%20-%20Cash%20flow%20management%20software.webp)

7 best cash collection software to get paid faster in 2026

If you’re running a mid-market business today, managing cash flow has likely become a relentless balancing...

%20-%20AR%20collection%20process.webp)

Modern accounts receivable collection process: A guide to faster payments

Most finance teams do not need another textbook explanation of the accounts receivable collection process....

%20-%20Reduce%20DSO.webp)

How to reduce DSO: Proven strategies to improve cash flow

A healthy P&L and a growing top line should feel like success. For many mid-market finance leaders, it feels...

%20-%20Cash%20collection%20formula.webp)

Cash collection formula: The complete guide to forecasting when customers will pay

In textbooks, the cash collections formula looks simple:

.png)

How to make the most of Xerocon Brisbane 2025

From3-4 September 2025, thousands of accountants, bookkeepers, and finance professionals will head to the...

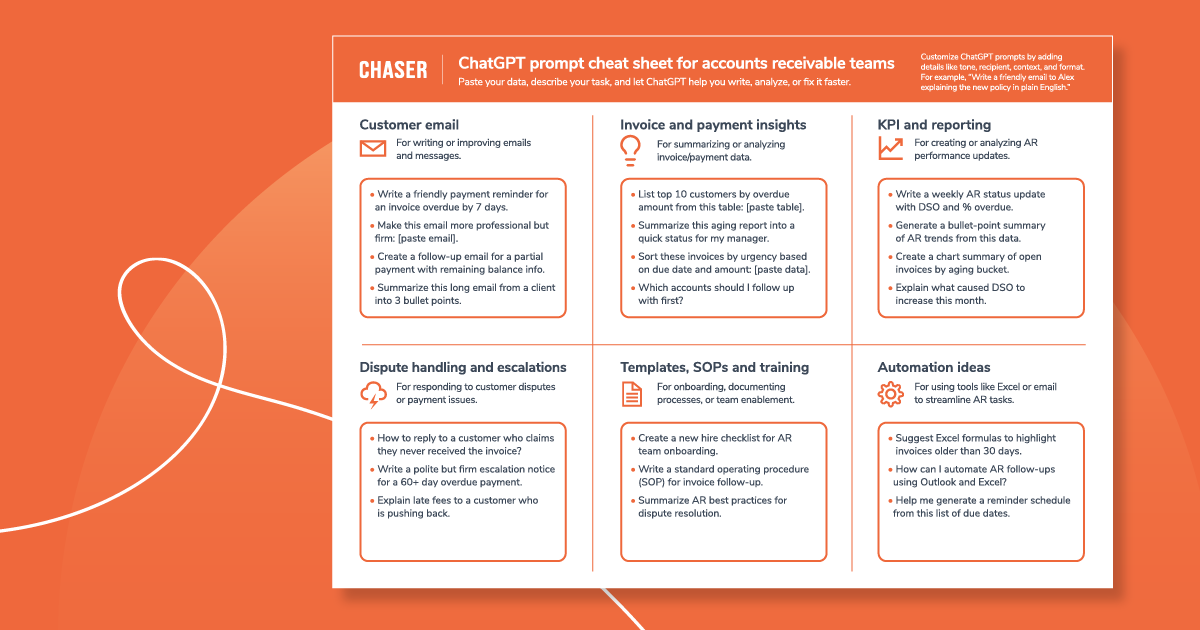

ChatGPT prompt cheat sheet for accounts receivable teams

Late payments are not just a cash flow problem — they derail forecasting, create bottlenecks, and increase...

.png)

Accountex London 2025: Highlights from the event

Last week Accountex London 2025 brought together over 11,500 finance professionals, accountants, and...

-1.png)

What to expect at Accountex London 2025 with Chaser

Are you planning to attend Accountex London 2025? Chaser will be exhibiting at this year’s premier accounting...

What are uncollectible accounts & how to account for bad debt

Uncollectible accounts, also known as bad debt, represent the portion of accounts receivable that a business...

Why people don't use automated accounts receivable

Accounts receivable (AR) automation offers a more efficient and cost-effective way to manage cash flow,...

%20(1).webp)

Accounts receivable aging schedule: How it works, benefits, and example

An accounts receivable aging (AR) schedule is a critical tool for businesses to manage their unpaid invoices...

Outstanding receivables: How long is too long for AR to remain unpaid?

In the realm of business transactions, accounts receivable (AR) play a pivotal role in maintaining financial...