Unpredictable cash flow creates operational drag for finance teams. AR teams spend significant time on manual invoice follow-ups. CFOs and finance leaders have to forecast cash flow without accurate numbers.

Here’s what that might look like for you:

- You’re struggling to forecast accurately because of unreliable forecasting due to scattered AR data and you don't really know when customers will pay.

- You’re losing revenue to third-party collection agencies.

- You have no visibility into who's chasing what and your team is struggling with inconsistent customer communications.

These problems grow bigger as your business scales, turning minor cash flow disruptions into cash flow constraints.

When searching for solutions, you’ll realize that you need a cash flow management software that meets your specific needs.

- Mid-market platforms prioritize automation without long, complex setups, helping teams recover cash faster with minimal disruption.

- Enterprise platforms offer advanced features, deep integrations, and robust reporting, but often require longer onboarding and more training

This article provides a clear, side-by-side comparison of the top 5 cash flow management software solutions, helping you quickly identify which tool best fits your company's size, workflows, and specific cash flow needs.

Which cash flow management software is the right fit for you?

To find the right software, first identify your primary bottleneck: do you need to collect cash or forecast it?

- AR / Finance ops: If you’re in this bucket, your main pain is the manual work of collections. You need automation to get invoices paid faster through workflows, reminders, and payment portals

- CFOs / Treasury / FP&A: Your main pain is unpredictability. You need accurate cash projections and scenario modeling to make strategic decisions

- Accounting / Small business finance: You need an all-in-one platform where bookkeeping and basic cash visibility live in the same system.

Quick decision guide

- If you spend more than 10 hours a week chasing invoices, prioritize AR automation.

- If your forecasts are inaccurate because customers pay late, look for behavioral forecasting combined with AR data.

- If you need bookkeeping alongside cash tools to manage small business operations, choose accounting solutions.

Practical signals to watch for:

- Rising 90+ day receivables

- Frequent customer calls claiming "we didn’t receive that invoice"

- Frequent use of credit lines

- Excel-based chasing

You can significantly improve your working capital and cash forecasts by monitoring these indicators and using tools that track Days Sales Outstanding (DSO), predict late payments, and offer two-way sync.

Here’s an overview of the 5 best cash flow management software options we’ll compare in this article:

|

Tool |

Category |

Best suited for |

Pricing |

User rating |

|

Chaser |

AR automation |

Mid-market companies seeking complete AR automation |

"Complete visibility of our AR workflow" |

|

|

Billtrust |

AR automation |

Mid-market and enterprise B2B companies |

Quote-based enterprise pricing model |

"Reduced our DSO significantly." Rated 4.7/5 by Capterra |

|

Cube |

FP&A |

FP&A and finance teams that want spreadsheet-friendly planning. |

Quote-based enterprise pricing model |

"Perfect for accurate forecasting." Rated 4.6/5 by Capterra |

|

Vena |

FP&A |

Finance teams that want Excel-backed planning |

Quote-based enterprise pricing model |

"Revolutionized our planning." Rated 4.5/5 by Capterra |

|

Quickbooks |

Accounting |

Small businesses, freelancers, and SMB finance teams |

Quote-based enterprise pricing model |

"Ideal for small businesses." Rated 4.3/5 by Capterra |

This table provides a snapshot of each tool, allowing for quick comparison based on category, suitability, key features, pricing, and user feedback.

The best accounts receivable (AR) automation software

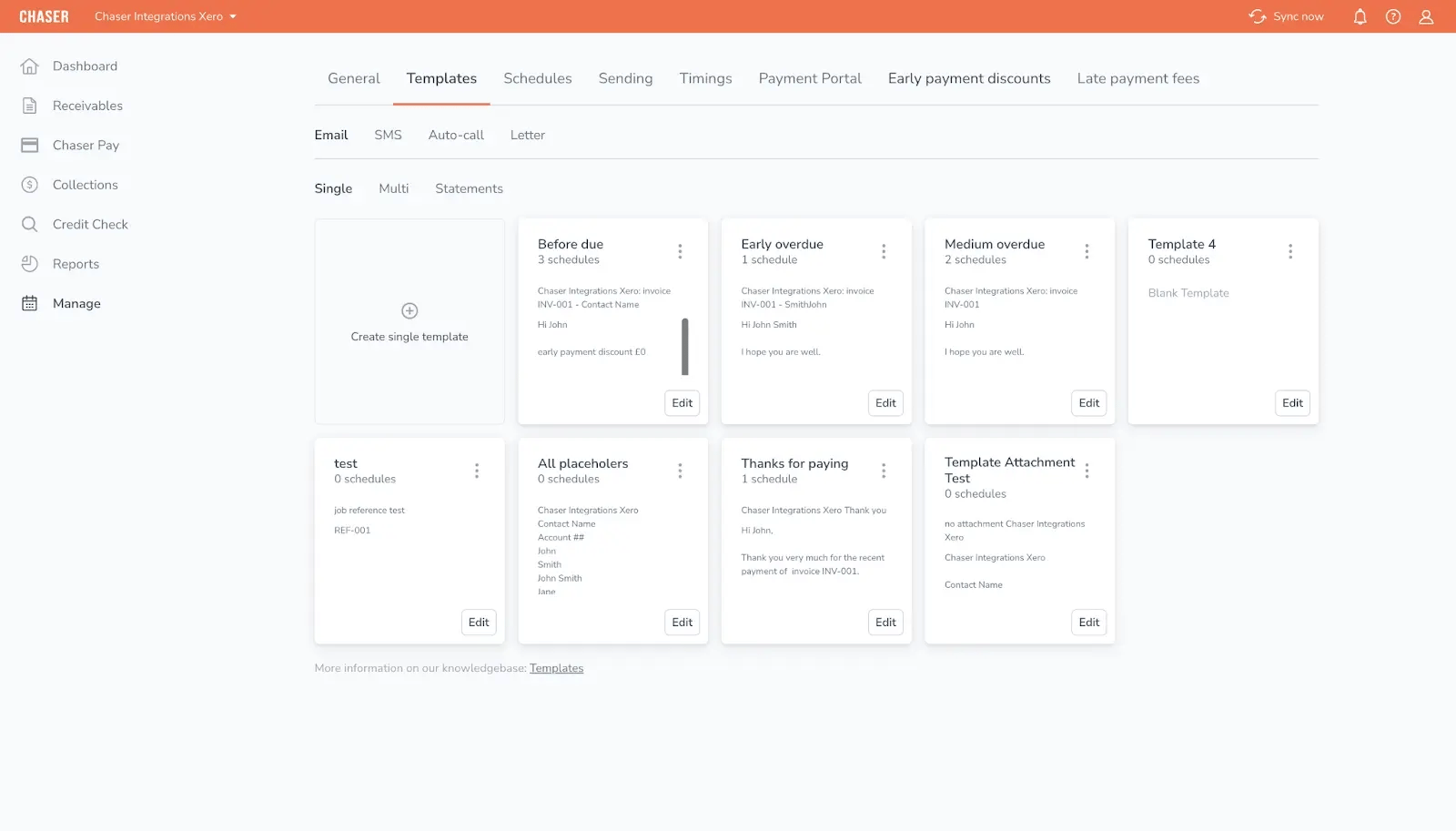

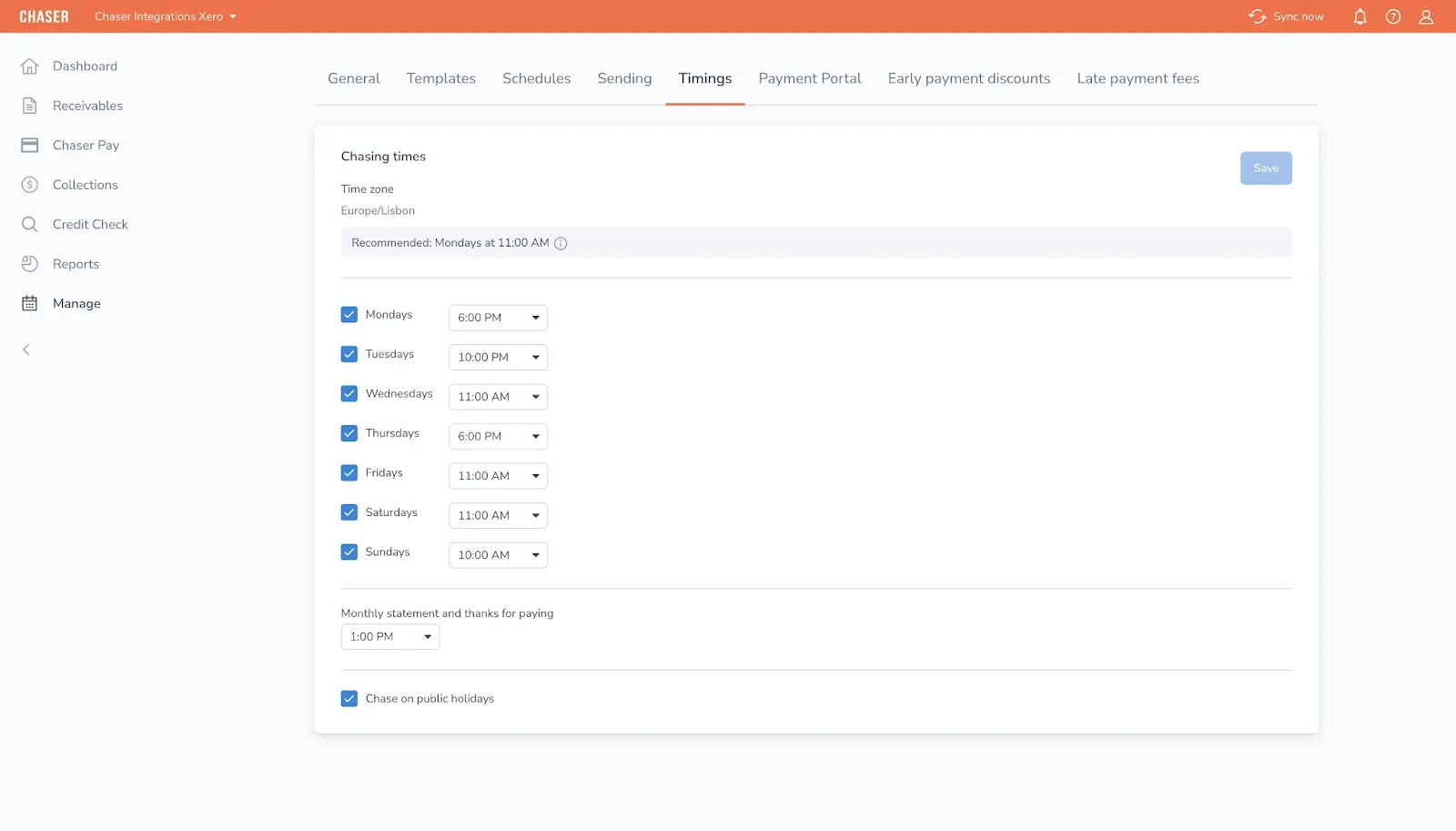

1. Chaser

Best for: Mid-market companies seeking end to end AR automation that gives you complete visibility and control over everything from payment collection to debt recovery.

Chaser automates the entire accounts receivable workflow while maintaining complete visibility into every customer interaction. From identifying payment risks to sending personalized reminders to facilitating payments, the platform helps finance teams accelerate cash collection without damaging customer relationships.

Identify high-risk invoices before they become bad debt

Traditional AR processes treat every invoice equally, forcing teams to chase everything manually without knowing which accounts actually need attention. Chaser analyzes each customer's complete financial picture by combining historical payment behavior, invoice value, and external credit reports.

The platform assigns each customer a payer rating (good, bad, or average) and gives individual invoices a Late Payment Predictor score with risk bands (low, medium, high). You can configure automated actions based on these ratings, assigning higher-risk accounts to more frequent reminder schedules while treating reliable payers with a lighter touch.

A complete audit trail and "Chasefeed" logs every chase, reply, and internal note, giving your team full context on every customer interaction. This centralized visibility means no more asking "where are we with this customer?" or team members stepping on each other's toes.

Collect faster with automated email and SMS reminders that feel hand-written

Generic reminder templates get ignored or alienate good customers.

Chaser's smart templates automatically adjust tone, content, and language based on each customer's payment history and your relationship with them. Messages are sent from your own email address and signature, building your customer relationship rather than appearing as system-generated notices.

The platform coordinates outreach across emails, texts, calls, and letters through a built-in cadence engine, reaching customers through their preferred channel. You can set compliance rules to avoid sending reminders on public holidays or to customers who've opted out, ensuring automation stays professional.

Real-time synchronization with your accounting system stops reminders the moment a payment is reconciled, eliminating the risk of chasing already-paid invoices.

Make it easier for your customers to pay you with Chaser Payment Portal

Every reminder links directly to a self-service Payment Portal personalized to your brand. Customers can view all outstanding invoices, see their exact balance, and pay immediately using their preferred method, eliminating the friction of hunting for old emails or manually entering bank details.

%20(1).webp?width=1317&height=833&name=unnamed%20(61)%20(1).webp)

The portal supports flexible installment plans for customers who can't pay in full, with Chaser automatically tracking and chasing each installment. International clients see the correct multi-currency payment details automatically. All payments reconcile back into your ERP without manual intervention.

Chaser key features

- Automated invoice reminders tailored to each customer's behavior.

- Two-way synchronization with major ERPs.

- Integrated payment portal for various payment options.

- Payer rating system to evaluate payment risk.

- Real-time predictive analytics for late payment forecasting.

- Dynamic cadence engine for personalized communication strategies.

- Comprehensive reporting and dashboards for detailed insights.

Chaser pros

- Saves finance teams significant time by automating manual tasks.

- Reduces Days Sales Outstanding (DSO) by ensuring timely payments.

- Strengthens customer relations with personalized, professional communication.

- Offers a user-friendly interface that integrates seamlessly with existing systems.

- Empowers teams with data-driven insights for better financial decision-making.

Chaser limitations

- Recommended minimum of 5-10+ users to see full automation benefits.

- Not suited for sole traders.

Chaser pricing

Chaser has a flexible pricing structure based on the features and level of service you need. For more details, refer to the pricing page.

Chaser user reviews

Chaser has received high praise from users, with Capterra reviews averaging 4.9 out of 5 stars and G2 reviews averaging 4.4 out of 5 stars.

Over 10,000 users worldwide rely on Chaser to get paid faster, protect their cash flow, and maintain good customer relationships.

Speak to an expert now and see how you can turn unpaid invoices into available working capital. By automating your collections with Chaser, you can reduce DSO and save 15+ hours a week, all while maintaining strong customer relationships

2. Billtrust

Best for: Mid-market and enterprise B2B companies that need end-to-end order-to-cash and high-volume invoice/payment processing.

Billtrust is an order-to-cash and accounts receivable automation platform designed for scalability and efficiency. It excels in automating invoicing, payment processing, and dunning workflows, reducing manual AR work to accelerate cash flow.

Billtrust is ideal for enterprises transitioning from paper checks and manual collections to electronic billing, payments, and reconciliation. It's particularly suited for billing-heavy enterprises due to its ability to handle high invoice volumes, distinguishing itself from pure-play AR automation tools by offering a comprehensive suite for large-scale operations.

Billtrust key features

- Collections and dunning automation

- Billing portal

- Multi-currency payment processing

- Cash application and reconciliation

- Reporting and analytics

Billtrust pros

- Excels in handling high invoice volumes and payments

- Integrated payments and invoicing reduce manual reconciliation

- Proven enterprise stability with broad payment method support

- Customizable AR rules and workflows for complex billing scenarios

Billtrust cons

- Can feel heavyweight for smaller teams

- Implementation timelines and costs can be substantial

- May require professional services for complex setups

- Less nimble for teams seeking plug-and-play simplicity

Billtrust pricing

Billtrust employs a quote-based enterprise pricing model. Prospective buyers should contact sales for custom packages and implementation costs.

Billtrust reviews

Billtrust holds an average score of 4.4 out of 5 stars from 505 reviews on G2.

The best cash flow forecasting and financial planning software

Cash flow forecasting and financial planning software offer businesses the tools to accurately predict and manage future cash flows, aligning financial strategies with long-term goals. These platforms are invaluable for CFOs, treasury managers, and finance teams.

These tools help businesses make informed decisions, anticipate financial challenges, and optimize resources.

3. Cube

Best for: FP&A and finance teams that want spreadsheet-friendly, driver-based planning and scenario modeling without abandoning Excel workflows.

Cube is an FP&A-first platform that centralizes financial and operational data while maintaining the familiar spreadsheet workflows that finance teams rely on. Designed for FP&A teams, Cube enables driver-based forecasting, scenario analysis, and collaborative reporting, all without forcing analysts to leave Excel.

Acting as a bridge between spreadsheet-native models and governed, version-controlled forecasting, Cube allows teams to achieve robust financial planning while complementing AR automation efforts.

Cube key features

- Driver-based forecasting

- Spreadsheet integration and sync

- Scenario analysis

- Consolidated reporting

- Rolling forecasts

- Data connectors

- Model versioning and collaboration

Cube pros

- Maintains Excel workflows while adding governance

- Enables fast scenario modeling and what-if analysis

- Ideal for consolidation and board-ready reporting

- Offers low ramp-up time for spreadsheet-first finance teams

Cube cons

- Not a substitute for AR automation; forecast accuracy relies on input quality

- May require data hygiene work for accurate model inputs

- Custom pricing can obscure the total cost of ownership (TCO)

Cube pricing

Cube uses a custom pricing model, requiring buyers to request a quote.

Cube reviews

Cube holds an average score of 4.5 out of 5 stars from 122 reviews on G2.

4. Vena

Best for: Finance teams that want Excel-backed planning, corporate consolidation, and tighter workflow controls while preserving spreadsheet familiarity.

Vena is an Excel-centric planning platform designed to enhance governance, consolidation, and workflow management while working within the familiar spreadsheet environment. Ideal for finance teams seeking centralized budgeting, variance analysis, and role-based approvals, Vena integrates seamlessly without forcing a new user interface on analysts.

It appeals to organizations that prioritize user adoption and auditability over replacing Excel, particularly for those needing strong corporate consolidation capabilities.

Vena key features

- Excel-native modeling

- Budgeting and forecasting

- Consolidation and close management

- Variance analysis

- Workflow approvals

- Audit trails

- Integrations with ERPs and GLs

Vena pros

- Low friction for Excel users, leading to faster adoption

- Strong consolidation and workflow controls

- Effective for centralized budgeting across teams

- Role-based access and audit trails enhance compliance

Vena cons

- Perceived as premium-priced; implementation may require consulting

- Advanced modeling might necessitate professional services

- The UI is perceived as more spreadsheet-centric rather than a modern app-first approach

Vena pricing

Vena offers quote-based pricing.

Vena reviews

Vena holds an average score of 4.5 out of 5 stars from 366 reviews on G2.

The best accounting platforms with cash flow features

Accounting platforms with cash flow features are essential tools for businesses seeking comprehensive financial management and operational efficiency.

These platforms integrate core accounting functions with enterprise resource planning, offering robust features like cash flow management, budgeting, forecasting, and consolidation.

Ideal for businesses of all sizes, they streamline processes such as invoicing, inventory management, and financial reporting.

By providing a central hub for financial data and analytics, these platforms enable informed decision-making, improved cash flow visibility, and enhanced business performance, making them invaluable for managing the complexities of modern business finances.

5. QuickBooks

Best for: Small businesses, freelancers, and SMB finance teams that want simple accounting, invoicing, and basic cash-management tools quickly.

QuickBooks, developed by Intuit, is a widely used small-business accounting suite offering bookkeeping, invoicing, bank feeds, basic cash flow insights, and integrated payment options. It's ideal for teams needing a swift, user-friendly accounting setup supported by a vast ecosystem of partners and add-ons. QuickBooks often serves as the entry point for many businesses before they scale to more specialized AR or ERP systems, thanks to its ubiquity and ease of use.

QuickBooks key features

- Invoicing and billing

- Bank reconciliation

- Payments and payroll add-ons

- Cash flow dashboard

- Expense tracking

- Reporting

- Large app marketplace with AR/payment add-ons

QuickBooks pros

- Fast setup with a familiar user experience for SMBs

- Extensive integrations and support for third-party apps

- Built-in payment processing minimizes friction for small customers

- Strong partner and an accountant ecosystem offers robust support

QuickBooks cons

- Limited enterprise-grade AR automation and forecasting capabilities

- Advanced needs may require add-ons or migration to an ERP system

- Add-on costs can accumulate as teams grow

QuickBooks pricing

QuickBooks offers publicly listed tiered plans that vary by region. For detailed and current tiers, including entry prices and payment processing fees, refer to their pricing page.

QuickBooks reviews

QuickBooks has an average score of 4.4 out of 5 stars from 338 reviews on G2.

Which tool should you pick? 3 real scenarios

To select the right financial tool, you must align your choice with your specific operational needs. With a wide range of software options available for accounts receivable, billing, and cash flow/revenue forecasting, the best fit depends on your business size and complexity. Here are 3 common scenarios to help you decide.

Scenario 1: Small in-house AR team using spreadsheets

If your AR team manages collections manually in Excel, prioritize Chaser. You can implement these solutions quickly, utilizing intuitive interfaces and 2-way synchronization that fit seamlessly into your existing workflows.

With the Payment Portal, you simplify the payment process for customers and streamline your AR operations without overwhelming your resources.

Scenario 2: Mid-market with high invoice volume and complex billing

If you manage high invoice volumes and complex billing structures, consider Billtrust or HighRadius. You can use these platforms to handle enterprise-grade workflows through comprehensive automation.

Choose Billtrust for end-to-end order-to-cash management, or HighRadius for AI-driven cash application and dispute resolution. While these require a higher initial investment and complex setup, you gain the robust scalability and reliability needed for large-scale operations.

Scenario 3: CFO needing an accurate rolling cash forecast

If you need precise rolling cash forecasts, combine Cube or Vena with upstream AR automation. You can use these tools to build detailed financial models and scenarios.

By pairing them with reliable AR automation, you ensure your forecasts are grounded in real, timely collection data rather than theoretical payment terms, significantly enhancing your strategic planning accuracy.

Mix-and-match suggestions:

- Pair Cube with Chaser: You can build reliable forecasts based on real-time AR data and actual collection performance.

- Integrate Vena with HighRadius: You can achieve robust corporate planning alongside efficient, high-volume cash application processes.

Automate your entire AR workflow and improve cash flow with Chaser

You can streamline and enhance your entire accounts receivable workflow with Chaser. By automating every stage, from identifying risk to collecting cash, you can reduce manual effort and significantly lower your DSO.

By implementing automated reminders, payment portals, and real-time analytics, you ensure your finance team can focus on strategic initiatives rather than chasing overdue invoices.

FAQ

Chaser gives mid-market finance teams centralized visibility through email inbox integration, automatic communication logging, and comprehensive audit trails. Unlike basic invoicing tools, you see exactly who contacted which customer, when, and what was said, eliminating the common problem of team members stepping on each other's toes. This complete transparency is important when managing 5+ users and prevents the "where are we with this customer?" confusion that slows down collections.

Chaser maintains customer relationships through personalized, behavior-based communication. The platform adjusts reminder tone and frequency based on each customer's payment history, treating reliable payers with a lighter touch while focusing attention on high-risk accounts. Messages send from your email address with your signature, appearing personal rather than system-generated, while compliance rules prevent inappropriate outreach.

Cash flow management software provides businesses with tools to monitor, analyze, and optimize their cash flows. Designed to enhance financial visibility, this software helps organizations track inflows and outflows, forecast future cash needs, and ensure that they have enough liquidity to meet obligations. By automating these processes, it enables businesses to make informed decisions and improve financial stability.

Yes, QuickBooks offers basic cash flow management features. It includes capabilities such as tracking cash inflows and outflows, generating cash flow statements, and offering insights through dashboards. Its integration with bank feeds allows for real-time updates, making it easier for small and medium-sized enterprises to monitor their cash positions. However, for advanced forecasting and analytics, additional tools or integrations might be needed.

The best software for cash flow forecasting often depends on the specific needs of a business. For those looking for robust and flexible solutions, platforms like Cube and Vena are excellent choices. These tools offer advanced forecasting capabilities, scenario planning, and integration options that align financial forecasts with comprehensive business strategies. Both are suitable for businesses seeking detailed, actionable insights.

%20-%20Cash%20flow%20software%20(1).webp?width=1200&height=628&name=Blog%201%20(Nov)%20-%20Cash%20flow%20software%20(1).webp)

%20-%20Cash%20flow%20management%20software.webp?width=400&height=225&name=Blog%204%20(Oct)%20-%20Cash%20flow%20management%20software.webp)

%20-%20Automate%20debt%20collection.webp?width=400&height=225&name=Blog%201%20(Oct)%20-%20Automate%20debt%20collection.webp)