CHALLENGE

Lacking the time and resources internally to collect the money they are owed

SOLUTION

Chaser Collections and Huttie Group: the perfect resolution to a frustrating problem

As Huttie was already using Chaser’s accounts receivable automation software, and had integrated it with their Xero cloud accounting system, the handover process to Chaser’s debt collection team was seamless. All previous communication between Huttie and their customers was stored in the Chaser software, as well as the invoice details and contact information. As a result, Chaser’s debt collectors had all the information they needed to successfully collect Huttie’s unpaid invoices, without having to go through a lengthy handover process.

Before escalating an invoice to Chaser Collections, all users are presented with an instant quote in the Chaser app. Consequently, Huttie was able to know exactly what the price would be for every invoice before escalating, and this combined with Chaser’s no-win, no-fee approach meant that they were not spending or wasting any money without seeing results. This was a cost-effective alternative to other debt collections agencies that they had used in the past where they had to pay the fee up front without knowing if it would pay off.

Combining data driven insights with Chaser’s eight years of invoice chasing expertise, Chaser’s debt collector’s are able to personalise messages specific to the customer, optimise when to reach out and choose the right channel. This solved one of Huttie’s main problems; getting in contact with the customers who were ignoring their emails. Having a dedicated and experienced debt collector phone and email their debtors, Huttie was able to both get the long overdue invoices paid, but also be told when they could expect payment which was of great importance for their cash-flow forecasting.

Chaser debt collector’s main focus is to maintain great customer relationships, whilst getting the invoices paid. The benefit of Chaser Collections is that all communication between Chaser’s debt collectors and the debtors are carefully logged in the Chaser software, ensuring full transparency. As a result, Huttie had at all times full control over the progress that was made on the file, and how the debt collectors were engaging with their customers, and they were never worried about negatively impacting their customer relationships when they escalated invoices.

Recover more

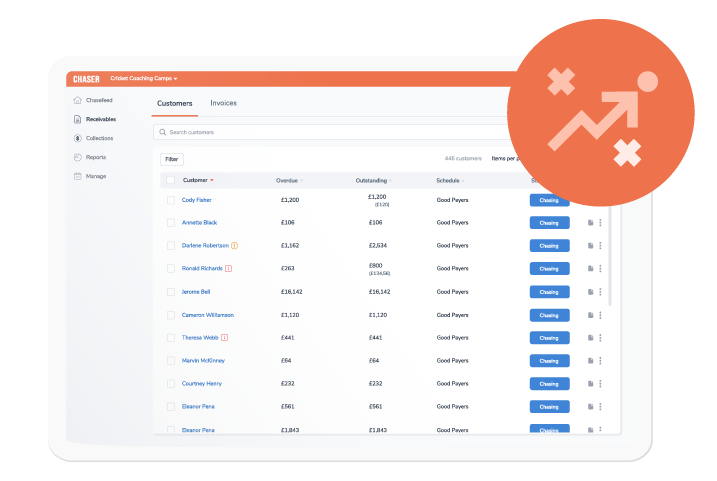

Quickly escalate any overdue invoices to the Chaser Collections team efficiently. Just a few clicks can help alert the team and let them know that you want to escalate an overdue invoice.

Protect customer relationships and your reputation

Customer relationships are the cornerstone of a business, and if the customers are unhappy, then you’re going to lose business. That’s why organizations need to ensure that they get paid on time without causing any potential damage to their relationships with customers.

When you use a friendly debt collector like the Chaser Collections team, you can go about your operations knowing that your reputation will always remain safe.All the debt collectors at Chaser Collections adopt a people-first attitude and always try to work with your customers to achieve a solution.

Save time

Time is money, and for a profitable business, every little minute counts. By working with Chaser Collections, you can ensure that you focus on operating a successful business. Instead of spending time chasing invoices, you can quickly escalate overdue invoices in a few clicks.

Track customer interactionsfor full transparency

Their key services include:

- Ethically trained debt collectors

- Access to all the necessary software

- Transparent pricing

Chaser and Chaser Collections have become an integrated part of our weekly and monthly credit control process. Before using Chaser and Chaser Collections, we could spend 2-3 days each month on credit control activity, and there was no guarantee that we would even receive a response or payment

TOM HAYS

Head of Finance, Huttie

RESULTS

Huttie Group: The Aftermath

Thanks to Chaser’s seamless integration with Xero, the automated payment reminders and effective debt collection services mean that Chaser is now an integral part of Huttie’s finance team. As a result, they would effectively operate the credit-control process, and they wouldn’t need to hire an in-house credit controller.

Chaser Collections helped save us at Huttie both time and money. Aside from that, Chaser Collections played a significant role in helping recover bad debt, and the partnership was immediately successful.

Chaser’s debt collectors actively call and email bad debtors to ensure that Huttie receives more responses and payments. These all came from customers that were known to ignore them for months previously.

As a result, the Huttie team can ensure that their cash-flow forecasting is correct and budget properly for the future.

Tom Hays, Head of Finance, stated that they’re achieving a 90% response rate with 80% of all invoices already paid.

While the results are exceptional, they don’t come at the expense of customer relationships. As they have plenty of recurring customers, maintaining the relationship is important.

It was essential for Tom and the rest of the finance team to be confident that their customers would be treated with respect. They had the chance to see whether the communication and dialogue would represent them appropriately as a business.

Download PDF

Download the full user story

Learn how Mechanical and Electrical business Huttie Group have recovered over £15,000 in old debts whilst keeping their customer relationships sweet.

Download customer story