Chaser news & blog

SME debt recovery - dos & dont's for small businesses | Chaser

Small businesses and startups can be likened to those sheep that spend their days on the outside of the herd....

Debt collection etiquette to maintain customer relationships

There’s no doubt that debt collection ranks right up alongside waxing when it comes to painful and unpleasant...

How to credit check a company

My first year as CEO of Chaser: What’s happened and what I’ve learned

The last year at Chaser has been a time of exciting growth and considerable challenge. The pandemic indelibly...

Chaser becomes one of the first to join the new Xero App Store

This week, Xero released their new Xero App Store. It’s their app marketplace reimagined, and where Xero...

Credit checking customers | 5 key reasons to do it | Chaser

Every customer you take on represents a certain level of risk and that risk is compounded if you plan to...

Chaser is attending the Digital Accountancy Show 2021 and hosting 'How to improve your cash flow by £250,000' panel

Chaser is proud to be exhibiting and hosting a panel at the Digital Accountancy Show 2021. This event on 1...

Chaser shortlisted for 2021 SaaS Awards

International Software Awards Program Announces Finalists

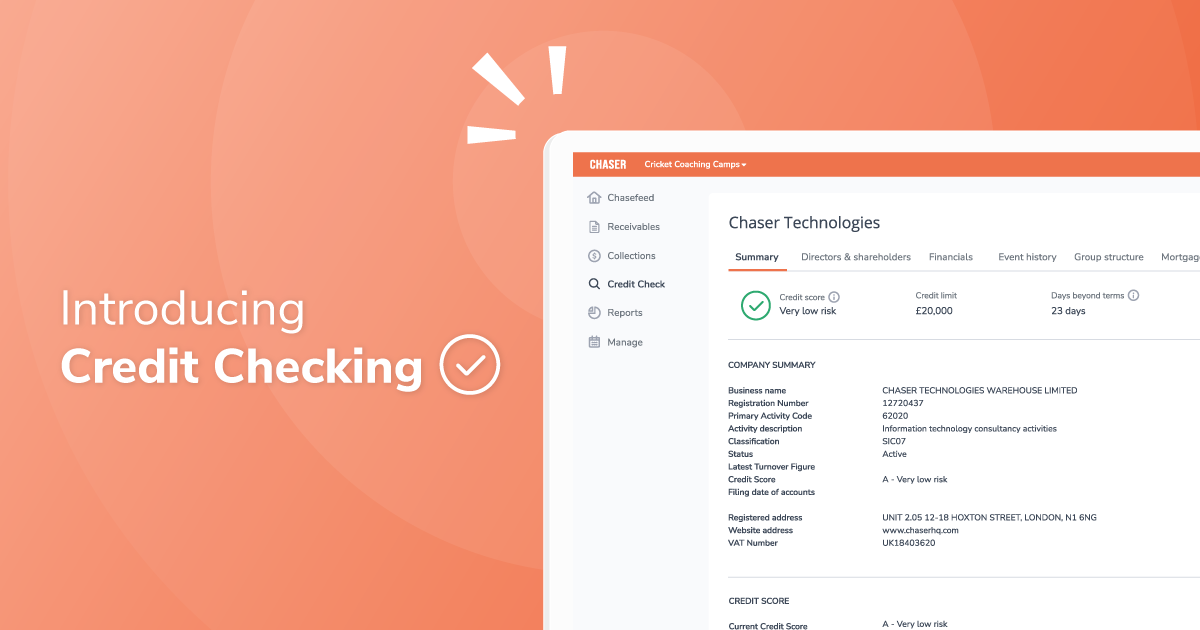

Chaser releases in-app credit checking for UK organisations

Today we unveiled a new credit checking feature that helps businesses make more informed decisions on who...

Thousands of UK SMEs in danger because of a culture of late payments

The number of unpaid invoices in the UK is quickly reaching a point where it will endanger a significant...

The definitive guide for credit control best practices

One of the top reasons that businesses fail is due to poor money management.

The digital transformation of credit management

Credit has become an integral part of how most people and businesses operate in the modern world. Here in the...