintain professionalism and transparency throughout the payment journey.

Automation also delivered substantial efficiency gains. By reducing repetitive tasks and manual follow ups, Chaser saved businesses over 101 million minutes on receivables work during the year. That time was redirected toward higher value activities such as forecasting, analysis, and collaboration across finance and leadership teams.

Together, these results reflect a continued shift away from spreadsheets and fragmented tools toward more reliable, automated receivables management.

Product innovations: Building for visibility, control, and confidence

Product development in 2025 focused on helping finance teams see further ahead, stay organized, and act with greater confidence across the entire receivables process. Rather than adding complexity, innovation centered on improving visibility, flexibility, and day to day control.

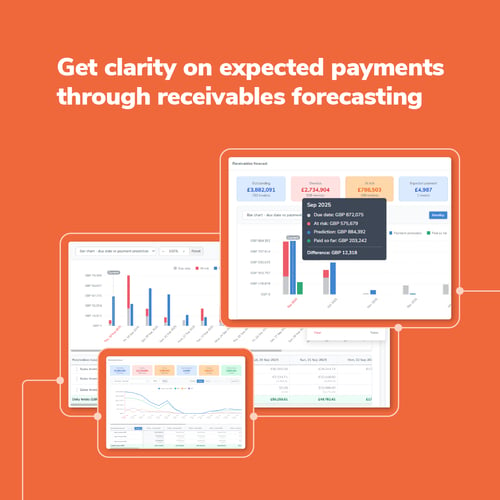

A major milestone was the introduction of cash flow forecasting, designed to move teams beyond static spreadsheets. The live forecast connects real time receivables data, ledger balances, and manual inputs into a continuously updated view of future cash position. By reflecting actual customer payment behavior, projections adjust automatically as payments are made or delayed, supporting more informed decisions around hiring, investment, and growth.

Alongside this, receivables forecasting was expanded to give finance teams clearer insight into when invoices are likely to be paid. By combining due dates, predicted payment behavior, and real time invoice status, teams can anticipate shortfalls earlier, prioritize at risk accounts, and plan budgets with greater confidence.

To support day to day execution, Chaser introduced a centralized task list, allowing finance teams to create, assign, and track receivables tasks directly within the platform. Tasks such as call reminders, credit checks, invoice validation, or follow ups can be managed in one place, improving accountability, balancing workloads, and maintaining visibility without relying on separate tools or inboxes.

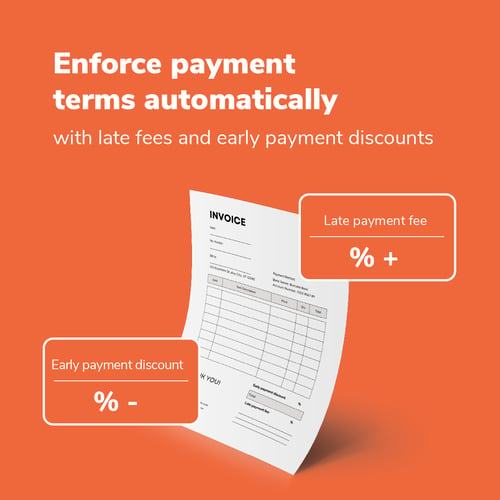

Chaser also expanded tools designed to influence payment behavior earlier in the cycle. Early payment discounts allow businesses to automatically incentivize customers to pay before the due date using fixed or percentage-based discounts. These incentives help bring cash forward, improve predictability, and support cash flow goals without relying solely on overdue collections.

At the same time, late payment fees were introduced to discourage habitual delays and recover costs associated with overdue invoices. Fees can be configured based on business rules and local requirements, applied selectively by customer or invoice, and enforced automatically to protect revenue while maintaining flexibility.

To reduce manual workload within collections, Chaser also introduced an AI email generator. This feature analyzes incoming debtor emails, identifies intent such as disputes or promises to pay, and suggests a polite, payment-focused reply directly inside Chaser. Suggested responses include relevant invoice details and secure payment links, helping teams keep conversations moving while maintaining control over tone and messaging.

Together, these developments strengthened Chaser’s ability to support proactive receivables management, combining forecasting, execution, and communication within a single, connected platform.

Integrations and ecosystem

Connectivity remained a priority throughout 2025 as finance teams sought to reduce data silos and manual reconciliation. Chaser expanded integrations with financial systems including NetSuite Oracle, iFinance, and Sage Intacct, alongside CRM connections with HubSpot, Zoho CRM, Zendesk, Salesforce, and Pipedrive.

These integrations enable receivables activity, customer communication, and forecasting to sit within connected workflows, supporting more accurate reporting and better collaboration across finance, operations, and leadership.

Learn more about Chaser integrations here.

Re-imagining and revamping Chaser Care: People and technology, together

2025 marked the reintroduction of Chaser Care, a managed receivables service designed to complement Chaser’s software.

Chaser Care combines experienced accounts receivable specialists with automation and AI technology, providing businesses with dedicated receivables support without the need to hire internally. The service supports consistent processes, improved cash flow, and professional customer communication, particularly for teams managing growth or limited internal resources.

The launch of Chaser Care reflects a belief that technology delivers the greatest impact when paired with human expertise and judgment.

Find out more about Chaser Care service.

Event highlights: Connecting with the finance community

Engagement with the wider finance and accounting community remained a priority throughout 2025. Chaser participated in industry events across multiple regions, creating opportunities to share insights, learn from peers, and better understand evolving challenges.

Key events included Accountex London, Xerocon Brisbane, DynamicsCon 2025, and Sage Future Atlanta, alongside a series of Finance Showcase events across the United Kingdom. These conversations helped inform future development and reinforced the importance of collaboration within the finance ecosystem.

.png?width=600&height=314&name=Accountex%202025%20header%20(2).png)

Awards and recognition

Recognition across the credit and fintech communities reflected progress made throughout 2025 across technology, culture, and customer impact.

Chaser was shortlisted for the CICM British Credit Awards 2025, acknowledging professional standards and contribution within the credit management industry. Innovation in artificial intelligence was also recognized, with a shortlist position for Best Use of AI in Fintech of the Year at the Fintech Awards London 2025.

In addition, Chaser was named a finalist at the Credit Strategy Awards 2025 in 3 categories: Best Company to Work For, Best Marketing Campaign of the Year, and Best Use of Technology. These recognitions reflect a balanced focus on people, education, and practical innovation.

.jpg?width=500&height=375&name=IMG_0126%20(1).jpg)

Celebrating customers: Chaser Excellence Awards

Customer success remained central throughout 2025, with the Chaser Accounts Receivable Excellence Awards recognizing outstanding customers across ten categories.

The awards celebrate measurable improvements in payment performance, efficiency, customer experience, and innovative use of receivables technology. From reducing days sales outstanding to building customer-friendly collections processes, the awards highlight organizations and individuals raising standards across credit management.

Culture highlights

Chaser operates as a distributed team, with culture shaped through regular connection rather than location. Throughout 2025, biweekly virtual coffee meets, shared team lunches, and online games created space for informal conversation alongside day-to-day work.

.png?width=600&height=292&name=image%20(19).png)

Pets became a familiar presence in internal meetings and are widely considered part of the extended Chaser family, reflecting a culture that values balance and authenticity.

.png?width=500&height=500&name=Chaser%20pets%20(1).png)

The annual team trip to Gran Canaria brought colleagues together in person, combining focused working sessions with shared experiences including time on a yacht and team games.

The year concluded with an online Christmas celebration featuring a crafting clay class, stand up comedians, and a shared team lunch delivered across locations, reinforcing connection and appreciation at the end of the year.

Celebrating people at Chaser

Internal recognition continues to play an important role in reinforcing values. The annual Chaser Awards celebrate individuals who embody the values of Candid, Celebrate, Care, and Courageous, alongside recognition for Employee of the Year.

These awards highlight peer recognition and the behaviors that contribute to a strong culture and positive customer outcomes. These awards recognize the behaviors and values that shape how Chaser operates, both internally and with customers.

Employee of the year: Manfredi

Manfredi’s impact throughout 2025 was defined by consistency, depth of expertise, and care for customer outcomes. As Chaser’s credit control and professional services lead, they played a critical role in shaping Chaser Care into a service customers trust with some of their most sensitive processes. Manfredi combines practical credit management experience with a calm, solutions-focused approach, helping customers improve payment performance while maintaining strong relationships. His leadership strengthened service quality, supported revenue growth, and set clear standards for how human expertise and automation work together at Chaser.

Care: Amaya

Amaya drove meaningful progress across brand, demand, and market positioning in 2025. Her work strengthened Chaser’s visibility while keeping messaging grounded in real finance team needs rather than marketing jargon. From campaigns to content and event presence, Amaya helped ensure that Chaser’s voice remained clear, human, and credible. She consistently connected activity back to outcomes, supporting pipeline growth while reinforcing trust in the brand. Her award recognizes both execution and a growing strategic contribution to how Chaser shows up in the market.

Candidness: Connor and Lewis

Connor and Lewis were recognized together for their shared contribution to revenue growth and customer outcomes throughout 2025. Working closely with finance teams, partners, and internal stakeholders, they demonstrated discipline, curiosity, and resilience in complex sales cycles. Their strength lies not only in closing deals, but in setting customers up for long-term success by aligning solutions to real operational challenges. Their collaboration reflects the team-based approach Chaser values, where trust and shared accountability matter as much as individual performance.

Celebration: Ayca

Ayca was recognized for truly embodying Chaser’s Celebrate value throughout 2025. She consistently brought positivity, warmth, and encouragement into day-to-day work, helping teams pause to recognize progress, effort, and shared wins, even during busy or challenging periods. Whether celebrating customer successes, team milestones, or individual contributions, Ayca helped reinforce a culture where achievements are acknowledged and people feel valued. Her impact went beyond tasks and outcomes, strengthening connection, morale, and a sense of shared purpose across the team.

Courage: Dean

Dean’s recognition reflects their role in pushing Chaser forward with clarity, focus, and delivery discipline. Throughout 2025, Dean helped translate complex ideas into practical, testable outcomes, particularly in forecasting and product development initiatives. They brought structure to ambiguity, challenged assumptions constructively, and kept teams aligned around what could realistically be delivered and what could be learned. His contribution reinforced a culture of trust through execution, where progress is measured not by intention, but by what ships and works.

Looking ahead: Building on 2025

The progress achieved in 2025 provides a strong foundation for the year ahead. Continued investment in automation, forecasting, and connected systems will remain a focus, alongside sustained attention to people, culture, and customer relationships.

As finance teams face increasing complexity, the objective remains unchanged: supporting calmer, more confident receivables management through thoughtful technology and human expertise.

The achievements of 2025 reflect the trust and collaboration of customers, partners, investors, and the Chaser team. The year ahead presents opportunities to build on this momentum and continue shaping the future of receivables management.

Feel free to connect with me at sonia.dorais@chaserhq.com or via LinkedIn: Sonia Dorais.

Thank you for being part of the journey.