As a finance manager or CFO, inefficient AR software creates real problems: it locks up cash, scatters communications, and keeps your team stuck in repetitive manual tasks.

Common challenges include:

- Spending valuable time reconciling Days Sales Outstanding (DSO) reports that differ from accounting records, which detracts from focusing on growth-focused financial strategies.

- Scattered messages and notes across different platforms, leading to disjointed communication and potential misunderstandings with clients.

As you scale, these nuisances turn into significant bottlenecks. When searching for more effective alternatives, smaller businesses might manage with basic tools, but mid-market and larger enterprises require tailored solutions.

This guide provides a research-backed comparison of leading Upflow alternatives, mapping each tool to these specific operational challenges to help you identify the right fit for your team.

Why finance teams look for Upflow alternatives

If you're evaluating alternatives, you're probably dealing with 2 recurring frustrations: reporting discrepancies and fragmented communication.

According to user reviews on G2 and other review platforms, these issues create tangible operational hurdles:

- Discrepancies in DSO calculations. When Upflow’s DSO figures differ from your ERP (e.g., NetSuite), you face credibility issues in board meetings. Instead of strategic planning, your team ends up spending hours manually adjusting figures in Excel just to ensure the numbers align.

- Lack of ad-hoc email logging. Upflow often limits you to scheduled workflow messages, forcing you to use your standard email client for manual "thank you" notes or one-off replies. Because these interactions aren't logged in the platform, the customer timeline remains incomplete, leaving the rest of your team blind to key conversations.

Inaccurate reports can undermine trust in board meetings, while fragmented communication can strain customer relationships. As transaction volumes grow, these challenges make your processes inefficient and challenging. That’s why we’ve put this list of alternatives together for you.

The Upflow alternatives evaluation is based on:

- ERP integration capabilities and reporting accuracy

- Automation features and customization options

- Communication management and customer portal functionality

- Ease of implementation and user experience

- Pricing transparency and value for mid-market companies

The 6 best Upflow alternatives in 2025

|

Software |

Best for |

Standout features |

User reviews |

|

Chaser |

Mid-size businesses needing flexible AR management |

Customizable DSO calculations, AI-driven email responses, centralized communication logs |

Highly rated for usability and customer service. Rated 4.9/5 on Capterra |

|

HighRadius |

Mid-market and large enterprises requiring comprehensive solutions for O2C |

AI-driven segmentation and risk identification, straight-through cash posting, and AI-based exception handling |

Praised for automating complex processes, but noted for complexity in implementation. Rated 4.4/5 on Capterra |

|

Invoiced |

Mid market and large enterprises seeking a quick setup and tangible results |

Comprehensive AR automation, low DSO focus, self-service portal, easy setup |

Users appreciate the rapid deployment and effective reductions in DSO and customer inquiries. Rated 4.3/5 on G2 |

|

Growfin |

Businesses that value predictive analytics for cash flow management |

Sophisticated Behavioral AI, predictive intelligence, high reconciliation accuracy, and cash flow forecasting |

Valued for reducing time on collections and enhancing financial visibility. Rated 4.2/5 on G2 |

|

Versapay |

Businesses seeking better customer collaboration and communication |

Self-service customer portal, personalized messaging, invoice matching, collections, and analytics |

Praised for improved communication efficiency and faster resolution of payment issues. Rated 4.4/5 on Capterra |

|

Quadient AR |

Mid-to-large markets focused on measurable ROI and customer satisfaction |

Automated cash application, credit and risk assessment, comprehensive dashboards, centralized work tracking |

High satisfaction with team efficiency improvements and responsive support, rated with 93% 4-5 stars on G2 |

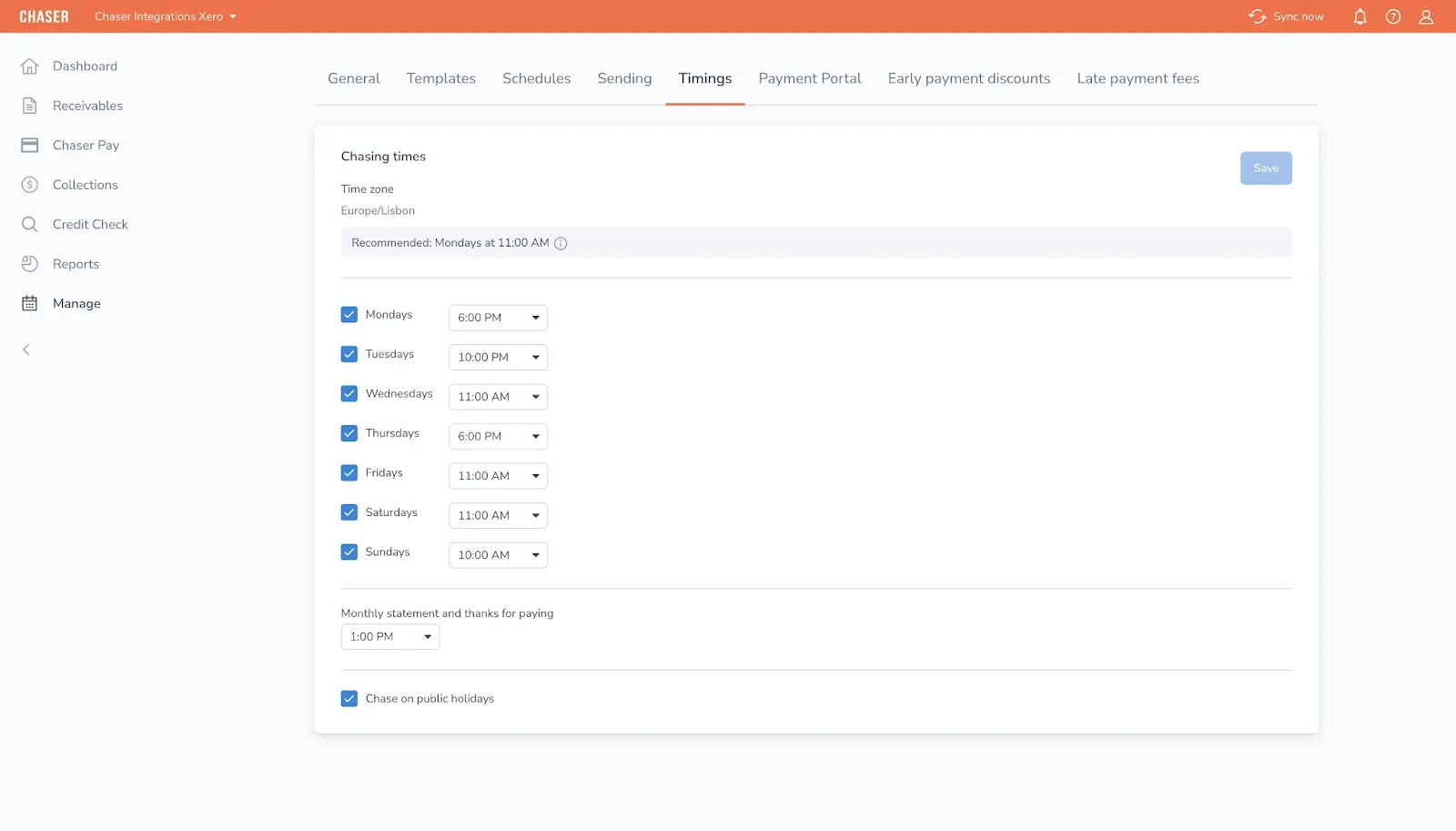

1. Chaser

Best for: Mid-market companies seeking end to end AR automation that gives you complete visibility and control over everything from payment collection to debt recovery.

Finance teams use Chaser to save over 15 hours weekly by automating the debt collection process. This includes identifying late payment risks, sending targeted personalized invoice reminders that accelerate collections by over 54 days, and managing debt recovery with a human touch.

Here’s why you should consider Chaser.

Complete visibility: Centralized communication timeline

When collections communication is spread across email clients, SMS apps, and manual calls, your team loses visibility. AR specialists send follow-ups that never appear in your AR platform, leading to duplicate outreach and frustrated customers.

Chaser captures every interaction in a centralized timeline, whether it's an automated reminder, a personal thank-you, or a bespoke reply. Your entire team sees the full conversation history before reaching out, eliminating duplicate messages and maintaining professional consistency.

You can build customizable chasing schedules with unique intervals and reminder sequences, segmenting customers by relationship, language, or payment history. These scheduled sequences deliver reminders across multiple channels: personalized emails that feel hand-typed, SMS reminders, and automated calls. When a situation requires a personal touch, you can use saved templates or the AI email generator to draft contextual replies.

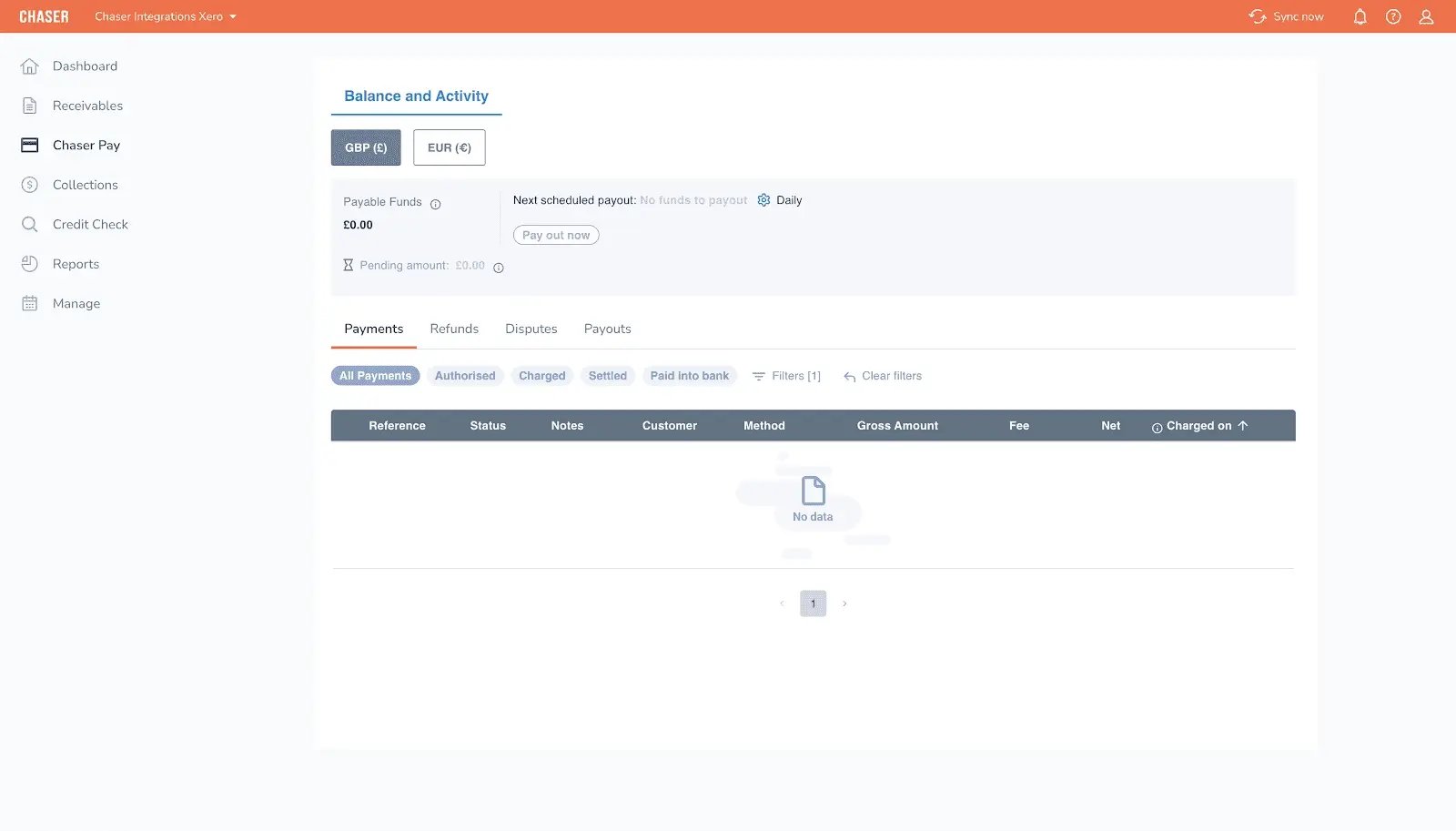

Make it easy for customers to pay

When customers can't easily find payment methods or invoices, payment delays pile up from process friction alone. Finance teams waste time answering "How do I pay?" inquiries.

Chaser's branded payment portal removes this friction. Your customers get a personalized payment experience where they can view all outstanding invoices and choose the payment method that works for them: credit card, instant bank transfer, Apple and Google Pay, or Direct Debit.

When customers pay through the portal, Chaser automatically updates your accounting system, eliminating manual reconciliation.

Reports you can trust: transparent DSO, exports, and ERP-ready integrations

With Chaser, finance teams gain confidence through transparent and reliable reporting features.

Chaser's DSO calculations align with your accounting system, using specific calculations based on the time between invoice issuance and payment, aggregation, and value-weighting. This ensures you can export DSO figures and match the systems in use, facilitating consistency in financial reporting.

For those transitioning from Upflow, with Chaser, you can request a raw DSO export for side-by-side comparisons with ERP data, ensuring a seamless switch.

Chaser's integration capabilities with popular ERPs like NetSuite, and accounting software like Sage, and Xero ensure that all payment actions synchronize and reporting parity remains, further simplifying the financial workflow.

Over 10,000 users globally use Chaser to accelerate payment cycles, protect cash flow, and maintain customer relationships.

Chaser pros

- Automation of reminders with a personal touch to maintain relationships

- Integration with major accounting systems like QuickBooks and Xero to reduce data entry

- Multi-channel reminders to increase contact success

- AI-driven insights identify high-risk accounts proactively

- One-click escalation of overdue invoices to expert debt collection services

- Branded payment portal to simplify and speed up payments

Chaser cons

- Best suited for mid-market firms with established finance teams or dedicated credit control function

- Not ideal for businesses with no dedicated finance person.

Chaser pricing

Chaser provides clear and transparent pricing. All pricing details are easily accessible via the pricing details page.

Chaser reviews

Chaser enjoys a strong reputation for user satisfaction, with over 400 5-star reviews.

It boasts an average rating of 4.9 out of 5 stars on Capterra and 4.4 out of 5 stars on G2, and is recognized by industry awards as a leader in accounts receivable software.

Speak to an expert and see how Chaser can reduce your DSO by 75% while saving 15+ hours weekly.

2. HighRadius

Best for: Large, global enterprises that require sophisticated Order-to-Cash automation and scalability to manage high transaction volumes and complex AR workflows.

.webp?width=1600&height=662&name=highradius%20(1).webp)

HighRadius positions itself as the premier enterprise solution for managing the entire Order-to-Cash cycle with advanced AI and Machine Learning. Its approach transforms accounts receivable from a reactive process to a proactive, strategic operation, perfect for large enterprises that handle extensive and complex transactions.

HighRadius key features

- Prioritized Worklists: AI-driven segmentation for targeted collections.

- Straight-Through Cash Posting: Seamless payment processing and remittance linkage.

- AI-Based Exception Handling: Reduces manual reconciliation by processing complex remittance data.

- Self-Service Customer Portal: Clients can independently manage invoices and payments.

HighRadius pros

- Exceptional scalability for handling complex, high-volume environments.

- Advanced cash application capabilities minimize manual reconciliation.

- AI-powered automation frees staff for strategic tasks, enhancing efficiency.

HighRadius cons

- Implementation can be time-consuming and heavily dependent on IT resources.

- Higher cost of ownership compared to smaller competitors due to extensive customization.

HighRadius pricing

Pricing is custom and based on transaction volume, ERP connectivity complexity, and module deployment. Organizations should reach out directly for a tailored quote.

HighRadius reviews

Highradius Accounts Receivable has an average rating of 4.3 out 5 from 220 reviews on G2.

Customer feedback emphasizes significant efficiency gains in automating complex cash applications, with AI offering strategic collection insights. Ratings on platforms like G2 and Capterra reflect positive experiences with automation and process improvement.

3. Invoiced

Best for: Mid-market companies seeking rapid AR automation that reduces administrative overhead and accelerates cash flow.

Invoiced is an award-winning accounts receivable automation suite known for its ease of setup and its ability to quickly impact cash flow. The platform focuses on maximizing payment speed while minimizing administrative tasks, a fit for companies that want quick deployment and practical, user-friendly results without needing extensive IT resources.

Invoiced key features

- Comprehensive AR Automation: Full suite handling invoicing through to cash application.

- Low DSO Focus: The platform significantly reduces Days Sales Outstanding.

- Inquiry Reduction: Achieves a 45% decrease in customer inquiries with clear invoicing.

- Easy Setup: Provides rapid implementation compared to ERP-heavy solutions.

Invoiced pros

- High ROI due to simplicity and effectiveness in reducing DSO and administrative inquiries.

- Quick and easy setup makes it accessible for teams without dedicated IT support.

- Significant reduction in customer confusion boosts labor productivity.

Invoiced cons

- May face challenges with specialized global tax compliance and complex ERPs.

- Not optimized for the complex workflows typical of large multinational enterprises.

Invoiced pricing

Invoiced tailors its pricing to the features required and transaction volume, so companies should contact Invoiced directly for a custom quote.

Invoiced reviews

Invoiced has an average rating of 4.5 out 5 from 405 reviews on G2.

Customer feedback frequently highlights Invoiced's rapid implementation process, intuitive user interface, and overall effectiveness in automating payment reminders and handling cash application tasks, contributing to noticeable improvements in cash flow. Many users appreciate how the platform reduces administrative burdens and enhances operational efficiency.

4. Growfin

Best for: Enterprises seeking predictive intelligence to enhance accounts receivable processes and cash flow forecasting.

Growfin is a predictive intelligence platform that leverages sophisticated behavioral AI to "self-adapt to payment signals." Unlike standard automation tools, Growfin combines collections automation with advanced cash flow forecasting to benefit FP&A and Treasury teams strategically. This design helps businesses automate routine tasks and gain predictive insights into payment behaviors.

Growfin key features

- Behavioral AI: Dynamically automates collections by analyzing customer payment signals.

- Predictive Intelligence: Anticipates payment delays by factoring in historical and external data.

- High Reconciliation Accuracy: Automatically matches remittance data, achieving up to 98% accuracy.

- Treasury/FP&A Synergy: Offers real-time cash position tracking and planning tools.

Growfin pros

- Enhances cash forecast reliability, aiding in budgeting and liquidity management.

- Reduces time spent on collections, freeing teams for strategic planning.

- Bridges operational AR data with higher-level financial functions, improving decision-making.

Growfin cons

- Requires substantial historical data and potential tech team collaboration for full benefits.

- Teams might face a learning curve when transitioning from traditional systems to AI-driven methods.

Growfin pricing

Growfin offers custom, quote-based pricing tailored to each company’s goals. Prediction accuracy and efficiency gains influence the final costs.

Growfin reviews

Growfin has an average rating of 4.5 out 5 from 68 reviews on G2.

Users appreciate Growfin's improvements in financial visibility and operational efficiency, noting significant reductions in manual collection effort and an enhanced focus on strategic tasks.

5. Versapay

Best for: Industries where customer retention is critical, such as B2B services and SaaS companies that value collaborative relationships.

Versapay brands itself as the "Collaborative AR Network," focusing on enhancing the customer payment experience and improving communication to speed up collections and reduce disputes.

By prioritizing relationships and reducing friction between suppliers and customers, Versapay positions itself as a solution that goes beyond internal efficiency to foster mutually beneficial outcomes.

Versapay key features

- Self-Service Customer Portal: A central hub for managing invoices and payments, streamlining customer interactions.

- Personalized Customer Messaging: Tools to customize follow-up communications, helping maintain strong relationships.

- Invoice Matching: Automated matching of payments to invoices, managing disputes and incomplete payments efficiently.

- Collections and Analytics: Manages workflows and monitors collection effectiveness.

Versapay pros

- Emphasizes relationship-driven collections, crucial for industries focused on customer satisfaction.

- Centralized communication simplifies handling disputed or incomplete transactions, reducing customer churn.

- Improves clarity in communications and accelerates the resolution of payment issues.

Versapay cons

- Less mature in advanced AI capabilities compared to specialized platforms like Growfin or HighRadius.

- Primarily focused on communication efficiency rather than predictive analytics.

Versapay pricing

Uses a custom pricing model based on network usage, the number of users, and transaction volume processed. Interested organizations should inquire directly for a tailored quote.

Versapay reviews

Versapay has an average rating of 4.1 out 5 from 76 reviews on G2.

User feedback highlights the ease of use of Versapay's payment portal and the enhanced communication efficiency it offers. Faster resolution of payment issues and improved communication clarity are common themes in positive reviews.

6. Quadient AR

Best for: Mid-to-large market companies seeking a comprehensive and customizable AR automation platform for efficient cash flow management.

Quadient AR (formerly YayPay) aims to make accounts receivable management effortless. It offers rapid, measurable ROI and high customer satisfaction through its superior support and flexible customization options. This makes it ideal for businesses aiming to streamline operations and reduce friction in managing cash flow.

Quadient AR key features

- Effortless Cash Flow Management: Minimizes manual effort in chasing late payments.

- Automated Cash Application: Simplifies reconciliation by automatically applying payments.

- Credit and Risk Assessment: Quick evaluations of payment scores and risks.

- Comprehensive Dashboards: Advanced tools for data visibility and team management.

Quadient AR pros

- Proven ROI with significant reductions in DSO and time savings for administrative tasks.

- Highly customizable, with excellent customer support ensuring the platform meets specific needs.

- Rated highly for improving team efficiency and communication.

Quadient AR cons

- May struggle with scalability or global reach when compared to long-established vendors.

- History as YayPay might affect perceptions in complex, multinational settings.

Quadient AR pricing

Quadient AR offers custom, quote-based pricing, tailored to the size and needs of the organization, ensuring the cost aligns with the ROI delivered.

Quadient AR reviews

Versapay has an average rating of 4.4 out 5 from 115 reviews on G2.

The platform's support and task management capabilities are often described as game-changing in collaborative AR management.

Comparison checklist: How to choose the right Upflow alternative for your team

Choosing the right Upflow alternative involves aligning platform capabilities with your team's specific needs. Use the following checklist to guide your decision-making process:

- If your priority is DSO parity with NetSuite, consider Chaser or HighRadius.

- If you want a portal with customer collaboration, Versapay is the ideal choice.

- If you want document automation at scale, explore Quadient AR.

- If you need modern UX with ad-hoc email logging, choose Growfin or Chaser.

Next-step diagnostic

Before scheduling demos with vendors, it's beneficial to answer these 3 key questions internally:

- Do your DSO reports match your ERP system? (Yes/No)

- Do you require ad-hoc email logging directly in your AR timeline? (Yes/No)

- Do you want to improve collaboration between your finance team members? (Yes/No)

Your responses will help narrow down your options, ensuring that you find the most compatible solution for your needs. By carefully considering these factors, you can effectively select the best fit among the various Upflow alternatives available.

FAQs

Chaser provides centralized communication timelines that capture every interaction, automated reminders, personal thank-yous, and ad-hoc replies all in one platform. Unlike scheduled-only workflows, Chaser logs all customer communications including manual emails through inbox integration, giving your entire team complete visibility into conversation history and eliminating duplicate outreach that frustrates customers.

Chaser's DSO calculations align directly with your ERP system using transparent methodology based on invoice issuance-to-payment timing, ensuring board-ready reports without manual Excel adjustments. You can export raw DSO data for side-by-side ERP comparisons. This way, Chaser eliminates the reporting discrepancies that occur in financial meetings.

Chaser's automation maintains the personal touch through emails sent from your own domain and signature, so messages feel hand-typed rather than system-generated. The platform combines customizable chasing schedules with multi-channel outreach (email, SMS, calls) and AI-powered email responses for ad-hoc situations, ensuring consistent professional communication while your team saves 15+ hours weekly on manual follow-ups.

Chaser automates the entire AR workflow from risk identification to payment collection, allowing teams to handle growing invoice volumes without hiring additional credit controllers. The centralized platform provides complete audit trails and team activity visibility, ensuring seamless handovers and consistent processes as you scale. With optional Chaser Care services, you add flexible AR capacity on-demand while maintaining control through the same platform.

%20-%20Uplow%20alternatives.webp?width=1200&height=628&name=Blog%206%20(Oct)%20-%20Uplow%20alternatives.webp)

%20-%20Automate%20debt%20collection.webp?width=400&height=225&name=Blog%201%20(Oct)%20-%20Automate%20debt%20collection.webp)

%20-%20Cash%20flow%20management%20software.webp?width=400&height=225&name=Blog%204%20(Oct)%20-%20Cash%20flow%20management%20software.webp)

%20-%20Cash%20flow%20software%20(1).webp?width=400&height=225&name=Blog%201%20(Nov)%20-%20Cash%20flow%20software%20(1).webp)