Topic: Receivables management

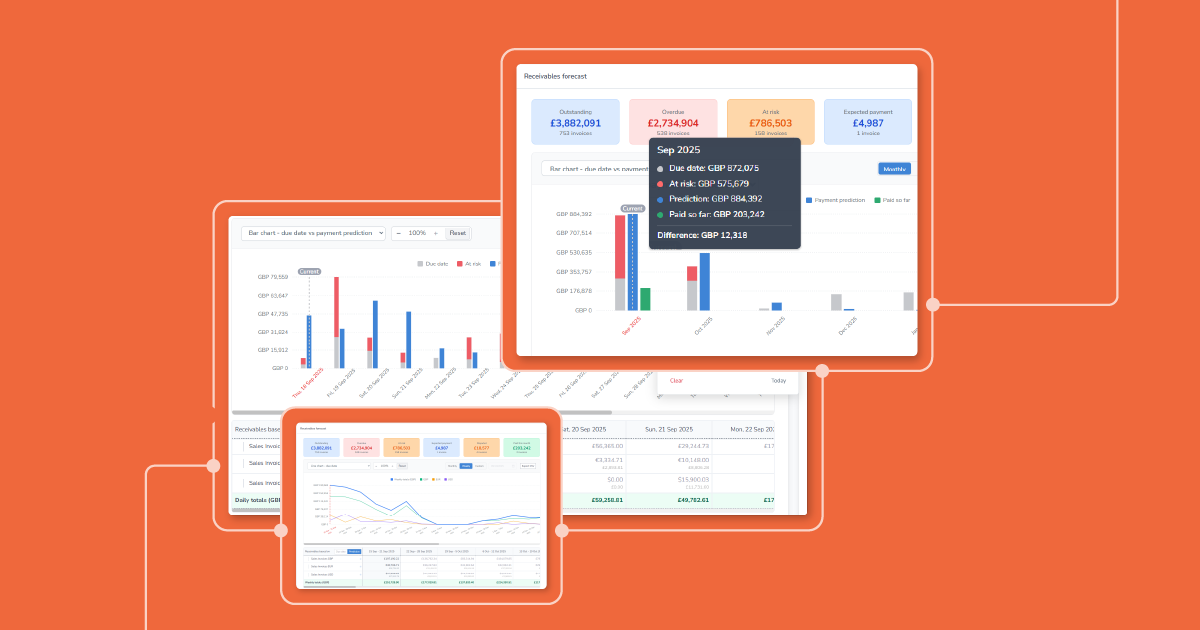

Get clarity on expected payments through receivables forecasting

Uncertainty over incoming payments makes financial planning harder than it needs to be. Even with accurate...

%20-%20Accounts%20receivable%20process_%20Challenges.%20examples%2c%20and%20how%20to%20improve.webp)

Accounts receivable process: The end-to-end playbook for finance teams

In the talks with finance experts and collections managers, we’ve understood that the problem with the AR...

Chaser achieves ‘Built for NetSuite’ status

NetSuite users can now benefit from Chaser's accounts receivable software as it has achieved 'Built for...

.webp)

Accounts receivable aging report: Complete guide (+ free template)

You've done the work and sent the invoice, but your bank account doesn't reflect it. The key to controlling...

Late payments still hold SMEs back: Truth behind the UK PM’s warning

A short post on X (formerly Twitter) has recently shone a spotlight on a challenge small businesses across...

4 “thank you for your payment” emails to copy and paste

Looking for the right words to thank your customers for their payment? You're in the right place. Manually...

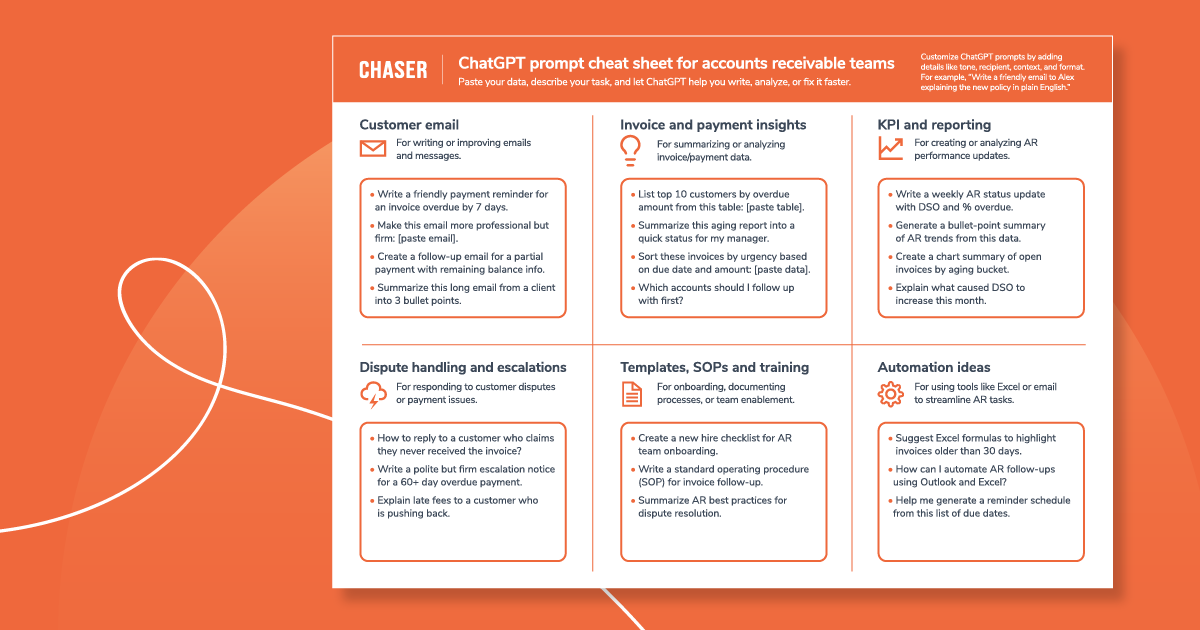

ChatGPT prompt cheat sheet for accounts receivable teams

Late payments are not just a cash flow problem — they derail forecasting, create bottlenecks, and increase...

How to write a dunning letter | 3 example dunning letter templates

Late payments are a persistent challenge for businesses of all sizes. While polite reminders can work in some...

Automate accounts receivables, reduce late payments with Odoo and Chaser

Chaser has launched a new integration with Odoo, bringing automated accounts receivable management to...

Dunning management: Importance, processes, and best practices

Your DSO keeps climbing, and your finance team is spending hours chasing payments instead of focusing on...

What is a write off & how companies use it

Navigating the world of finance can often feel like entering a complex maze of terminologies. One such term...

.png)

What is an accounts receivable aging report?

What is AR aging? An accounts receivable aging report summarizes the age of outstanding invoices and provides...