As a CFO or finance manager, you know that unpaid invoices aren’t just numbers. They lock up cash, complicate planning, and keep your team stuck in tedious follow-ups. Your finance team often ends up:

- Spending hours sending reminders and tracking payments instead of analyzing cash flow, managing credit risk, or optimizing working capital.

- Delaying or sending overlapping follow-ups can make your team appear disorganized, confuse clients, and strain relationships.

- Losing 15–50% of recovered amounts when overdue invoices are handed to collection agencies.

- Struggling to forecast and plan, as late payments make it hard to know what funds are available for operations or strategic investments.

These challenges intensify as your business grows, turning what started as an annoyance into a serious threat to your financial health.

When you start looking for solutions, it becomes clear that not all debt collection software fits every business. Small companies rarely need automation, while mid-market and enterprise teams do, but their needs are different:

- Mid-market platforms prioritize automation without long, complex setups, helping teams recover cash faster with minimal disruption.

- Enterprise platforms offer advanced features, deep integrations, and robust reporting, but require longer onboarding and more training.

This article gives you a clear, side-by-side comparison of the best tools to help you quickly find the solution that fits your company size, workflow, and collections needs.

Here are the 6 best debt collection software at a glance:

|

Software |

Segment |

Best for |

User rating |

|

Chaser |

Mid-market |

Mid-market companies seeking complete AR automation that maintains the personal touch and improves customer relationships |

4.9/ 5 (Capterra) |

|

Upflow |

Mid-market |

Growing B2B companies seeking relationship-focused accounts receivable management |

4.5/ 5 (Capterra) |

|

ezyCollect |

Mid-market |

Small to mid-sized businesses needing comprehensive AR automation with credit risk management |

4.7 / 5 (G2) |

|

C&R Software |

Enterprise |

Large enterprises in regulated industries requiring humanized debt collection with advanced AI |

3.0/ 5 (Capterra) |

|

Billtrust |

Enterprise |

Large enterprises seeking established AI-powered order-to-cash platform with extensive integrations |

4.4/ 5 (G2) |

|

HighRadius |

Enterprise |

Large enterprises seeking an autonomous finance platform |

4.3/ 5 (G2) |

3 best debt collection solutions for mid-market businesses

1. Chaser

Best for: Mid-market companies seeking complete AR automation that maintains the personal touch and improves customer relationships while providing full visibility and control.

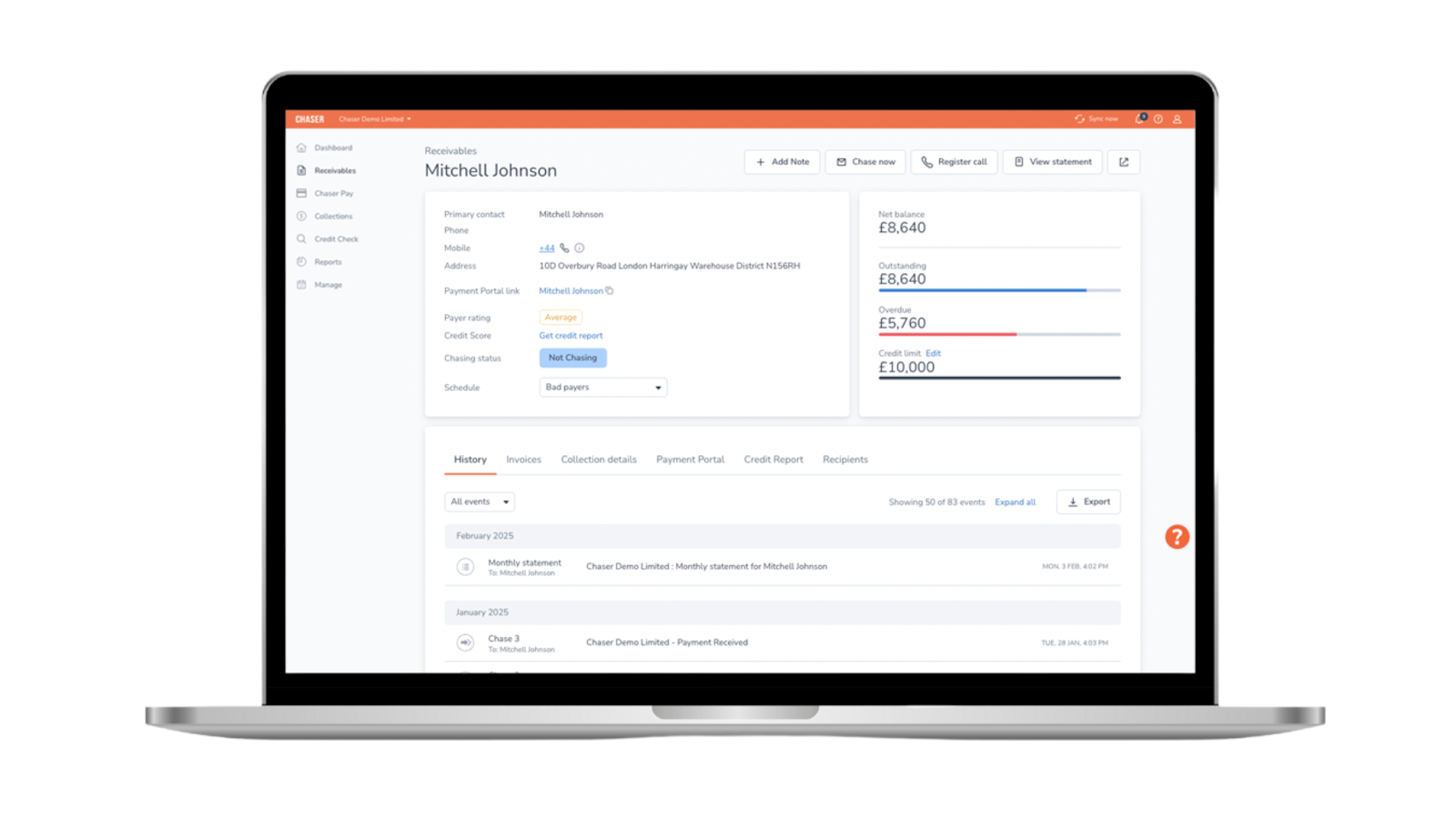

Chaser gives mid-market finance teams complete visibility and control over accounts receivable. See every customer interaction in a centralized platform, who's chasing what, what's been said, and where payments stand. Automate reminders, accelerate cash collection, and maintain customer relationships.

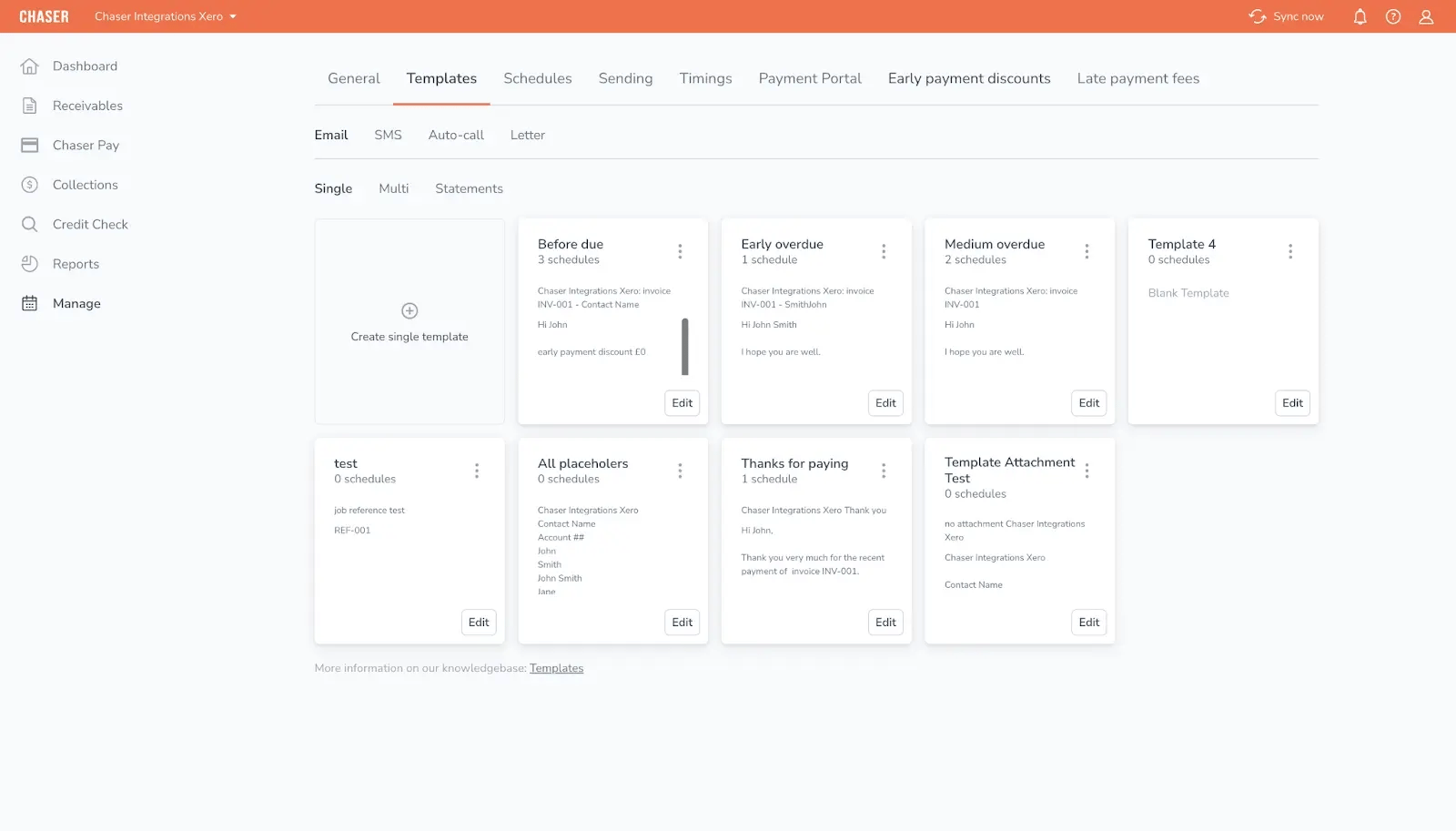

Here's a closer look at how Chaser makes your debt collection more efficient:

Collect faster with automated reminders that feel hand-written

Unlike one-size-fits-all reminder systems, the platform doesn’t send the same reminder to everyone. It uses a multi-channel approach based on how each customer is most likely to respond.

Automatically send personalized and timely:

What makes Chaser stand out is that all communication matches your writing style, brand voice, and signature, so reminders feel like they're coming directly from your organization. Customers get a personal experience while you save time through automation.

You can tailor reminder schedules for different customer groups, deciding how often and in what order they’re contacted. With verified sending from your own email domain, reminders land directly in the inbox and bypass spam filters.

Chaser does more than just send reminders; you can also:

- Reply to debtor emails in seconds with the AI email generator

- Enforce payment terms automatically (late fees or early payment discounts).

- keep a full, auditable record of all communication.

Through the entire AR process, direct integrations with your accounting system keep all invoices, payments, and records accurate and up to date.

Make it simple for customers to pay outstanding debt

Chaser transforms how customers pay by eliminating the typical barriers that slow down collections.

A branded Payment Portal provides your customers with a transparent hub to view outstanding debts, review invoices, and access multiple payment options, including:

- Instant bank transfer

- Credit card

- Apple and Google Pay

- Direct Debit

Payment links are embedded directly in email and SMS reminders, so customers can settle invoices in seconds rather than logging into separate systems.

%20(1).webp?width=1317&height=833&name=unnamed%20(61)%20(1).webp)

If you’re using Xero or QuickBooks, payments are automatically marked as paid in your accounting system as they come in.

When customers have simple, convenient ways to pay, invoices get settled sooner, turning unpredictable cash flow into a reliable, steady stream.

Spot late payment risks before invoices go overdue

Here's what separates a good collection strategy from reactive scrambling: knowing which invoices need attention before they're overdue.

Chaser's built-in AI assesses invoice risk levels based on debt value and historical payment behavior, analyzes customer payment patterns to help prioritize follow-ups, and delivers up-to-date credit reports with ongoing alerts when a customer's financial health changes.

Accurate risk assessment is built right into your collection workflow, letting you stay one step ahead.

Chaser pros

- Automates reminders while keeping customer communications personal.

- Integrates with QuickBooks, Xero, Sage, and other systems to reduce manual data entry.

- Multi-channel reminders through email, SMS, calls, and letters to increase contact success.

- AI identifies high-risk accounts so you can act before payments are late.

- Lets you escalate overdue invoices ($250+ USD) to debt collection with one click.

- A branded payment portal that offers multiple options to speed up customer payments (bank transfer, credit card, Apple & Google Pay).

- Implementation and onboarding take a couple of days, not weeks.

Chaser cons

- Recommended minimum of 10 customers to see full automation benefits.

- Not suited for sole traders.

Chaser pricing

Chaser presents transparent, publicly available pricing for multiple regions and currencies.

You can find all pricing details on the Chaser website.

Chaser reviews

Chaser maintains strong user satisfaction with over 400 5-star reviews.:

- Capterra reviews average 4.9 out of 5 stars.

- G2 reviews average 4.4 out of 5 stars.

Various industry awards recognize Chaser as the leader in the accounts receivable software category.

One user reported that Chaser “Decreased DSO by 60%”, followed by:

“Very happy from the start. Helpful onboarding team, easy to implement and very happy with the results, reducing our debtor days from 60 to approx 24 in a matter of months.” - Ravi, Mid-Market Finance Director (Organic Capterra Review)

Speak to an expert today and discover the remarkable difference Chaser can make in optimizing your debt recovery process, leading to improved cash flow, reduced risk, and a more robust financial standing for your business.

2. Upflow

Best for: Mid-market and enterprise B2B companies seeking relationship-focused accounts receivable management.

Upflow positions itself as a "Financial Relationship Management" platform rather than traditional debt collection software. The company focuses on converting revenue into cash while maintaining customer relationships throughout the process.

With tiered pricing based on Annual Recurring Revenue, Upflow serves businesses from startups to companies with over $50M ARR. The platform emphasizes proactive customer engagement over reactive invoice chasing, supported by AI-powered insights and automation features.

Upflow key features

- Collections automation with live dashboards and DSO forecasting

- Upflow AI for personalized outreach and cash application assistance

- Self-service payment portal with multiple payment methods and autopay

- Seamless integrations with existing invoicing and accounting systems

Upflow pros

- User-friendly interface praised across 47 G2 reviews for workflow enhancement

- Automation features save significant time according to 25 user reviews

- Reliable customer support highlighted in 24 user reviews

- Collections efficiency helps users reduce payment terms substantially

Upflow cons

- Email automation lacks scheduling capabilities and sends overwhelming admin notifications

- Cannot remove inactive clients from the platform, leading to clutter

- Integration issues reported with certain apps and reporting features

- Limited email functionality affects composition and contact management

Upflow pricing

Upflow offers a free plan. Their premium plans are priced based on company ARR.

- The Discover plan is free for businesses exploring AR health.

- Grow and Scale plans serve companies with $0-$10M and $10M-$50M ARR respectively.

- The Strategic plan targets businesses over $50M ARR.

However, pricing is not publicly available. Specific pricing requires consultation.

Upflow reviews

Upflow has an average rating of 4.8 out of 5 from 231 reviews on G2.

3. ezyCollect

Best for: Small to mid-sized businesses needing comprehensive AR automation with credit risk management.

ezyCollect markets itself as a "full-stack Accounts Receivable Automation Software" designed to help businesses get paid faster. The platform claims clients achieve an average 43% reduction in overdue outstandings within their first year.

Beyond standard AR functions, ezyCollect offers credit risk management tools, including online credit applications and U.S. credit scoring. The platform also provides cash flow finance as an unsecured line of credit for approved users.

ezyCollect key features

- Automated AR workflows with email and SMS reminders plus payment writebacks

- Integrated payment portal with "Pay Now" button that reportedly doubles payment rates

- Credit risk management, including a late payment riskometer and credit insights

- Cashflow finance offering for approved users

ezyCollect pros

- Collections efficiency praised for effective debtor management and targeted communications

- User-friendly design enables efficient debtor management and streamlined communication

- Overall efficiency is valued for the precise management of outstanding accounts

- Credit risk tools provide additional financial protection beyond basic AR

ezyCollect cons

- Connection and syncing issues occasionally disrupt workflows despite quick resolution

- Dashboard reportedly less intuitive than it should be

- Pricing discrepancy with one user reporting costs "nearly 3 times" the advertised rates

- Limited review volume suggests a smaller market presence

ezyCollect pricing

ezyCollect has different pricing tiers for different business needs. Check their pricing page for more details.

ezyCollect reviews

ezyCollect has an average rating 4.7 out of 5 from 24 reviews on G2.

3 best debt collection solutions for larger enterprises

4. C&R Software

Best for: Large enterprises in regulated industries requiring humanized debt collection with advanced AI.

C&R Software positions itself as a leader in "humanized" debt collection, offering sophisticated AI-native solutions for large-scale organizations.

C&R Software's Debt Manager provides end-to-end collections with emphasis on customer-centric approaches and regulatory compliance. The platform's open architecture allows businesses to integrate their own algorithms and data sources.

C&R Software key features

- AI identifies vulnerable customers before delinquency and guides treatment paths

- Open architecture supporting "bring your own algorithms" and external data enrichment

- End-to-end collections from pre-delinquency to resolution with comprehensive analytics

- Communication Center provides a complete customer interaction history

- Built-in compliance rules, limits, and contact timelines for regulatory adherence

C&R Software pros

- Advanced AI and analytics help optimize collections performance and decision-making

- High configurability allows business users to design UI and author rules without IT support

- Proven track record with major financial institutions and government sectors

- Strong compliance and security features for highly regulated industries

- Testimonials from enterprise clients highlight configurability and a partnership approach

C&R Software cons

- No public third-party reviews available on G2 or Capterra platforms

- Custom pricing model requires direct sales engagement

- An enterprise-focused solution may not suit smaller organizations

- Complex implementation likely requires significant resources and time investment

C&R Software pricing

C&R Software uses custom pricing. You have to speak to their sales team to get a quote.

C&R Software reviews

C&R Software has an average rating of 3.0 out of 5 on Capterra.

5. Billtrust

Best for: Large enterprises seeking an established AI-powered order-to-cash platform with extensive integrations.

Billtrust positions itself as an established AR innovation leader offering AI-powered solutions for the complete order-to-cash process. The platform serves various industries from manufacturing to retail, focusing on customizable AR rules that fit unique business needs.

Billtrust emphasizes improving cash flow, maximizing revenue, and enhancing customer experience through deeply integrated AI functionality across their platform.

Billtrust key features

- AI-powered invoicing for faster generation and intelligent follow-up

- Intelligent collections software with automated reminders and simplified payments

- AI-driven cash application for instant payment-to-invoice matching

- Over 40 direct ERP and financial system integrations

- First-to-market generative AI providing real-time answers to finance teams

Billtrust pros

- Ease of use highlighted in 120 G2 reviews for simplifying cash application and customer experience

- Strong invoicing and payment processing capabilities streamline billing and improve satisfaction

- Automation modules reduce manual work and improve reconciliation processes

- Paperless customer portal simplifies invoice review and payment processes

Billtrust cons

- Poor customer support with slow response times and lack of urgency reported frequently

- Login issues, including invalid account messages and system timeouts

- Missing features like limited OCR functionality and a lack of statement balance

- System inflexibility forces companies to change procedures rather than adapting to business needs

- Slow performance and technical glitches impact user productivity

Billtrust pricing

Billtrust offers custom pricing tailored to specific business needs and transaction volumes. You can contact Billtrust for detailed pricing information.

Billtrust reviews

Billtrust has an average rating of 4.4 out of 5 from 505 reviews on G2.

6. HighRadius

Best for: Large enterprises that want an autonomous finance platform.

.webp?width=1600&height=662&name=highradius%20(1).webp)

HighRadius positions itself with the ambitious vision of "Autonomous Finance for the Office of the CFO," promising guaranteed KPI improvements rather than theoretical benefits. The company claims specific improvements including 10% DSO reduction, 50% reduction in idle cash, and 30% faster financial close.

HighRadius operates as a full-stack financial platform powered by proprietary Rivana AI engine and Freeda Digital Assistant, targeting large enterprises across diverse industries.

HighRadius key features

- Rivana AI engine with network of over 180 pre-built AI agents for various financial tasks

- Modular solutions covering Order to Cash, Accounts Payable, B2B Payments, and Treasury & Risk

- Advanced machine learning models like Random Forest and LightGBM for payment prediction and matching

- Prioritized collections worklist with automated dunning emails and in-app tools

- Cloud-based platform designed for enterprise scalability

HighRadius pros

- Automation and efficiency significantly reduce manual workload and minimize errors

- User-friendly dashboard and reporting provide clear, actionable insights despite technical complexity

- Scalable cloud-based platform suitable for large enterprise requirements

- High Gartner ratings for service and support with smooth implementation processes

HighRadius cons

- Customer support quality varies significantly between G2 and Gartner user reports

- Complex initial setup and limited customization flexibility

- Discrepancy in support experience between executive-level and front-line users

- High technical complexity may require significant training and adaptation

HighRadius pricing

HighRadius uses a custom pricing model. Specific pricing unavailable publicly.

HighRadius reviews

Highradius Accounts Receivable has an average rating of 4.3 out 5 from 220 reviews on G2.

How to choose the right debt collection software

The right debt collection software depends on your business size, goals, and workflow.

Here's how to choose:

Assess your business size and complexity

Your company’s size and operational complexity play a huge role in determining the best software for you. For mid-market businesses managing hundreds to thousands of accounts, look for solutions that balance robust automation with ease of implementation.

Enterprise-level organizations, on the other hand, may need highly customizable platforms that can handle large-scale operations and compliance requirements.

Define your goals

Are you looking to reduce Days Sales Outstanding (DSO)? Automate manual processes? Improve customer communication? Clarifying your priorities will help you focus on software that aligns with your objectives.

Evaluate features that matter most

Not all software is created equal. Look for features that directly address your pain points, such as:

- Automated reminders and follow-ups

- Credit risk management tools

- Integration with your existing accounting or ERP systems

- Real-time reporting and analytics

- Customer payment portals for a seamless experience

Consider ease of use and implementation

A powerful tool is only as good as your team’s ability to use it. Choose software with an intuitive interface, clear training resources, and responsive customer support. For mid-market businesses, solutions with shorter implementation timelines (4 weeks to 3 months) are ideal.

Check scalability

As your business grows, your software should grow with you. Opt for platforms that can handle increasing account volumes, more complex workflows, and additional integrations without requiring a complete overhaul.

Understand pricing and ROI

Software costs can vary widely, from affordable monthly subscriptions to custom enterprise pricing. Look beyond the price tag and consider the return on investment.

How much time will your team save? How quickly will you see improvements in cash flow? These factors are just as important as the upfront cost.

Use Chaser’s ROI calculator to see how much you can save with a debt collection software.

Request demos and trials

Most software providers offer free trials or demos. Use this opportunity to test the platform’s functionality, user experience, and customer support. Involve your finance and AR teams in the evaluation process to ensure the software meets their needs.

Implementation planning for mid-market success

Mid-market companies can expect faster deployment than enterprises, typically completing implementation in 4 weeks to 3 months. This accelerated timeline focuses on:

Resource allocation:

- Limited IT resources, often shared across departments

- Finance team typically leads with vendor support

- Budget primarily covers SaaS fees with minimal setup costs

Key implementation steps:

- Initial configuration of automated workflows and communication templates

- Integration with core accounting, ERP, or CRM platforms

- Data migration of customer and invoice information

- Hands-on training for finance and AR teams

Success measurement:

Focus on direct improvements that impact your bottom line:

- Days Sales Outstanding (DSO) reduction

- Collection rate improvements

- Time saved on manual processes

- Customer satisfaction scores

- Cost per collection

The iterative approach allows for rapid value realization. Start with core automation features, measure results, then expand functionality based on what delivers the most impact for your specific needs.

Conclusion

Inefficient debt collection processes create real challenges, unpaid invoices lock up cash and keep your team stuck in manual follow-ups.

Chaser streamlines your debt collection process with automation that maintains the personal touch. By leveraging Chaser, businesses can expect to streamline their accounts receivable, reduce late payments, and ultimately improve their overall financial health.

The trial period lets you experience the benefits and user-friendly interface that Chaser offers, without any initial commitment.

FAQ

Chaser preserves relationships through personalized automation that feels hand-written rather than system-generated. All reminders sent from your email address using your brand voice and signature. The Payment Portal offers flexible installment plans and multiple payment methods, removing payment friction. This relationship-focused approach means customers often thank you and apologize for delays instead of feeling aggressively pursued by collection software.

Mid-market companies typically see significant DSO reductions with Chaser's automation. Case studies show reductions from 60 to 24 days and 88 to 64 days. The platform's AI-powered risk assessment, multi-channel reminders, and Payment Portal work together to accelerate collections by 54+ days on average, while the centralized visibility helps teams prioritize high-risk invoices before they age.

The "7 7 rule" in collections refers to the practice of contacting a debtor no more than 7 times in 7days. This guideline is designed to prevent harassment and ensure ethical communication practices. It’s often tied to compliance regulations, such as those outlined in the Fair Debt Collection Practices Act (FDCPA) in the U.S.

The most common tools include:

- Accounts receivable automation software: Automates reminders, follow-ups, and payment reconciliation.

- Credit risk management tools: Helps assess customer creditworthiness and predict late payments.

- Customer payment portals: Provides a self-service option for customers to pay invoices.

- Analytics and reporting dashboards: Offers insights into AR performance and collection rates.

- Communication tools: Automates personalized email and SMS reminders to maintain consistent follow-ups.

%20-%20Automate%20debt%20collection.webp?width=1200&height=628&name=Blog%201%20(Oct)%20-%20Automate%20debt%20collection.webp)

%20-%20Cash%20flow%20management%20software.webp?width=400&height=225&name=Blog%204%20(Oct)%20-%20Cash%20flow%20management%20software.webp)

%20-%20Automate%20debt%20collection%20(1)-1.webp?width=400&height=225&name=Blog%201%20(Oct)%20-%20Automate%20debt%20collection%20(1)-1.webp)

%20-%20Reduce%20DSO.webp?width=400&height=225&name=Blog%202%20(Nov)%20-%20Reduce%20DSO.webp)